Ethereum has been gaining institutional curiosity over the previous few weeks. Nevertheless, the worth is built-in In a tricky vary.

On-chain information reveals that regardless of the shortage of Altcoin costs, gross sales stress from US-based whales and businesses has been steadily declining over the previous month.

Demand for Ethereum is powerful amongst US buyers

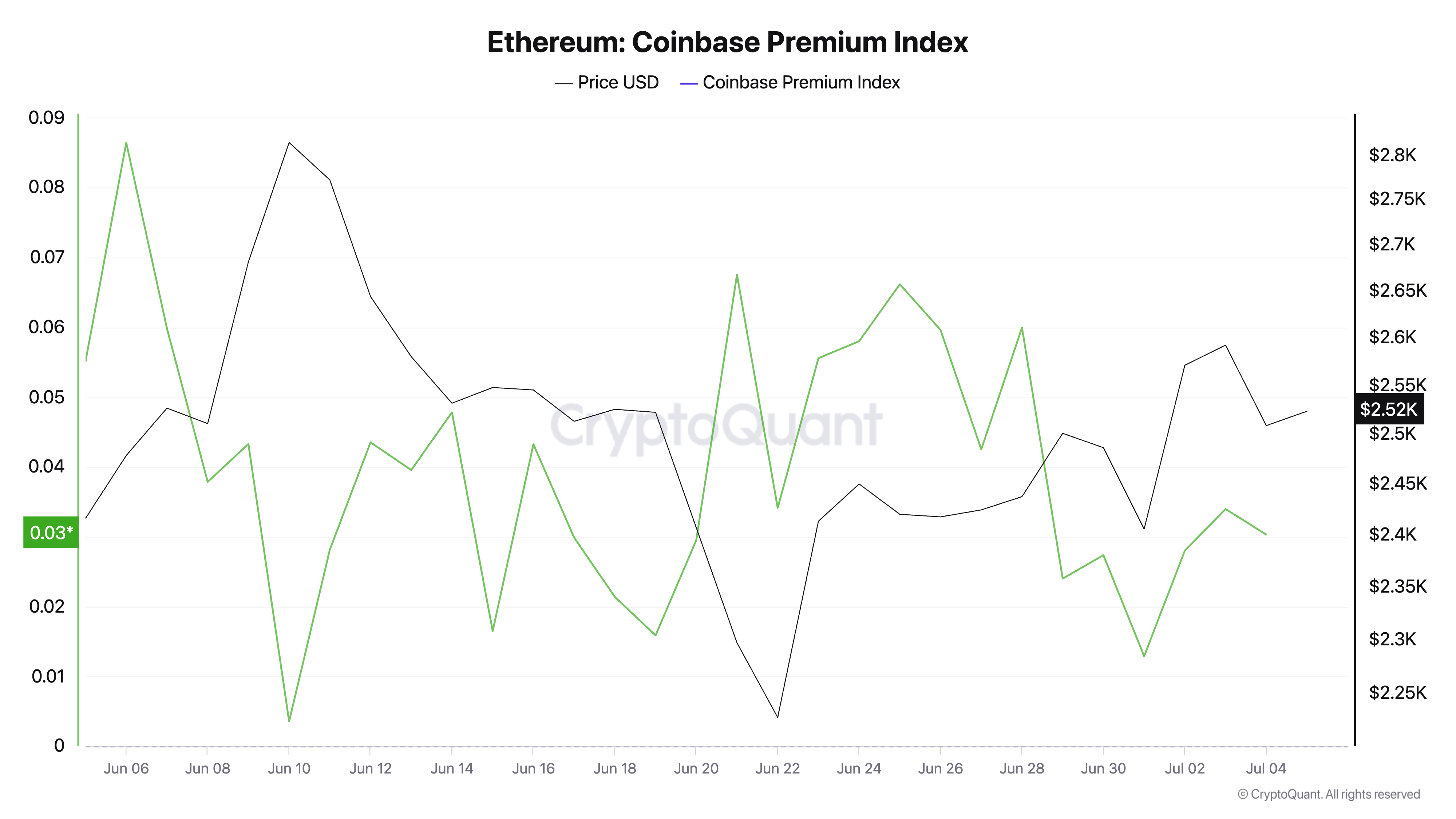

Based on information from Cryptoquant, Ethereum's Coinbase Premium Index (CPI) has persistently surpassed the zero mark for the previous month. This can be a sign of sustainable buying rights from US-based buyers.

