Cango Inc. has been pivoted from automobile buying and selling to Bitcoin mining, concentrating on 50 EH/s in early 2025.

A lot of deep diving

The next visitor posts are posted by bitcoinminingStock.io, a one-stop hub for all of Bitcoin Mining Shares, Academic Instruments and Trade Insights. It was initially revealed on March 25, 2025, however was declared by Cindy Feng, writer of bitcoinminingstock.io.

It's been weeks since I delved right into a deep final identify right into a lesser identified identify within the Bitcoin mining house. I used to be a bit quiet. Particularly as a result of the sector was sluggish, however he’s recovering from a lower-level harm (a reminder to take heed to the physique in relation to bodily exercise and never push it too exhausting).

Within the second article on this collection, I wish to speak about it. Cango Inc. (NYSE: CANG). why? Whereas your complete mining sector has been just lately assaulted, Cango had some sturdy daysit is going to increase Share the announcement of buyback And a Non-binding acquisition supply.

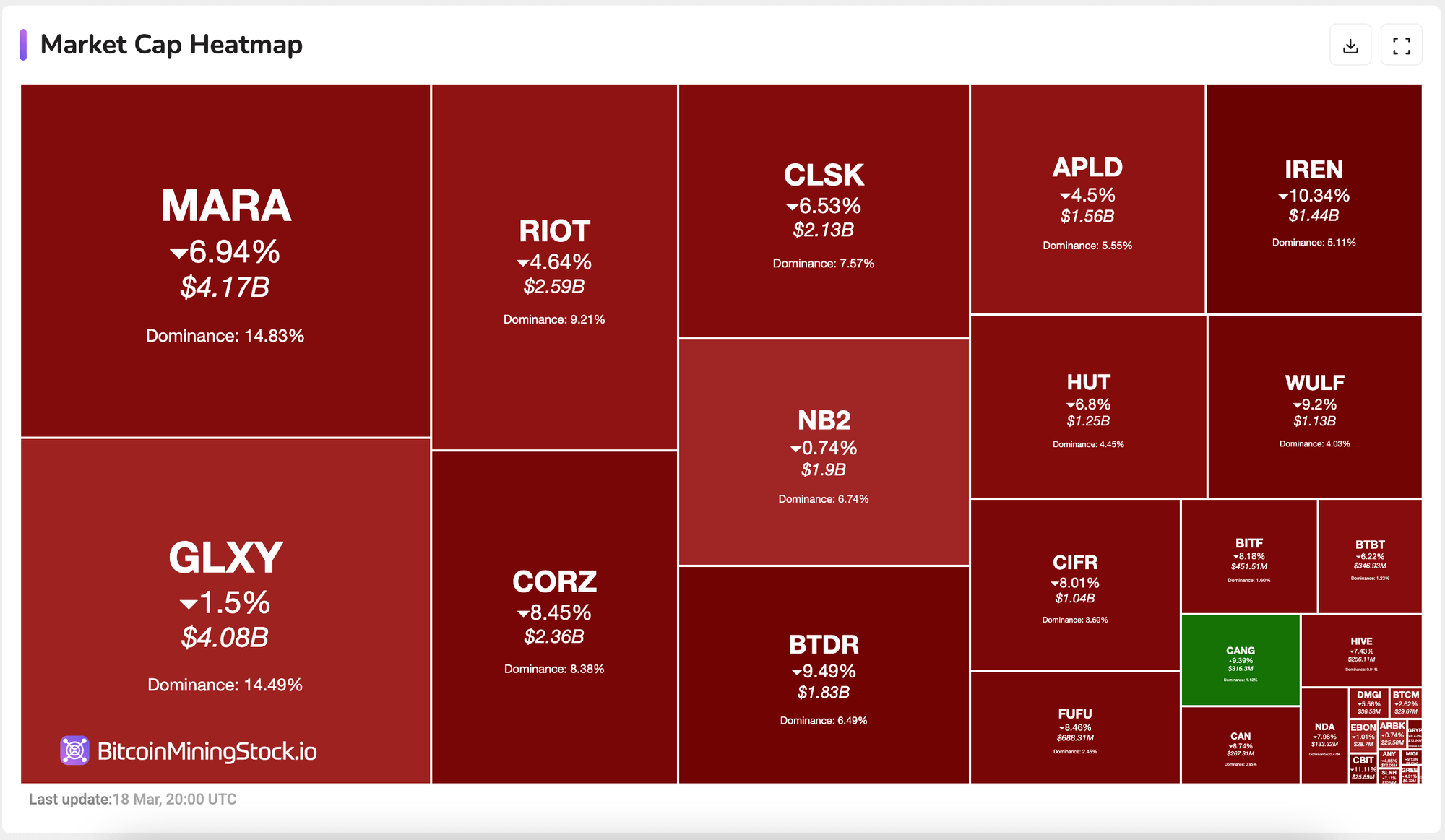

