- Ethereum costs went above $2,500 on Friday after rising practically 100% from the underside in early April.

- The ETH Pectra improve boosts approval of over 11,000 EIP-7702 in per week, indicating wholesome consumption by wallets and Dapps.

- Rising steady use and tokenization, layer 2 institutionalization, and ETH Shortroins assist value gatherings.

Ethereum (ETH) is again after months of unperformance. As of Friday's writing, it's over $2,500 after an almost 100% rise from the underside in early April.

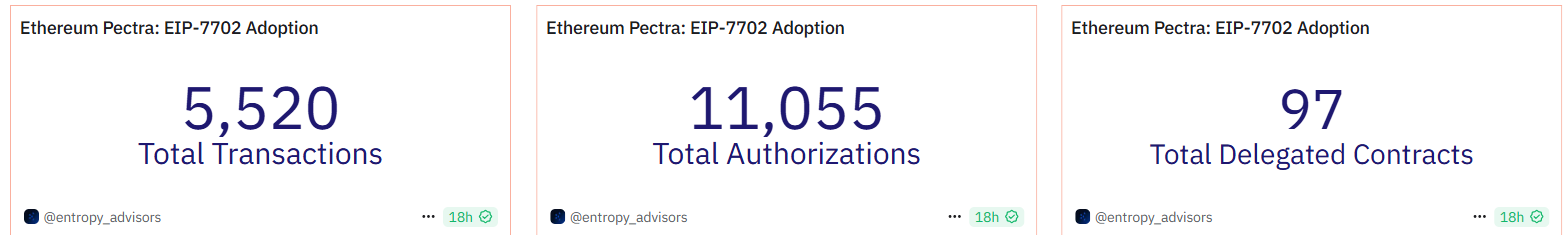

The Pectra improve has seen Swift adoption, with over 11,000 EIP-7702 approvals already being processed in per week, indicating wholesome intakes from wallets and distributed functions (DAPPS).

Moreover, a surge in steady exercise, a rise in institutional adoption of the Ethereum Layer 2 community, and a rewind of ETH quick positions has renewed market optimism. To know whether or not this rally has ongoing energy, FXStreet spoke with a number of cryptography specialists for his or her insights.

Ethereum's Pectra Improve Boosts Approval

Ethereum's newest main community upgrades, PektraIt was launched on Could seventh and marked a significant step ahead for the ecosystem. In line with Dune Information, over 5,520 transactions and 11,055 approvals had been processed beneath the brand new framework inside only a week of its activation. This exhibits robust adoption by wallets and DAPP.

Based mostly on the momentum of final 12 months's Dencun improve, Ethereum's Pectra replace gives vital enhancements throughout ease of use, scalability, and staking infrastructure.

In an unique interview, Bitget Pockets COO Alvin Kan instructed FXStreet, “Ethereum's Pectra Improve brings options like gas-free transactions and session-based permissions, permitting you to unleash highly effective options and produce the subsequent wave of customers! Appears like a developer's instrument, and Pectra reduces Layer 2 charges.

Indicators of a comeback

Ethereum costs have skyrocketed practically 100% from a low of $1,385 in April to a excessive of $2,738 on Could 13, regardless of falling behind BTC and different layer 1 early within the cycle.

Analysts at Bernstein, led by Gautam Chhugani, have recognized three key drivers behind Ethereum's current value rally. First, the adoption of Stablecoin and the surge in belongings tokenization have rekindled curiosity in Ethereum's function as a elementary infrastructure. Stripe's $1.1 billion acquisition of Bridge After which a push to stubcoin for Meta's new push.

