Well-known cryptocurrency analyst Michael Van de Poppe shared his bullish outlook on Ethereum (ETH) in an X publish dated Might 17, 2025.

He claims that ETH costs under $2,400 are “steals” following the latest surge, suggesting that Ethereum can proceed its upward trajectory. His publish included a chart exhibiting Ethereum's sharp rebounds.

The chart exhibits the excessive assist and key resistance zone of ETH

The TradingView chart shared by Van de Poppe exhibits Ethereum's value motion (USDT) in opposition to Tether in Binance Trade. It exhibits ETH that had sharply intensified in early Might 2025 after an extended decline. The chart marks a transparent excessive time-frame assist zone for ETH, near $2,100, and a resistance space recognized between about $2,600 and $2,800, with Van de Poppe particularly pointing to $2,750 as a resistance level.

Ethereum $2,400 Buy Zone has been highlighted. sauce: x

Van de Poppe labels the $2,400 stage as a “important alternative,” that means that present costs nonetheless provide worth earlier than potential continuity. His predictions present the opportunity of integration that’s near resistance, adopted by an additional rise.

Ethereum Eye Rise Breakout

van de Poppe's evaluation is in line with optimistic progress throughout the crypto market. The present construction of Ethereum means that merchants can monitor the $2,100 to $2,400 vary for indicators of assist and accumulation.

Chart means bullish setup. With this setup, a confirmed breakout above the resistance zone can result in additional advantages. The chart directional arrow factors to the brand new excessive, however no actual time-frame is supplied.

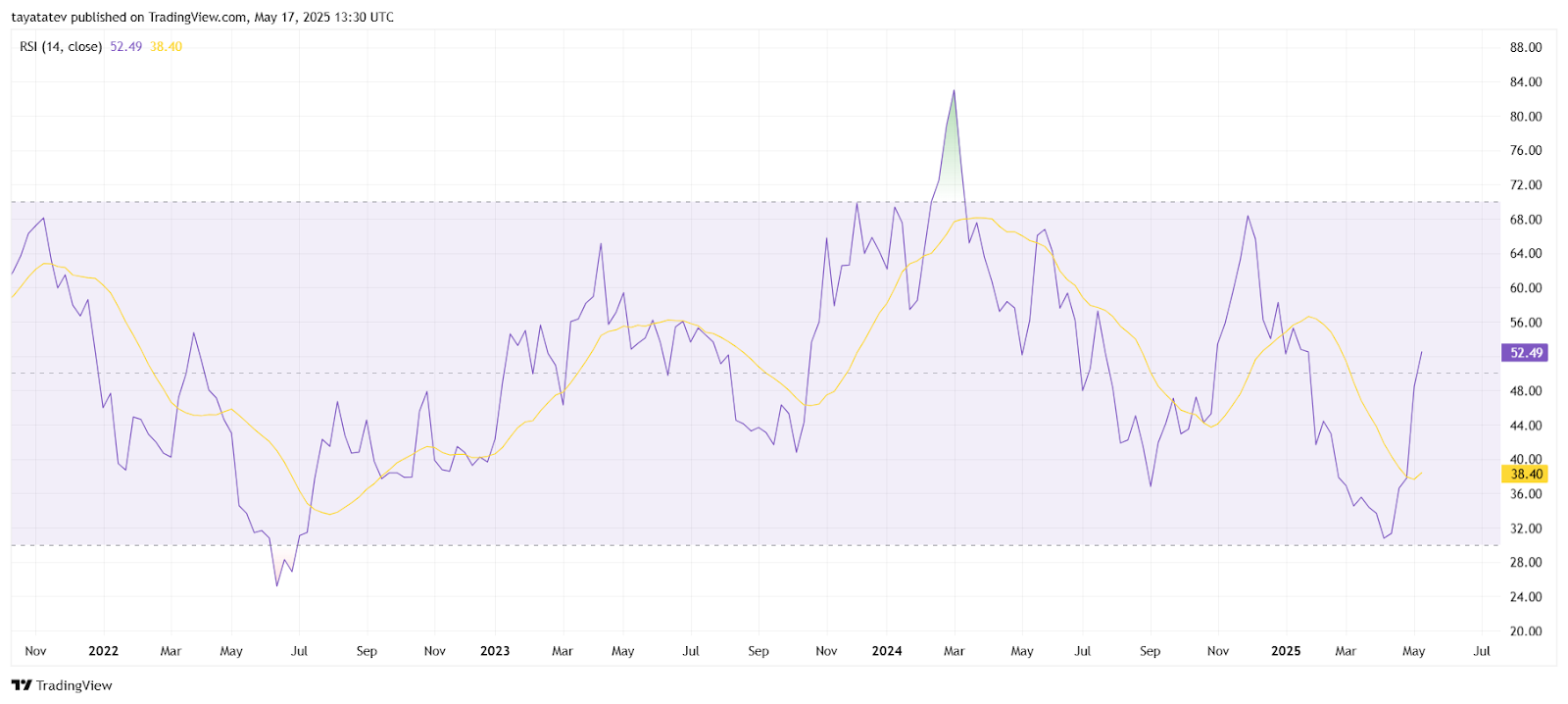

Ethereum RSI breaks key 50 midpoint

In the meantime, Ethereum's relative energy index (RSI) rose to 52.49, surpassing the impartial 50 mark for the primary time since March 2025. The RSI's transferring common is at the moment 38.40, reflecting earlier weaknesses.

The Ethereum RSI will break above 50 for the primary time since March. sauce: TradingView

This upward motion signifies a rise in buying momentum. RSI measures the pace and depth of value adjustments on a scale of 0 to 100. Ranges above 70 are thought-about over-purchased, whereas ranges under 30 counsel over-selling circumstances. Positions above 50 normally point out bullish strain.

Ethereum's RSI has remained under 50 over the previous few months, reflecting vendor management. The present breakout shifts this dynamic. The final significant benefit got here when RSI briefly surged to 85 in early 2024 after which surged backwards.

The present rise signifies a brand new development change with out excessive circumstances. Not like earlier failed makes an attempt, this motion additionally clears transferring common.

Advances above each the typical and midpoint ranges of RSI point out a reversal of the potential development. It emphasizes a rise in emotional adjustments. This might assist additional earnings if wider market circumstances align.

Because the RSI path rises, merchants have an early sign to watch value continuity, particularly when quantity sees momentum.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any form of monetary recommendation or recommendation. Coin Version shouldn’t be chargeable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.