Bitcoin Mining Inventory Warmth Map (Dwell Replace)

However right here was my eyes. Just some months in the past, this was a automobile buying and selling platform that also had restricted development potential. Now it turns into a goal 50 eh/s Early this 12 months, 32 eh/s already on-line.

So, how does this daring pivot work? And may Cango quietly turn into a significant participant within the house? Let's dive in.

Firm overview

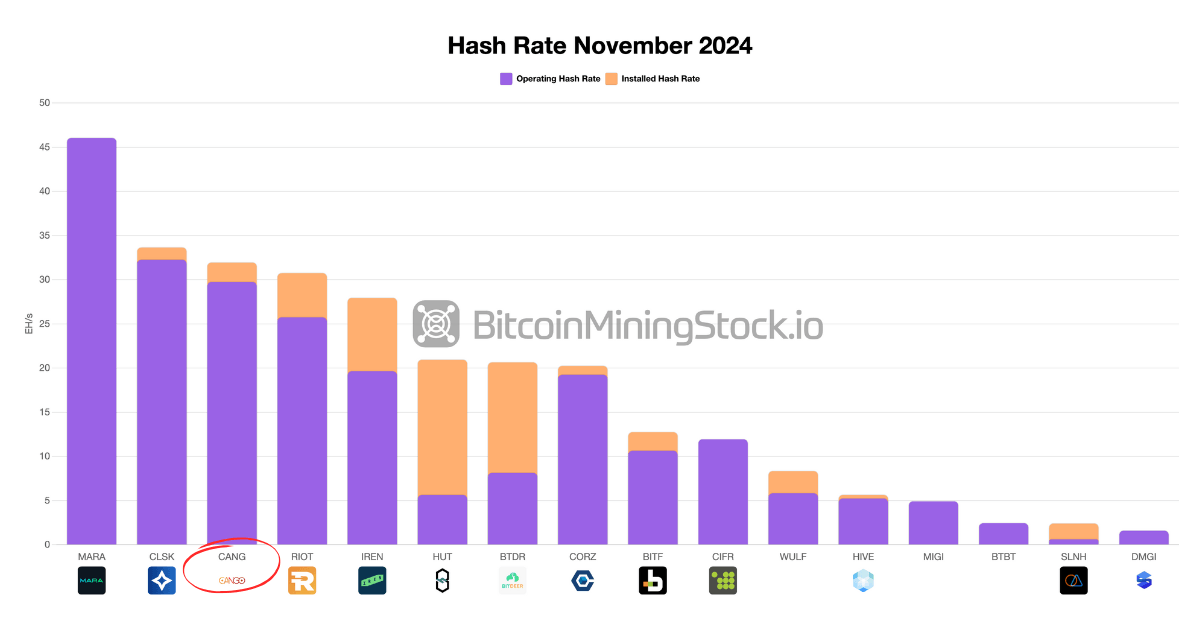

Cango Inc. (NYSE: CANG) started as a Shanghai-based auto finance firm and later established itself as a key participant in China's auto buying and selling providers. By the second half of 2023, the corporate had shifted its focus from its home market to selling gross sales in China from China. Then, in November 2024, CANGO introduced its entry into Bitcoin mining and started operations at 32 EH/s on-line hashrate. The size and immediacy of this motion have stunned many buyers. Mara and CleanSparkand make it The third largest public bitcoin miner As a result of capability developed on the time.

