After years of silence, SpaceX-related wallets all of the sudden moved $152 million in Bitcoin, igniting new considerations about what it means for BTC's subsequent worth switch.

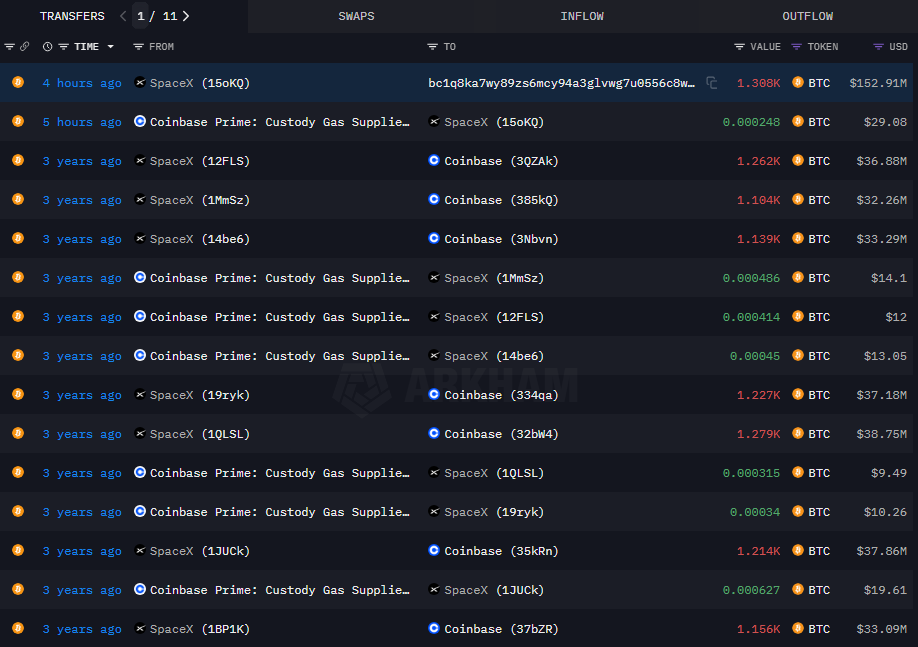

On July 22, a pockets related to Elon Musk's multi-billion greenback house firm SpaceX transferred roughly $122.91 million in 1,308.45 BTC to its new tackle, based on information from blockchain analytics platform Arkham Intelligence.

Particularly, the switch continued after SpaceX pockets despatched Coinbase Prime a small transaction charge of 0.000248 BTC price $29.

Supply: Arkham

Extra information from Arkham reveals that the pockets final noticed the transfer was nearly three to 4 years in the past when it obtained a single deposit starting from the Coinbase pockets, within the vary of 1,100-1,279 BTC.

For rookies, SpaceX first made headlines in 2021. Elon Musk publicly revealed at a ₿Phrase Digital Assembly that aerospace corporations have been stacking up bitcoin.

The precise quantity was by no means disclosed, however a report from the Wall Road Journal later confirmed SpaceX had written down the worth of Bitcoin Holding to round $373 million and bought the non-public portion. These occasions adopted a pointy decline in Bitcoin in 2022.

On-chain exercise later steered that the corporate's BTC holdings may have been nearing zero by the top of that 12 months, however this stays unconfirmed.

The corporate regularly restructured its steadiness, holding roughly 8,285 BTC by September 2024.

You may prefer it too: Bitcoin's benefit slides as Ethereum market share jumps to 11.6%

Following immediately's large transfers, SpaceX at present holds round 6,977 BTC, valued at round $822.65 million. This can make the corporate the world's largest firm Bitcoin holders, together with one other Musk-led entities akin to MicroStrategy (MSTR) and Tesla (TSLA). All SpaceX holdings are at present managed by Coinbase Prime.

In 2021, each SpaceX and Tesla gave the impression to be protecting their distance from Bitcoin, citing environmental considerations associated to vitality use, and prompting Tesla to droop funds for BTC.

However the tech billionaire then modified the tone. Earlier this month, Musk revealed plans to launch a brand new political social gathering in the USA. This expresses an express help for Bitcoin and a brand new embrace of belongings.

So many speculate that SpaceX positions itself alongside different massive corporations like Trump Media, which employs Bitcoin as a part of its monetary technique.

Will Bitcoin costs crash?

On the time of reporting, it stays unknown whether or not the switch alerts a sale or an inside actual location, however merchants are cautious as potential offloading could cause contemporary gross sales strain.

Some market contributors downplay the danger, and given the shortage of formal rationalization, this transfer means that this could possibly be a each day housekeeping or a transition to contemporary wallets.

* @spacex simply moved Bitcoin for the primary time in three years

I believe this motion is simply the correct quantity of house care. There’s a small likelihood that this may promote, however there’s zero notion of this. So there’s the belief that you’ll transfer your BTC right into a contemporary pockets. pic.twitter.com/6jrpxlolof

– cam (@cryptonews_eth) July 22, 2025

The broader market beforehand absorbed massive liquidation. For instance, in mid-2024, the German authorities offloaded nearly 50,000 btc, price about $2.9 billion inside weeks.

The transfer induced the preliminary drop to a low of $50,000, however as soon as gross sales strain settled, costs shortly recovered above $60,000.

Given the present bullish background, it seems that the market can be higher to soak up the gross sales strain that would come up from current transfers with out affecting Bitcoin's worth traits for a very long time.

In the course of the writing, Bitcoin (BTC) was buying and selling for $118,134. In line with analysts at Cryptoquant, retailers are reportedly lowering publicity within the US, South Korea and throughout the markets they’re deploying, so flagship crypto may face some strain within the brief time period.

Nevertheless, the continuing whale accumulation seems to offset among the pressurization on the vendor aspect, and the expertise means that cryptocurrency stays on the upward pattern.

learn extra: Solana's Defi TVL reaches its highest degree at $1 billion, six months excessive

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for academic functions solely.