Bitcoin traded at $115,975 on September 13, 2025, with a market capitalization of $2.31 trillion and a 24-hour buying and selling quantity of $43.07 billion. The mid-day value of cryptocurrency fluctuated between $114,838 and $116,705 because it continued to consolidate current income.

Bitcoin

Bitcoin has been steady close to the highest vary because it has bolstered its income from current upward breakouts, exhibiting indicators of a cautious however strong maturing rally. Present tendencies throughout a number of time frames reveal bullish bias, whereas some oscillators counsel overexpansion and potential short-term fatigue.

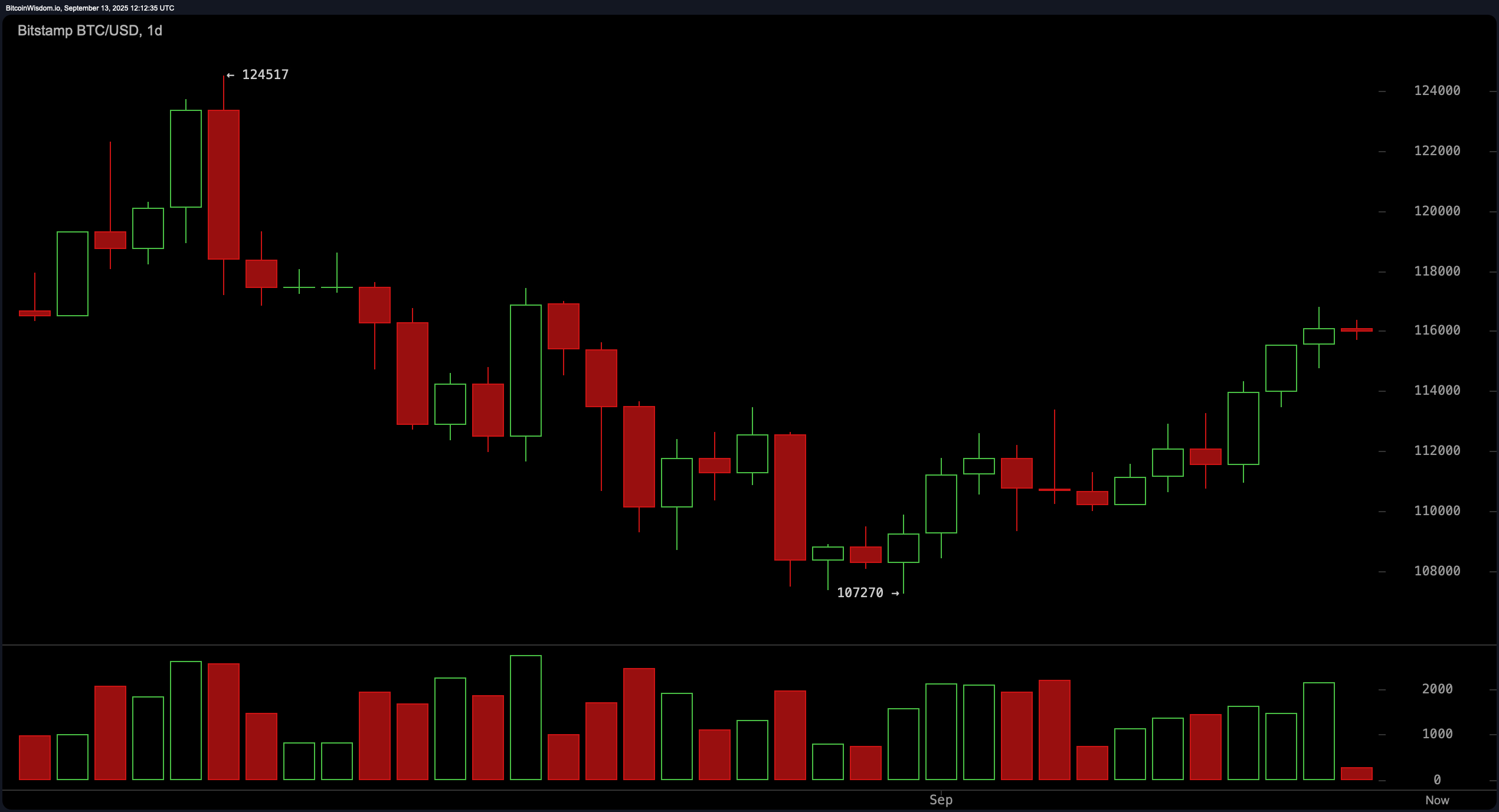

On the day by day charts, Bitcoin is within the midst of a bullish reversal after a critical downtrend that bottomed out at round $107,270. Since its low, value motion types a transparent sequence of upper and better lows, and the quantity step by step will increase, and is an indication of a conviction. The asset is at the moment testing vital resistance close to the $116,000 degree and is testing its robust proximity above the realm, which is required to additional verify the realm. The entry zone was extra advantageous throughout inversion, however a trailing cease technique near $113,500 helps shield the pursuits of individuals already lengthy. The worth goal ranges from $117,500 to $120,000 based mostly on resistance clusters.

BTC/USD 1-Day Chart by way of BitStamp on September twelfth, 2025.

The 4-hour Bitcoin chart affords a powerful bullish continuation sample that peaked at $110,624 from the breakout at $116,805. The rally stays intact, however current candles present small our bodies and present a pause with momentum. Consumers appear to be taking a break, with help shaped between $114,500 and $115,000. A confirmed breakout of over $117,000 may speed up income in the direction of over $118,000 if accompanied by quantity with development. A cautious bull might think about an entry on retesting help.

BTC/USD 4-hour chart by way of BitStamp on September twelfth, 2025.