Public Miner Hashrate Overview

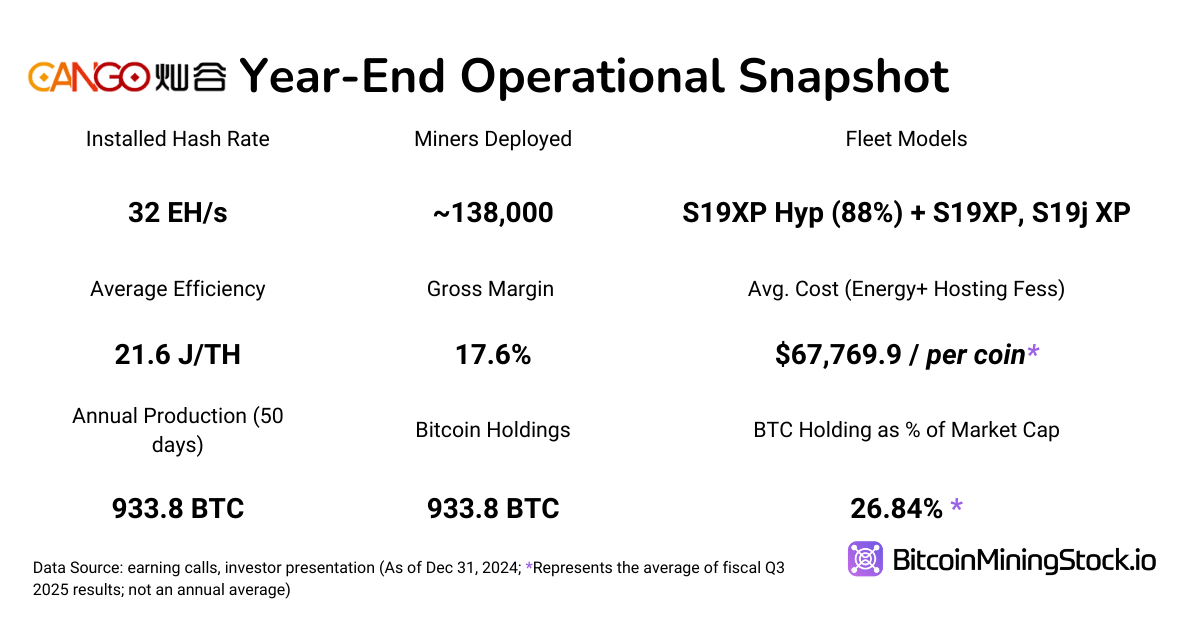

The mining acquisition settlement was being directed 50 eh/s In whole, the remaining 18 EH/S, that are anticipated to be on-line within the first quarter of 2025, will likely be topic to the efficiency requirements outlined within the contract. Specifically, the infrastructure was not constructed from scratch. Cango has acquired operational ASIC fleet instantly from BitmainBitmain associates additionally proceed to handle the operation and upkeep of their machines inside third-party internet hosting amenities.

