Within the minds of many traders, Bitcoin (BTC) is sort of a dream of wealth. It's a magical asset that may improve a whole bunch of p.c annually and ship that worth “to the month” at a worth of $1 million.

Analyst Willie Wu believes that the Bitcoin growth time could have ended. However not everybody agrees.

Willie Woo predicts that Bitcoin's CAGR will fall at 8% and can stabilize

Woo shares a chart entitled “Bitcoin Annualized Returns,” indicating that Bitcoin's mixed annual progress fee (CAGR) has dropped sharply from over 100% in 2017 to round 30-40% since 2020.

It was a time when main establishments, together with companies and governments, started to build up Bitcoin.

Bitcoin annual return. Supply: Willie Woo.

“Individuals suppose that BTC is sort of a magic unicorn that climbs endlessly on the moon. Right here's the precise CAGR chart.

Woo predicts that Bitcoin's CAGR will proceed to say no over the following 15-20 years, ultimately stabilizing round 8%. This fee is in step with long-term monetary progress (5%) and GDP progress (3%). He emphasised that even with a low CAGR, Bitcoin remains to be superior to most different inventory buying and selling property.

Nevertheless, investor and writer Fred Kruger opposed. He famous that Bitcoin has elevated seven occasions from its low in December 2022 and is at the moment buying and selling at $103,000 as of Could 2025.

Moreover, in a latest interview, Arthur Hayes went even additional. He predicted that Bitcoin would attain $1 million by the tip of Donald Trump's present time period. He expects costs to succeed in $250,000 by the tip of 2025, representing a 1,000% improve in simply 4 years.

GDP and Liquidity Progress Considered as a key driver for future income for Bitcoin

Woo's forecasts are based on GDP growth and monetary progress. In the meantime, RealVision's social head Paul Guerra supplied deeper perception into the problem.

Discussing liquidity, he argued that conventional diversification methods could now not work in at this time's market atmosphere. It’s because property equivalent to shares, bonds, Bitcoin and actual property have a tendency to maneuver collectively, pushed by a single essential issue: liquidity.

“The actual issue out there is liquidity: the quantity that flows by means of the system,” Paul stated.

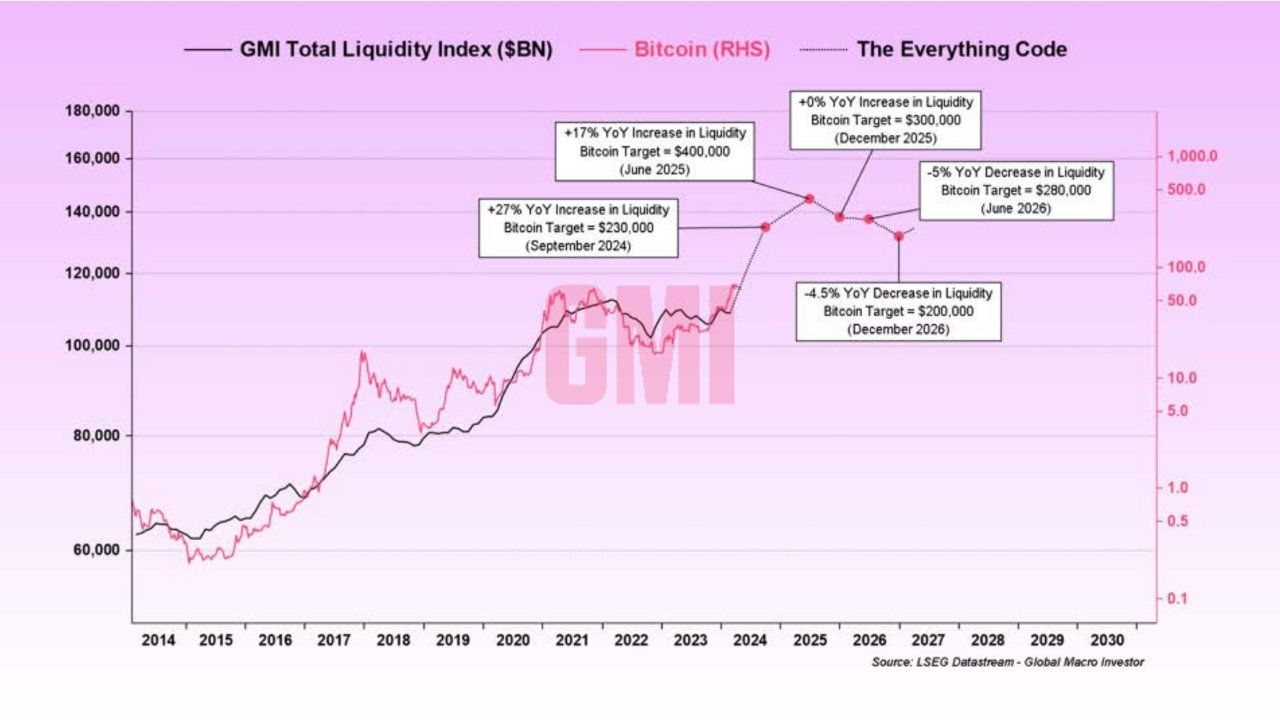

GMI Whole Liquidity Index. Supply: Paul Guerra.

Presently, the worldwide liquidity index is rising at 8% per yr. To grasp liquidity, Paul prompt that we should first perceive GDP. He offered the formulation for GDP progress: GDP progress = inhabitants progress + productiveness progress + debt improve.

Nevertheless, at this time, inhabitants progress and productiveness are declining worldwide. Consequently, the federal government is being pressured to inject liquidity to keep up its GDP and assist improve debt.

“The inhabitants is growing old. Productiveness is flat. Debt is exploding. Governments have just one device to maintain GDP alive and serve individuals's money owed.

Bitcoin Value and GMI Whole Liquidity Index. Supply: Paul Guerra.

Consequently, fluidity is anticipated to extend at even quicker charges. Paul predicted that Bitcoin would attain $300,000 by the tip of 2025 and will enter what he referred to as the “banana zone.” The time period describes the interval of huge asset worth will increase pushed by ample liquidity.

Historic examples embody a 19,900% improve in Bitcoin from 2013 to 2017, and a 699,900% spike in Ethereum in earlier cycles.

However, these analyses concentrate on macroeconomic components, whereas overlooking potential technical dangers. For instance, there’s rising concern that advances in quantum computing may threaten confidence in Bitcoin's long-term viability.