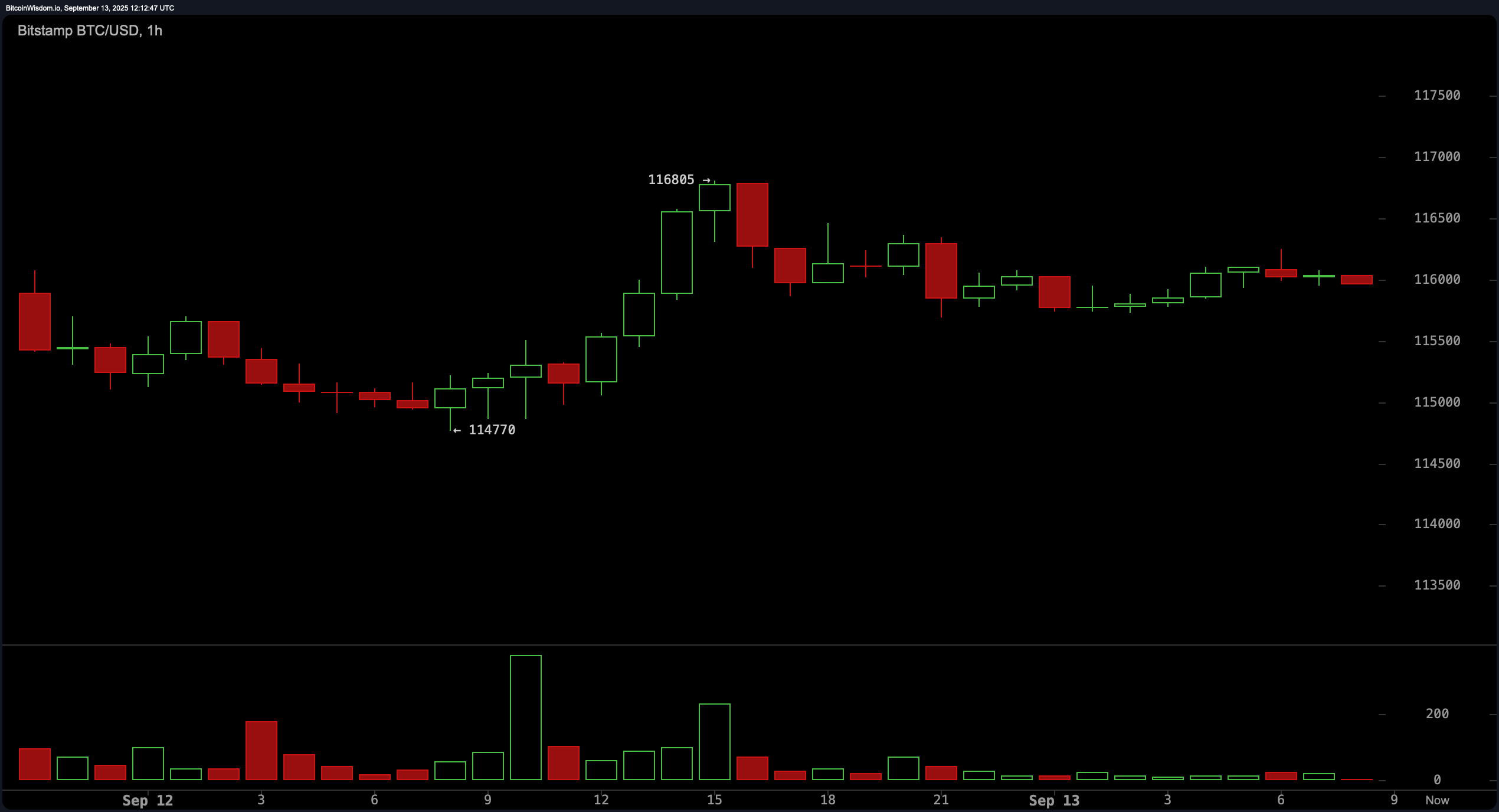

On the one-hour chart, Bitcoin is consolidated beneath $116,805 in peak, forming what seems to be a bullish flag or range-bound setup. Momentum cools, however usually precedes steady motion somewhat than reversal. Brief-term help is near $114,770 and so long as the worth is above $115,500, patrons are nonetheless in management. Scalpers might discover alternatives with breakouts above $116,800 or bounces close to the $115,000 degree, however with the potential for a short-term pullback, the outage ought to shut at beneath $114,770.

BTC/USD 1-hour chart by way of BitStamp on September twelfth, 2025.

From a technical indicator perspective, actions level evenly on common, exhibiting bullish momentum. All essential ranges of the exponential transferring common (EMA) and easy transferring common (SMA) (together with indicators for intervals 10, 20, 30, 50, 100, and 200) be sure that Bitcoin is buying and selling past key pattern markers. The exponential transferring common (10) at $113,586 (10), and the easy transferring common (10) at $112,799, present short-term pattern help, whereas the long-term easy transferring common (200) at $102,349, highlighting a deep bullish base.

The oscillator presents advanced photographs. The relative power index (RSI) is positioned at 59, suggesting impartial momentum with out extreme situations. The stochastic oscillator rises at 95, indicating a doubtlessly over-built sign. The Commodity Channel Index (CCI) 195, Momentum at 4,219, each issued gross sales indicators, suggesting an upward drive. In the meantime, the unbelievable oscillator of 475 and the transferring common convergence department (MACD) degree of 202 each present buy indicators, suggesting that the broader pattern stays intact. This distinction in indicators requires cautious optimism specializing in actions supported by the quantity.

Bull Verdict:

The broader technological construction stays bullish as Bitcoin holds above the principle help zone and all main transferring averages line up on the high. If the customer can push a $117,000 resistance with a powerful quantity, the street to $120,000 seems to be viable within the brief time period.

Bear Verdict:

Regardless of its bullish construction, it fastidiously means that it overstretches the vibrator and reduces daytime momentum. A breakdown beneath $114,770 may undermine short-term feelings and result in deeper retracements in the direction of earlier integration ranges close to $113,500.