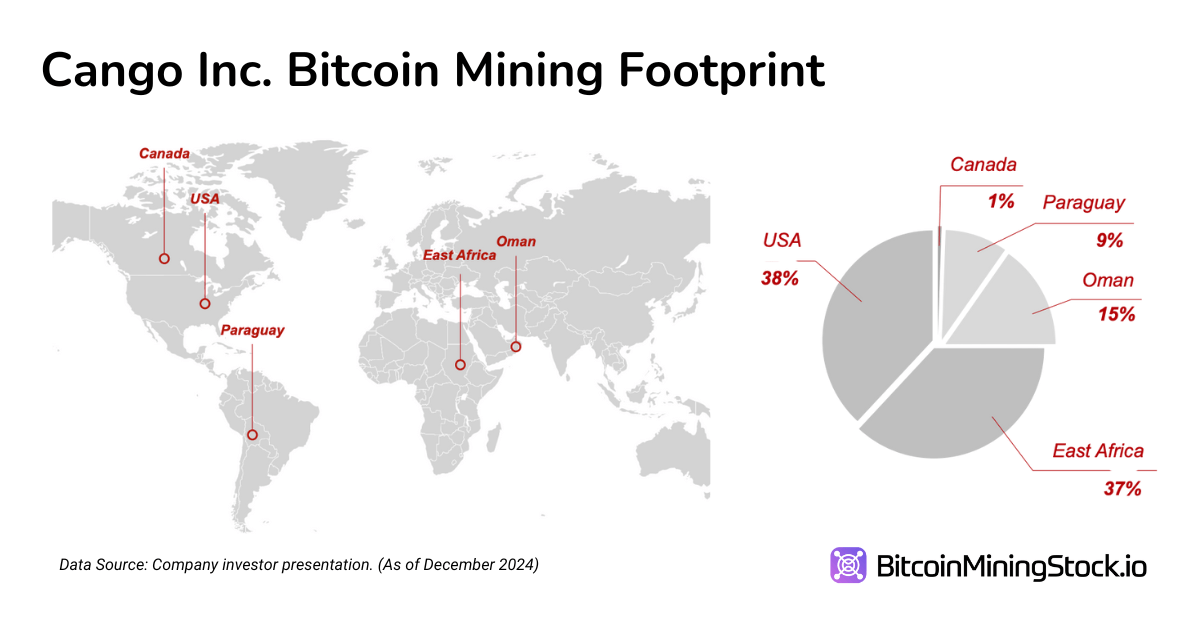

In accordance with firm disclosures, CANGO primarily hosts its fleet US, East Africa, Oman, Paraguay – This will likely be revealed from China's ongoing crypto restrictions.

Monetary highlights

Remodeling income and profitability

The affect of pivots on Cango's Bitcoin mining is clearly mirrored within the newest monetary outcomes. Within the fourth quarter of 2024, the corporate reported Income 668 million RMB ($91.5 million), a 414% year-on-year improve. This development was nearly utterly pushed Bitcoin mining, Which of It accounted for 98% of whole income. In distinction, the Automotive Buying and selling phase, as soon as a core enterprise at Cango, contributed to RMB15 million ($2.1 million). This sign that this legacy phase is successfully phased out.

Regardless of the sudden rise in income, Profitability stays an essential concern. Cango Put up 17.6% whole margin In This fall, we’re considerably beneath our friends who’ve related operational scales. For comparability, CleanSparkworks at comparable hashrate ranges, 57% whole margin In the identical interval. This means that Cango's value construction isn’t optimized. Dependency on third-party internet hostingand publicity Greater power prices They’re two major attributes.

Firm's Common Bitcoin manufacturing value I used to be standing $67,769 per BTC(Money prices embrace power and internet hosting charges). This diagram turns Cango Excessive-end value curve Among the many massive public miners we monitor – lots of them report All-in prices within the $50,000 vary. Till Cango secures a low-cost infrastructure or negotiates a extra advantageous internet hosting time period, Margin profiles might proceed to be underneath stressEven when income development continues.

Stability Sheet and Liquidity

Cango has entered 2025 Robust fluidity placereported RMB2.5 billion ($345 million) and short-term investments as of December 31, 2024, up from RMB1.7 billion ($232.9 million) the earlier 12 months. This substantial reserve offers a significant buffer for steady enlargement and cushioning to potential volatility within the Bitcoin market. Nonetheless, the corporate's Complete debt additionally rose sharplya rise of 126% from the earlier 12 months to 1888 million ($258 million). This rise was pushed primarily by infringed prices and different present liabilities associated to mining acquisition and associated operations.

Cango is presently liquid sufficient to fund short-term development, however stress is presently shifting to enhance its operational margins. With out stronger money stream technology, the corporate might have to in the end search it Exterior capital,hazard Elevated fairness dilution or leverage.

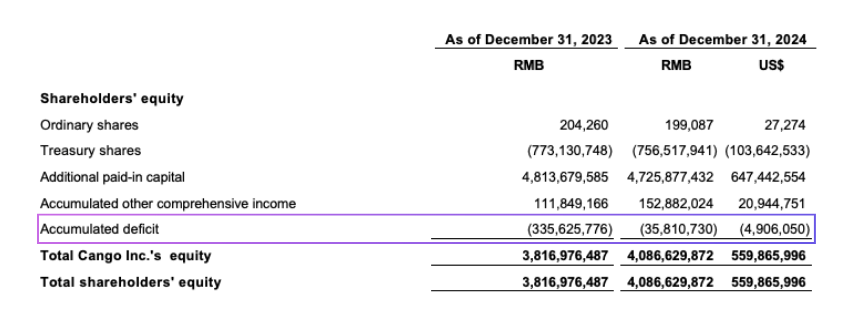

Please take a better look Fairness construction We spotlight these trade-offs. Shareholder inventory elevated to 7.1% ($559.9 million) year-on-year, primarily as a consequence of web revenue of 299.8 million ($41.1 million) in 2024.

however, A $144 million share base Parts of the $400 million mining machine acquisition It had a significant affect on the inventory construction. It expanded whole capital, but in addition diluted current shareholders. vendor, At the moment, stockholders collectively My very own Roughly 40% of the corporate After the transition. This variation in possession is mirrored in a decline in extra payroll capital from RMB481 million to RMB4.733 million to RMB4.743 billion, which refers to inventory redistribution fairly than recent capital inflows.

