Ethereum's continued underperformance towards Bitcoin has reignited the talk about who’s holding the asset and what’s behind its demand.

In accordance with Bitcoin proponent Samson Mow, about $6 billion of South Korean retail cash is backing so-called Ethereum treasuries, with firms accumulating ETH as a steadiness sheet asset in a microstrategy Bitcoin technique. Mow issued the declare in an Oct. 5 publish on X, claiming that “ETH influencers” flew to Seoul for court docket retail merchants chasing the following “strategic play.”

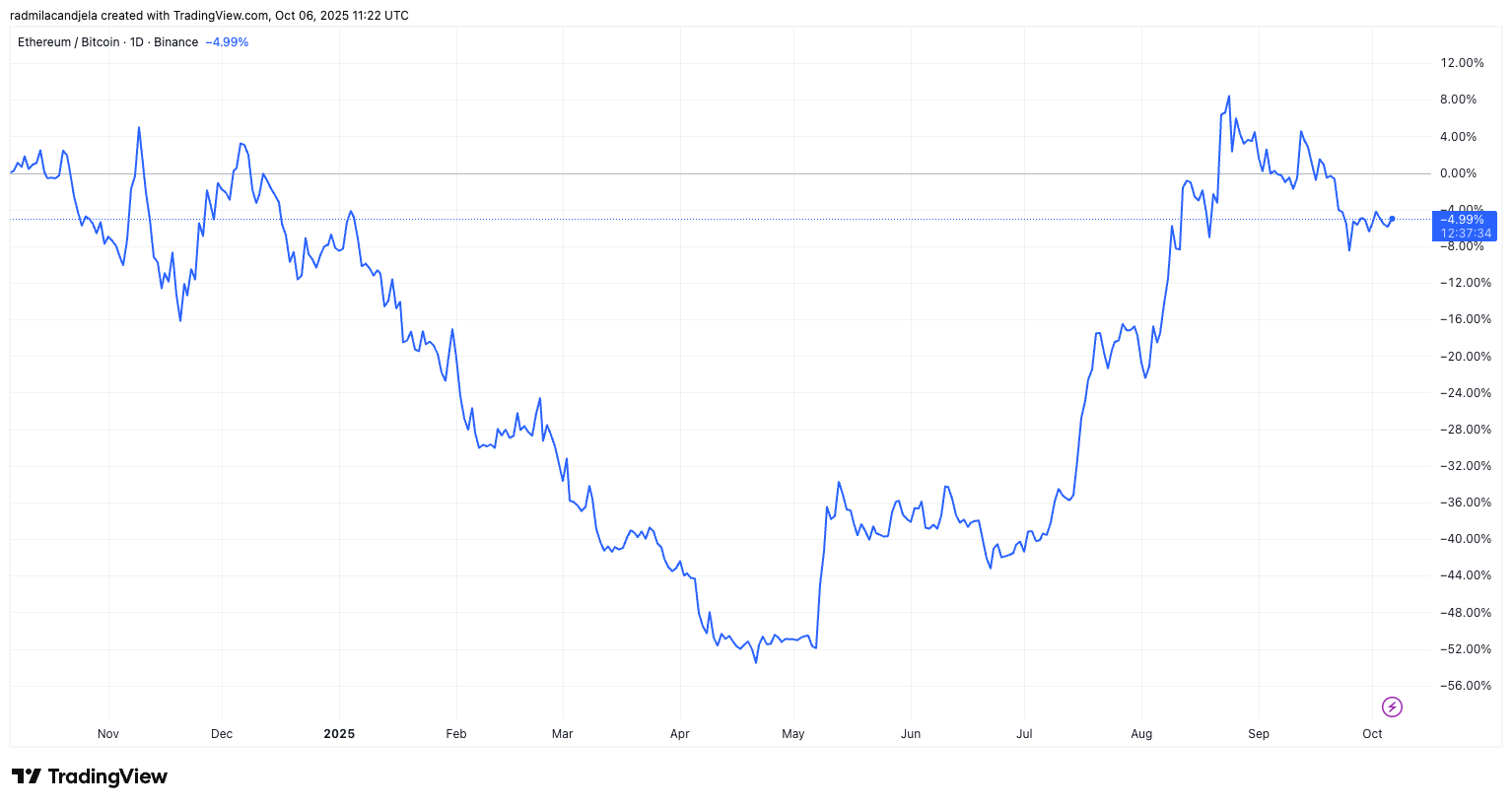

As of October 6, ETH has slipped about 1.9% prior to now 24 hours and is down about 5% versus Bitcoin over the previous month, in line with Coinmarketcap. In accordance with Mow, that weak point means that short-term retail enthusiasm, fairly than institutional perception, is sustaining Ethereum's valuation.

