The Cryptocurrency market was fairly secure regardless of the worldwide macroeconomic headwind that shook the normal market final week. The worth of Etherrium didn’t get pleasure from slogans equivalent to different massive property, which ended within the first quarter of April to the primary quarter of April.

The second largest Cryptocurrency is the final earlier than it loses $ 1,800 final week. Nevertheless, the most recent heat chain knowledge means that Etherrium costs could also be near the ground and are making ready for a rebound within the subsequent few weeks.

If the metrics rise, Etherrium costs are prepared to come back again.

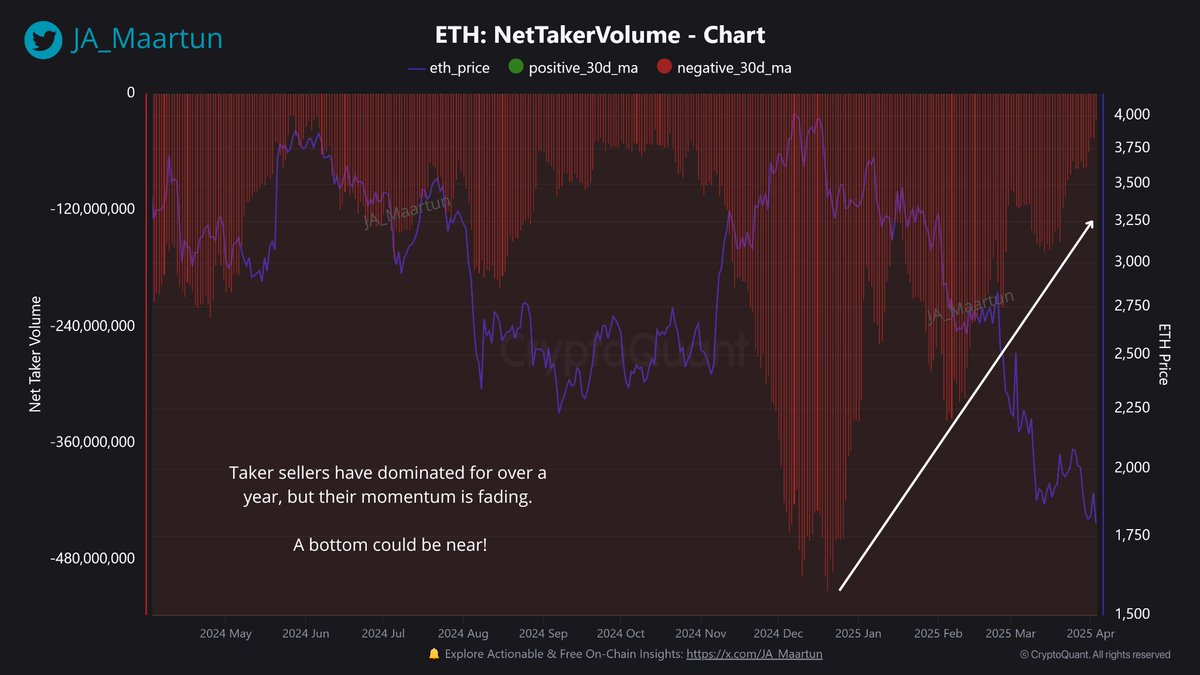

MAARTUNN, a sequence analyst from the latest publish on the X platform, shared a brand new perception into Etherrium traders' actions for the change of central response. In accordance with Crypto Pundit, the most recent scorching chain shift suggests {that a} new flooring can brew the worth of Etherrium.

The related indicators listed here are pure amount metrics, monitoring the distinction between Taker gross sales within the quantity and particular asset markets (on this case Ethereum, on this case). This thermal indicator can be utilized to measure the energy of gross sales or buy strain available in the market.

If the pure amount is constructive, the aggressive buy exercise (taker buy) signifies that it’s an awesome Taker Sells. The adverse metrics imply that the taker gross sales quantity is larger than the amount of takers. That is normally a weak sign.

MAARTUNN identified that aggressive gross sales actions of their posts have surpassed buying actions within the Etherum marketplace for greater than a 12 months. Nevertheless, the recent -chain analyst appears to have been weakened over the previous few weeks and misplaced some steams.

Supply: @JA_Maartun on XAs you possibly can see within the chart above, pure Sort Quantity types a better lowest degree even supposing Etherrium costs create a brand new low lowest degree. This traditional energy distinction Altcoin suggests that you could expertise optimistic reversal past the ground.

On the time of this text, ETH tokens are about $ 1,806, reflecting the worth enhance of about 1percentduring the last 24 hours.

Ethics whales refine their shares

Curiously, the conflicting scorching chain knowledge additionally seems, exhibiting that an necessary investor referred to as a whale offset property. The investor Cohort impacts market epidemiology as a consequence of a major stake and is normally monitored by different traders.

Supply: @ali_charts on X

Encryption analyst ALI Martinez mentioned in a April 4 publish that whales (10,000 to 100,000 cash) offered greater than 500,000 ETH tokens for the final 48 hours. Contemplating the dimensions of this promoting and the affect of traders, this exercise generally is a weak street block for the restoration of Etherrium costs.

The worth of ETH on the day by day timeframe | Supply: ETHUSDT chart on TradingView

Istock's most important picture, TradingView chart

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We assist the strict sourcing normal and every web page is diligent within the high expertise specialists and the seasoned editor's workforce. This course of ensures the integrity, relevance and worth of the reader's content material.