Lastly, the corporate purchased it again. 996,640 ADSS for $1.7 millionthe affect of buybacks on all shares was negligible. Nonetheless, whereas present capital allocations stay firmly centered on scaling mining operations, it means that administration views shares as undervalued.

Analysis modeling

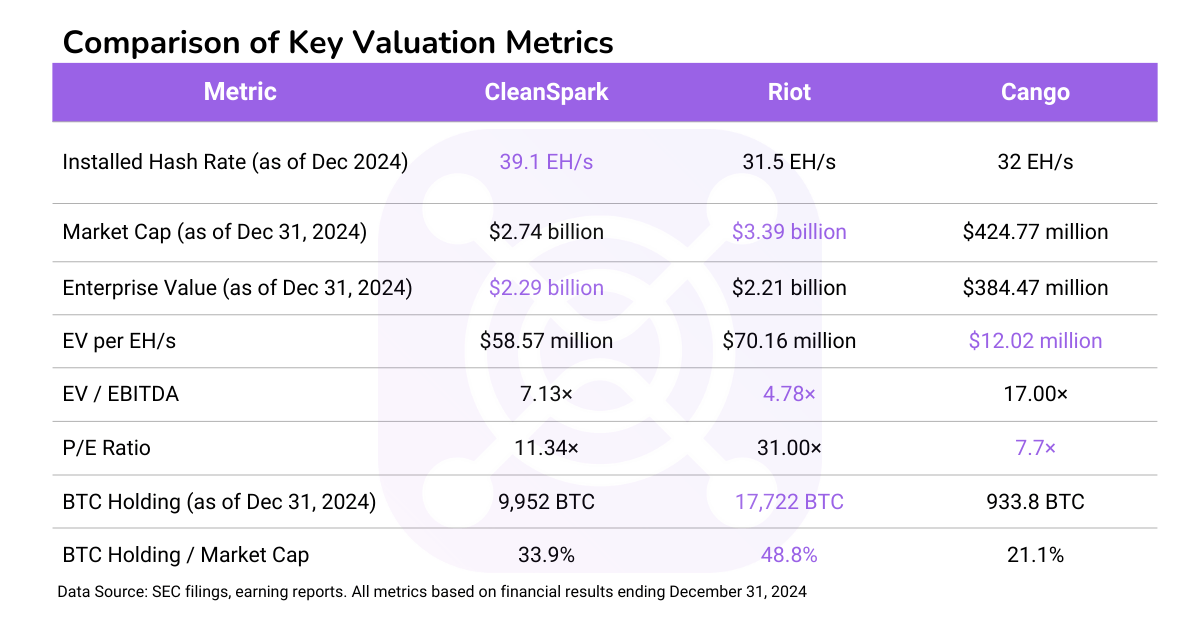

A key step in understanding Cango's worth is to benchmark it towards Bitcoin miners of comparable scales (e.g. Cleanspark, Riot). As of December 31, 2024Cango's market capitalization is $424.77 million).

- Enterprise Worth (EV): $229.2 million (market capital + debt – BTC holdings on money and money equivalents).

- EV/EBITDA Ratio: 17X ($384.47M/$228M)

- P/E: 7.7x

- P/S: 2.87X (Very Average Market Optimism on Income)

- Holds BTC / Market capitalization: 21.1%

Mining Operations and Effectivity

Cango is anticipated to roll out 32 EH/s by December 2024 and to 50 EH/s within the first quarter of 2025. Bitcoin Manufacturing Forecast for 2025:

- Manufacturing charge for the fourth quarter of 2024: 933.8 BTC solely 50 days (November to December 2024).

- Up to date January-February 2025: 1,010.9 BTC mining, 32 EH/s, a tempo of roughly 500 BTC/month was confirmed.

- Scaling Projection: If 32 EH/S generates about 6,000 BTC per 12 months, 50 EH/S ought to generate ~8,500 BTC, assuming a linear scaling mannequin.

