Bitcoin worth has spent many of the new yr above the psychological $90,000 stage and seems to be off to a great begin. Whereas the costs of prime cryptocurrencies have slowed just lately, there was vital bullish intent out there up to now in 2026.

Now, this latest optimism considerably contradicts latest predictions that this could possibly be the beginning of a bear marketplace for the Bitcoin worth. This raises the query of whether or not the bull market is prone to restart or if BTC worth is just witnessing a aid rally.

BTC's Latest Bounce Is Only a Bear Market Reduction Rally — Analyst

In a January 9 submit on the Market specialists have nailed the reply on on-chain and technical worth information.

First, Maartunn acknowledged that the latest surge was inevitable as the worth of Bitcoin discovered help close to the ETF realized worth of $85,000. This worth stage represents the typical price foundation for BTC ETF buyers, and as anticipated, consumers defended their positions, resulting in a worth rally.

This phenomenon is highlighted by one other on-chain indicator, the Coinbase Premium Hole. Coinbase Premium Hole measures the distinction between the worth of Coinbase and the worth of Bitcoin on world exchanges. The index started rising shortly after New 12 months's Eve, signaling renewed shopping for exercise from US-based buyers, in response to Maartunn.

Moreover, spot exchange-traded funds started seeing sturdy capital inflows simply days after the Coinbase premium hole elevated. “That is extra of a strategic buy/portfolio rebalancing (new quarter, new yr) relatively than emotional FOMO,” Maartunn added.

Supply: @JA_Maartun on X

Nevertheless, cryptocurrency analysts identified that in this rally, Bitcoin worth solely rose to a excessive of $94,000 earlier than being rejected. Primarily, which means that the flagship cryptocurrency doesn’t have the power to interrupt that resistance.

Maartunn additionally famous that Bitcoin continues to be buying and selling under vital on-chain ranges similar to short-holder realized worth and whale realized worth, each of that are performing as vital overhead resistance.

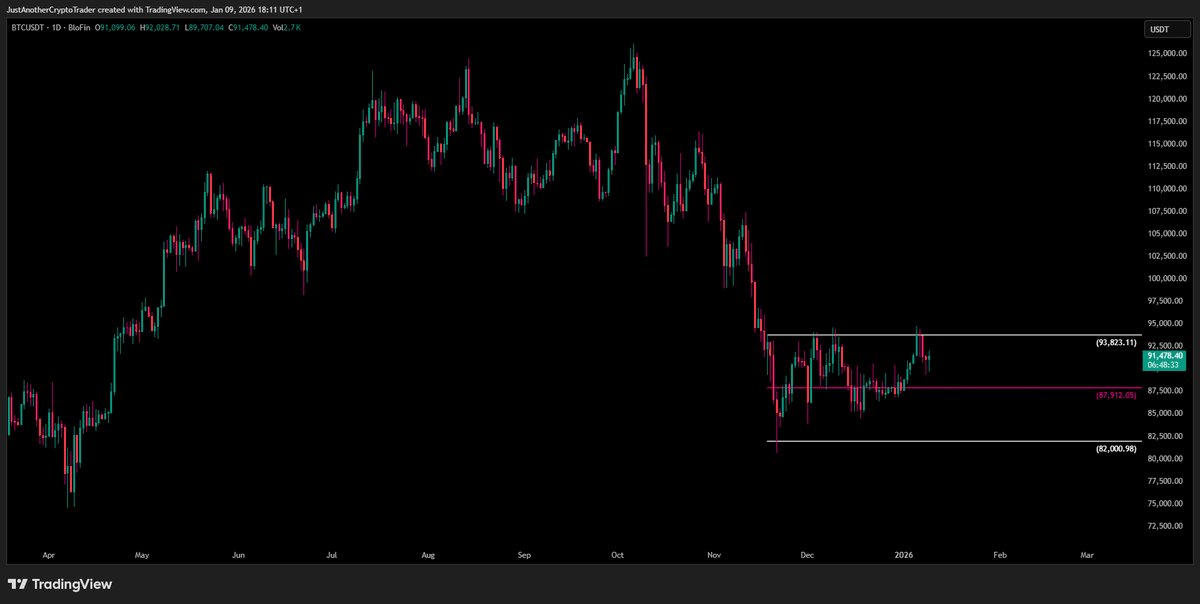

The on-chain analyst famous that in response to his on-chain observations, the latest bounce was merely a bear market aid rally and never a continuation of the development, regardless of the worth rising by about 10%. Martunn concluded that solely a clear breakout and sustained shut above $94,000 would sign a robust intention for the Bitcoin worth to rebuild its bullish construction.

Bitcoin worth at a look

As of this writing, the BTC worth is $90,360, down almost 1% within the final 24 hours.

The value of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

enhancing course of for focuses on offering completely researched, correct, and unbiased content material. We adhere to strict sourcing requirements and every web page undergoes diligent overview by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of the content material for readers.