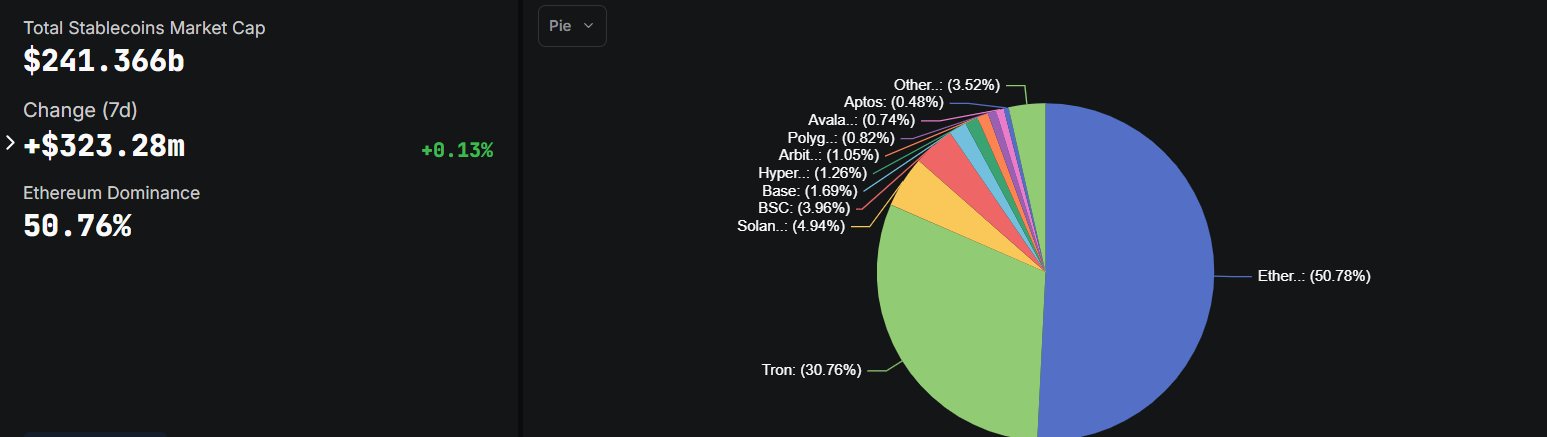

The next graph from Defilama exhibits that Ethereum at present hosts practically 51% of its complete stablecoin provide, making it the main platform that may profit from this pattern.

Whole stub cash per chain chart. Supply: Defilama

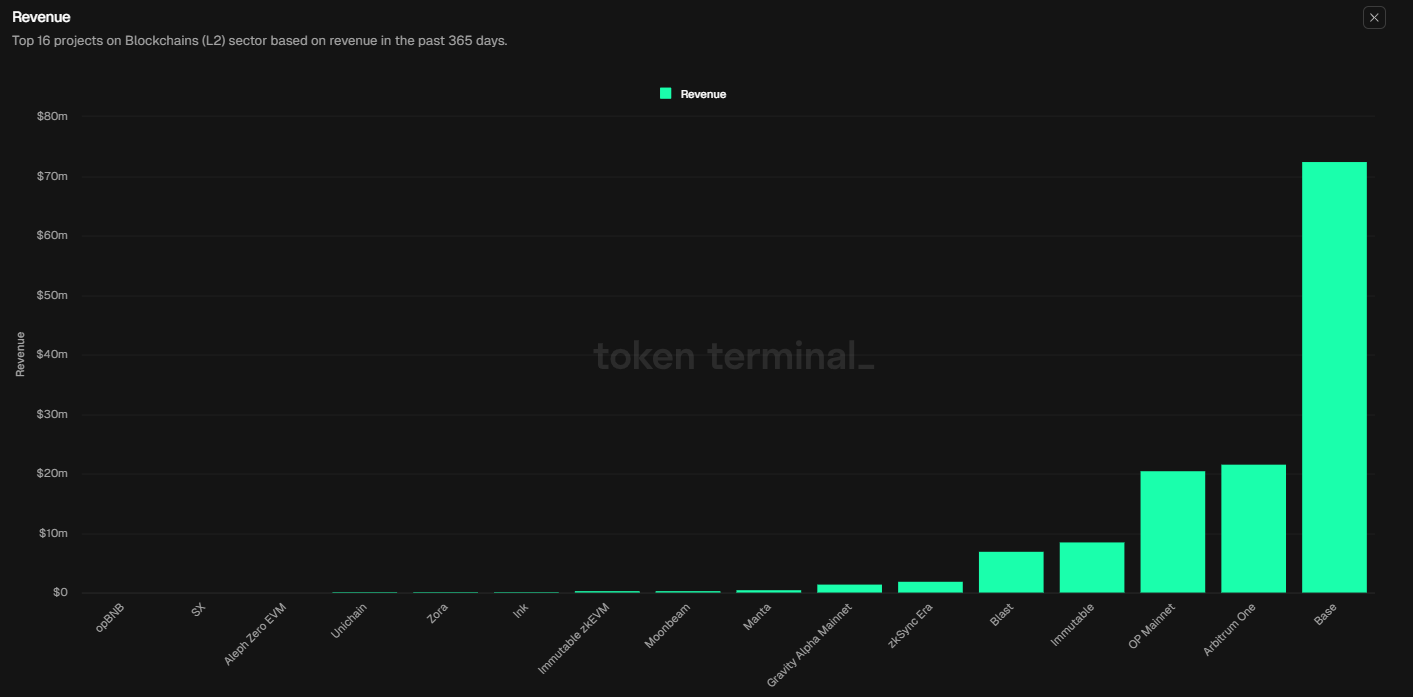

Second, Ethereum's Layer 2 community has change into important to institutional crypto infrastructure. Platforms like Bases generate vital income, as proven within the graph under. Robinhood's acquisition of Wonderfi Utilizing an Ethereum-based system, we present potential extensions to tokenized shares.

Layer 2 tasks income over the previous twelve months of charts. Supply: Token Gadget

Lastly, hedge funds that beforehand shortened ETH to hedges into longer positions in Bitcoin (BTC) and Solana (SOL) at the moment are reversing these transactions. Because the foundations of Ethereum had been strengthened and the market narrative modified in favour, the rewinding of those shorts added much more upward stress to the value of Eth.