This projection is a Finest Case State of affairsexcludes all variables, particularly community problem. In actuality, rising world hashrates and growing mining competitors can improve community problem, decreasing Cango's BTC output and affecting income forecasts. The corporate's publicity to such fluctuations is materials, given that the majority of its revenues are linked to mining.

Fleet effectivity is a priority. Cango reported Common 21.6 j/thIt consists of:

- 90% S19xp Hyd. Mannequin (water-cooled, effectivity).

- 10% older mannequin (larger energy consumption, much less aggressive).

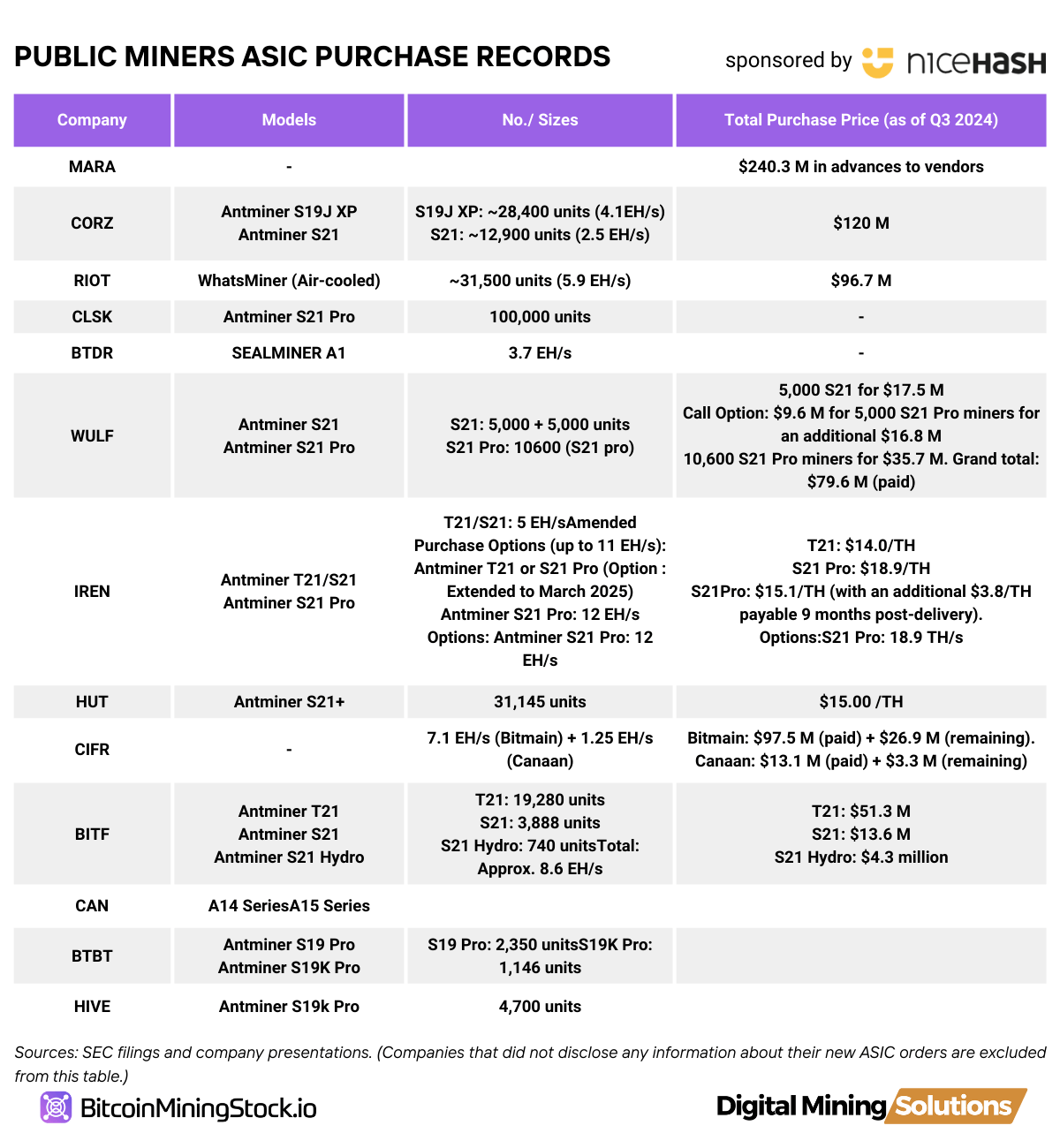

In distinction, high miners are already starting to maneuver S21 Collection {Hardware}considerably improves efficiency and power effectivity.