On the time of writing, the CPI is 0.03.

Ethereum Coinbase Premium Index. Supply: Cryptoquant

This metric is an effective indicator for measuring variations in ETH costs on Coinbase and Vinance and monitoring US investor sentiment.

When CPI rises, ETH trades at Coinbase premium in comparison with worldwide exchanges. This displays stronger buying stress from US-based buyers.

Conversely, if CPI falls and even worse, destructive, it indicators that Coinbase demand is lagging behind the worldwide market as it’s profiting and declining amongst US consumers.

Due to this fact, regardless of low worth efficiency in latest weeks, the steady CPI of ETH on the zero line means that US buyers proceed to purchase slightly than go away the market. This refers to measured accumulation tendencies slightly than sale.

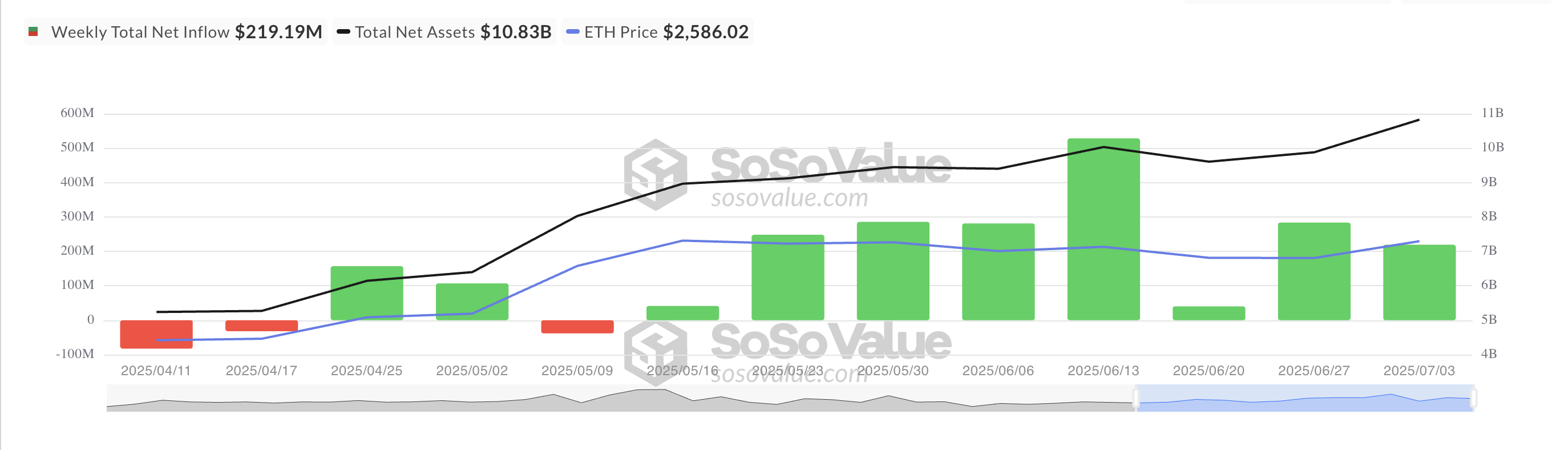

Moreover, constant weekly inflows into ETH-backed alternate commerce funds (ETFs) verify sustained returns from key buyers. For every sosovolu, these funds have recorded a constant weekly web influx since Might ninth.

All Ethereum spot ETF web stream. Supply: SosoValue

This displays a sustained urge for food amongst institutional buyers for publicity to ETH, even when worth motion is comparatively suppressed.

ETH trapped in a slim space

ETH/USD Measurements from the day by day chart verify that ETH is consolidated within the worth vary of $2,750 to $2,424 since early Might. If institutional buyers enhance shopping for stress and broader market sentiment improves, the coin may rally in the direction of a $2,750 resistance stage and try a breakout on high of that.

If profitable, the worth of the ETH may rise to a different $3,067.

ETH worth evaluation. Supply: TradingView

Nevertheless, as soon as buyers' participation weakens and bear stress builds up, ETH may return to $2,424. If that help shouldn’t be retained, it may drop to $2,185.