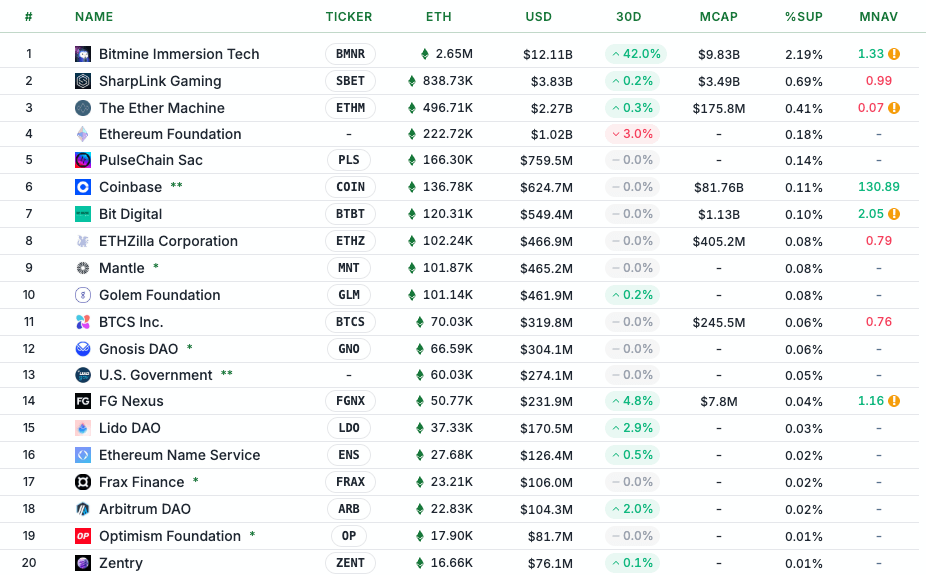

In accordance with information from Strategic ETH Reserve, 67 entities, together with Bitmine and Sharplink, collectively maintain roughly 5.49 million ETH (roughly $25 billion), or 4.5% of the overall provide.

Mow attributes a lot of this publicity to a Korean retail investor identified regionally as Seohak Gaemie, who claims to have funneled round $6 billion into the Ethereum treasury firm. He argues that promoters are promoting these firms as “the following micro-strategy,” luring merchants searching for a simple analogue to Bitcoin's company accumulation playbook.

“Many of those buyers have zero concepts in regards to the ETH/BTC chart and imagine they’re shopping for the following strategic commerce.”

He warned that enthusiasm constructed on “monetary illiteracy” might backfire, particularly as Ethereum continues to lag behind Bitcoin in relative efficiency.

Ethereum's value efficiency displays considerations. Regardless of common inflows and a brand new narrative push, ETH continues to weaken towards Bitcoin, falling beneath its earlier all-time excessive of $4,946. The ETH/BTC ratio has declined over 5% over the previous 12 months, reinforcing the notion that a lot of Ethereum's market cap assist is narrative-driven fairly than primarily based on elementary development or institutional adoption.

Mow's critique echoes feedback from Mechanims Capital co-founder Andrew Kang. Andrew Kang additionally questions the monetary logic behind an Ethereum-based treasury. Kang pointed to initiatives like Tomley's Bitmine as examples of “undisciplined monetary fashions” that lack the monetary construction present in profitable Bitcoin holding firms. “Ethereum know-how is bearish,” Kang stated, including that ETH’s long-term vary might stay between $1,000 and $4,800 with out main modifications in fundamentals.

Kang concluded that Ethereum's valuation “primarily comes from monetary illiteracy” and in contrast its speculative momentum to XRP's historic rally. He argued that whereas retail hype can maintain massive market caps for some time, it isn’t a sturdy basis. “The popularity that comes from monetary illiteracy shouldn’t be infinite.”

Whether or not Korean retail demand turns into a brand new structural pillar for Ethereum or the final gasp of a declining narrative might rely on how lengthy the “ETH Treasury” narrative is ready to overtake the charts.