My annual mining report reveals that almost all of enormous public miners ordered the S21 collection inside the first 9 months of 2024.

If Cango desires to remain aggressive, it’s possible you’ll want to take action Exchange the previous machineAnd take into account it Migrating from third-party internet hosting to self-operation infrastructuremight enhance margins over time by decreasing internet hosting charges and power prices. With out this enchancment, the manufacturing prices will likely be larger $67,769 per BTC– In tightening markets, profitability could possibly be eroding.

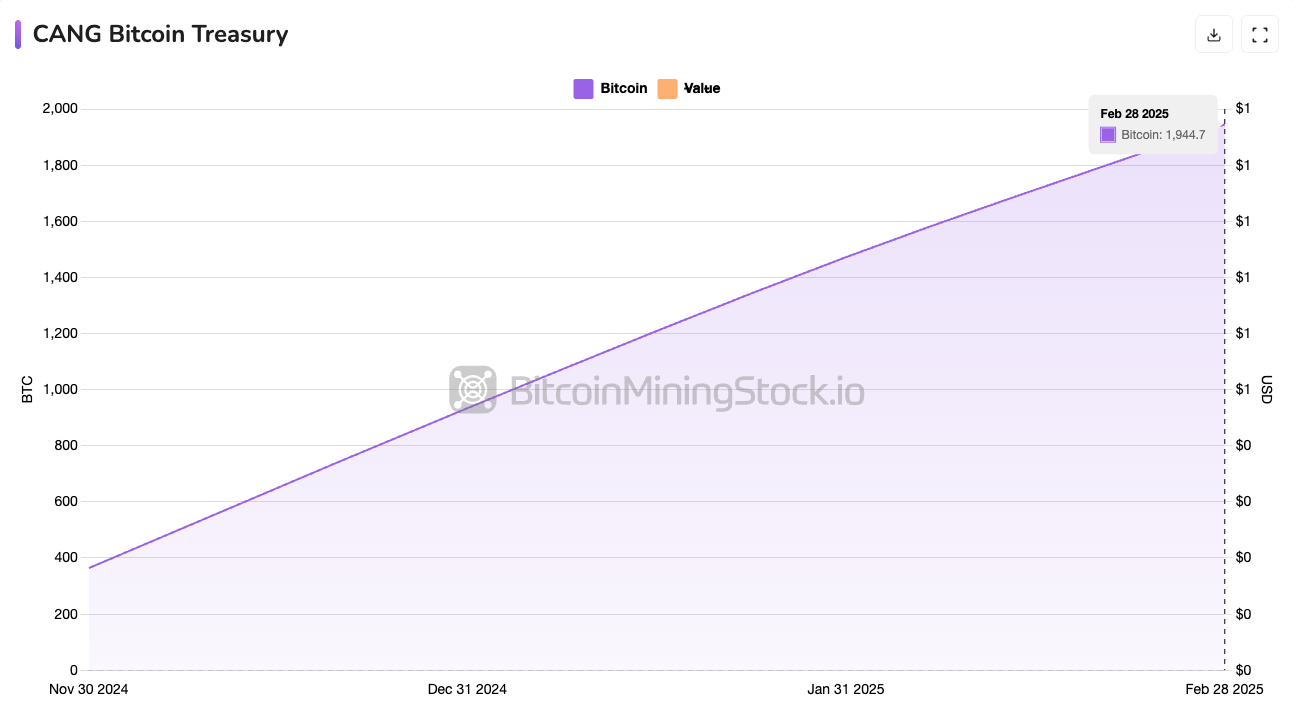

Bitcoin Treasures

Cango clearly adopts “My & Maintain” The technique chooses to carry Bitcoin as an alternative of liquidating for short-term money. As of December 2024, the corporate owns 933.8 BTC ($85 million at year-end worth). By February 2025, that determine had greater than doubled to 1,944.7 BTC, confirming an aggressive accumulation.

Historic efficiency knowledge for miners is now obtainable with the Premium function.

