Bitcoin ($BTC) may very well be positioned for one more vital rally as on-chain knowledge suggests sturdy accumulation exercise Some long-term holders. Darkfost on X, creator of CryptoQuant, highlighted a big improve in demand from accumulator addresses that constantly purchase and maintain Bitcoin. He stated the present actions of those buyers might have an effect. market sentiment And it causes the worth of Bitcoin to bounce again.

Bitcoin accumulation exercise suggests future upside potential

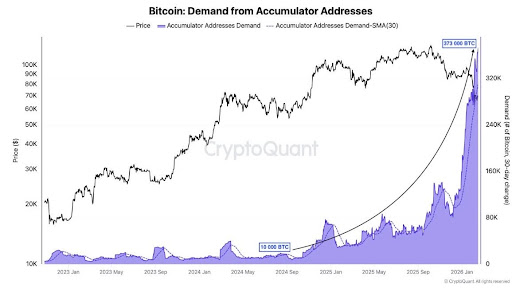

Darkfost’s CryptoQuant Chart Evaluation present At present, month-to-month accumulation from “accumulator addresses” averages roughly 372,000. $BTCa big improve from 10,000 $BTC This vital improve in long-term purchases signifies strategic positioning in distinction to latest purchases. short-term buying and selling habits On the market.

His graph additionally reveals that demand from accumulator addresses has steadily elevated through the years. In keeping with analysts, Bitcoin latest worth drop This seems to have created a possibility for these long-term buyers to proceed shopping for aggressively. Somewhat than reacting to ongoing worth actions, they appear to be centered on Bitcoin's future progress and seem like positioning themselves forward of a possible pullback.

Particularly, Darkfrost says the size of the latest accumulation is unprecedented, suggesting that a big portion of Bitcoin is being persistently faraway from circulation. This may create best situations, as demand continues to extend and provide decreases. worth improve motion.

Current accumulation traits additionally spotlight the stark distinction between short-term trades and intentional positions. Accumulator addresses are inclined to exhibit a disciplined and affected person method to investing, which traditionally coincides with intervals of sturdy market efficiency. Their aggressive purchases act as a market stabilizer and will be an early indicator of a possible worth rebound.

The identical precept applies to notable intervals. Promoting and weak demand. Low investor sentiment can result in extra pronounced downtrends, particularly in extremely risky situations.

Learn how to determine the accumulator tackle

Darkfost factors out that CryptoQuant makes use of an in depth set of standards to determine accumulator addresses. In keeping with him, nothing will seem at these addresses spill Will need to have bought a minimal quantity $BTC With the newest offers. Every tackle will need to have at the least two separate buy occasions or inflows, maintain a minimal complete Bitcoin steadiness, and be lively at the least as soon as up to now seven years.

To make sure accuracy, CryptoQuant additionally excludes recognized exchanges and exchanges. minor tacklein addition to the addresses that work together with the good contract. This framework helps scale back distortion and supplies sharper pictures. long run holder I’m actively accumulating Bitcoin.

Dirkforst emphasised that the identification and choice course of was correct and thorough, giving confidence within the validity of the noticed accumulations. Whereas CryptoQuant takes in depth measures to make sure accuracy, the report acknowledges that the choice is just not good and will not seize all entities akin to centralized exchanges or miners.

Featured picture from Getty Pictures, chart from Tradingview.com