Moreover, Derive.xyz analyst instructed FXStreet that ETH might attain $4,000 by Christmas (up 9% since final week), and a 12% likelihood of reaching $5,000. The chance that ETH will fall under $1,500 by Christmas has dropped to fifteen% (down from 40%).

The technical outlook suggests the rally continues as 200wEek Ema is highly effective

The weekly chart exhibits that it has garnered 39% and closed its 200-week index shifting common (EMA) at $2,243 within the first week of Could, surpassing the descending trendline (drawn by connecting a number of weekly highs from mid-December). Ethereum has been rising 3.26% up to now this week, and can commerce above $2,500 when written on Friday.

Taking a look at technical indicators, bullish momentum is gaining traction. The relative energy index (RSI) reads 53 and factors upwards on the weekly chart, exhibiting slight bullish momentum. Transferring Common Convergence Divergence (MACD) has proven bullish crossover this week, additional supporting bullish papers, giving buy indicators and exhibiting an upward pattern.

As ETH continues its upward motion, the rally might be prolonged and a 50% Fibonacci retracement might be retested (drawn since December) costly $4,107 In The April low of $1,385) was $2,746. A profitable weekly end above this degree might doubtlessly increase extra income to check a 61.8% Fibonacci retracement degree at $3,067.

ETH/USDT Weekly Chart

Nonetheless, if ETH closes under the 200-week EMA at $2,243 per week, it might doubtlessly increase that decline and retest the psychological significance degree at $2,000.

Specialists' Insights on Ethereum

To realize extra perception, FXStreet interviewed some specialists within the crypto market. Their solutions are listed under:

Marcin Kamierczak, co-founder & COORedstone Oracle

Q: How vital is management within the long-term evaluation of Ethereum in Stablecoins?

It’s a massive pillar of Ethereum moat, particularly because the stubcoins assist many of the on-chain exercise. If Solana or different chains begin to achieve vital Stablecoin shares, it might undermine Ethereum's dominance, however L2 vs. L1 worth splitting complicates the image. Most burns come from L1 actions.

Q: Can Ethereum compete with Bitcoin as a priceless retailer or ought to it focus solely on utilities?

You don't want to pick Ethereum. The sting lies in being a hybrid. It’s a technical reservoir of utility belongings powered by on-chain economic system and worth backed by ongoing innovation. The mix is tough to duplicate and stays compelling for long-term followers.

Q: Is Ethereum a transparent winner in real-world asset tokenization infrastructure?

Proper now, sure. Over 80% of tokenized belongings dwell in Ethereum or its L2, pushed by institutional belief and touring maturity. However as utilization strikes in the direction of defi, prices and UX are much more vital, opening the doorways of competitors and L2 if Ethereum doesn't proceed to run on scaling.

Jaehyun HA, Analysis Analyst at Presto Analysis

Q: What drives Ethereum's current 100% rallies since April – what’s the basis or positioning?

Ethereum's current rally seems extra positioning-driven than LEDs on the very core. Pectra upgrades have introduced significant enhancements by scalability, staking economics, and UX (EIPS 7251, 7702, and 7623), however these modifications are nonetheless within the early levels of pricing. ETF stream stays minimal, emphasizing that this transfer is pushed primarily by its place inside the crypto, fairly than institutional inflows.

Q: How vital is management within the long-term evaluation of Ethereum in Stablecoins?

The function of Ethereum because the dominant reconciliation layer of Stablecoins is the idea for its long-term relevance. Nonetheless, that lead is being examined by extra performant chains like Solana. Finally, Ethereum's skill to stay configurable and function the final word cost layer, in addition to host facility-grade stubcoins, together with these enveloping themselves in potential sovereignty, such because the KRW Stubcoins, are key to long-term worth era. Whereas management over the issuance of Stablecoin is vital, it’s the stickiness of the Ethereum cost layer that determines its persistence.

Q: How a lot does Ethereum profit from Layer 2 adoption and income progress?

The adoption of L2 is a crucial unlock for Ethereum, permitting for scalability with out compromising decentralization. The EIP-4844 and Pectra upgrades additional scale back L2 prices with Blobspace enlargement, however the important thing problem is current worth seize. ETH should show that L2S can retain significant income and validator incentives in an inexpensive and calm world. The L2S acts as a distribution channel, however after current declines in L1 revenues, it exhibits that Ethereum's monetary sustainability must be readjusted to match this scaling success

Q: What are the primary dangers to Ethereum's present value momentum?

Ethereum faces a number of headwinds: regulatory uncertainty concerning ETF staking and broader compliance points, and protracted issues that validator economics will weaken the decline in L1 revenues and that L2S might not contribute adequately to ETH burns and worth era. If the safety price range of the essential layer is eroded, validator participation and decentralization can overlap. In the meantime, except Ethereum finds a technique to sustainably monetize the L2 increase, momentum might stall regardless of robust recruitment metrics.