This monetary method has gained much more visibility Cango has been added to the Bitise Bitcoin Normal Companies ETF On March 18, 2025, an ETF tracks public firms with over 1,000 BTC. Inclusion can present consciousness of the establishment and improve visibility amongst encrypted buyers.

Following earlier assumptions, Cango was in a position to mine round 8,500 BTC in 2025. Coupled with its current holdings, its Treasury may attain round 9,500 BTC by the top of the 12 months. By then, if BTC reaches $100,000, Bitcoin Holdings may attain almost $1 billion. Among the many largest public BTC holders Worldwide, it may rival established mining firms and reconstruct the narrative of its evaluation.

This technique is in step with the long-term bullish view on Bitcoin, however I'll introduce it to you Liquidity and steadiness sheet dangers. Cango could also be compelled if the value of Bitcoin drops considerably Promote BTC at a drawback or Counting on exterior funding That is very true as a result of the corporate's mining operations are nonetheless margin-sensitive and capital-intensive, thus funding operations.

Non-binding buyout supply: Hidden bit major play?

On March 14, 2025, Cango obtained a non-binding acquisition supply from everlasting Wealth Capital Ltd. (EWCL). Little is thought about this funding administration firm, based within the UK's Virgin Islands. Key people in EWCL have a hyperlink to BitmainThe world's largest ASIC producer.

This raises some Hypothesis:

- Is that this an try? Separating Cango's Bitcoin Mining Enterprise from the origins of Chinese language firms? Given China's ban on mining in 2021, structural separation may scale back the chance of regulation and permit Cango to function extra freely.

- Successfully it will likely be cango Bitmain Help Mining Proxy? The corporate has bought your complete fleet from Bitmain's current enterprise, and Bitmain associates proceed to function and preserve these machines after their acquisition. At the moment, Bitmain linked personnel are behind the acquisition try.

If a transaction happens, Cango may have direct entry to Bitmain's ASIC provide, decreasing {hardware} prices and growing Cango's competitiveness, however it may be seen adjustments in possession construction that may have an effect on current shareholders. Traders have to intently monitor whether or not the transaction is realising and the terminology it accommodates, because it may essentially change the corporate construction of Cango.

Ultimate Ideas

Cango's aggressive pivot in the direction of Bitcoin mining basically restructured its company id. It’s now not an auto platform firm with medium development prospects – now Ranked one of many greatest bitcoin miners in hashrate. There’s a stack of BTC sitting on the steadiness sheet, which coincides with the brand new “Bitcoin Treasury” development.

That stated, the story remains to be underneath improvement. There are nonetheless core questions on operational effectivity stability of Bitcoin Worthand the way Cango can deploy its liquidity Optimize the price construction. As firms like Mara have completed, for instance, the transition from third-party internet hosting to self-mining infrastructure may considerably enhance long-term margins. Current non-binding acquisition gives from entities linked to Bitmain additionally add to the plot. If deeper integration with Bitmain is achieved, it may enable entry to discounted ASIC {hardware} and speed up fleet upgrades.

Nonetheless, the problem continues. Regardless of holding $345.3 million in money and short-term funding, it could possibly be roughly lined 1. Operations for 13 years On the present charge of combustion, Growing older fleet, It primarily consists of second-hand S19 XP HYDs. The mannequin is heading in the direction of quicker depreciation. As friends transfer to S21 collection machines, Cango might discover an environment friendly drawback in the event that they don't preserve their tempo. Fleet depreciation may additional erode the already skinny gross earnings, significantly on condition that the This fall report didn’t bear in mind these prices.

Specifically, Cango's management crew brings an A A robust monetary backgroundand its shareholder base contains Tencent as the highest 11 holder. This can be a reality that’s typically ignored by Western buyers. Nonetheless, China's headquarters proceed to pos Regulatory and geopolitical dangersparticularly as mining bans are in impact in China.

Anybody all in favour of Cang ought to Monitor the next essential elements:

- Bitcoin manufacturing prices for friends

- Depreciation and gross sales of previous mining fleets

- Liquidity and volatility of BTC holdings underneath the “HODL” technique

- The affect of China-based operations on future strategic flexibility

- Potential connections with Bitmain from the result of the acquisition supply

Solely time can inform whether or not Cango can set up himself as a key participant within the sector.