Following the instance of technique, corporations are more and more investing in Bitcoin. It is a development that has been strengthened by rising cryptocurrency costs. Nonetheless, these huge acquisitions elevate considerations about market collapse if corporations are compelled to promote and ask questions on Bitcoin's decentralized spirit.

Representatives from Bitwise, Komodo Platform and Sentora say advantages are far outweighing dangers. Smaller and extreme corporations may go bankrupt, however the market influence is minimal. Profitable corporations like MicroStrategy present no indicators of liquidating their property, so there isn’t a speedy danger.

Development tendencies in company adoption of Bitcoin

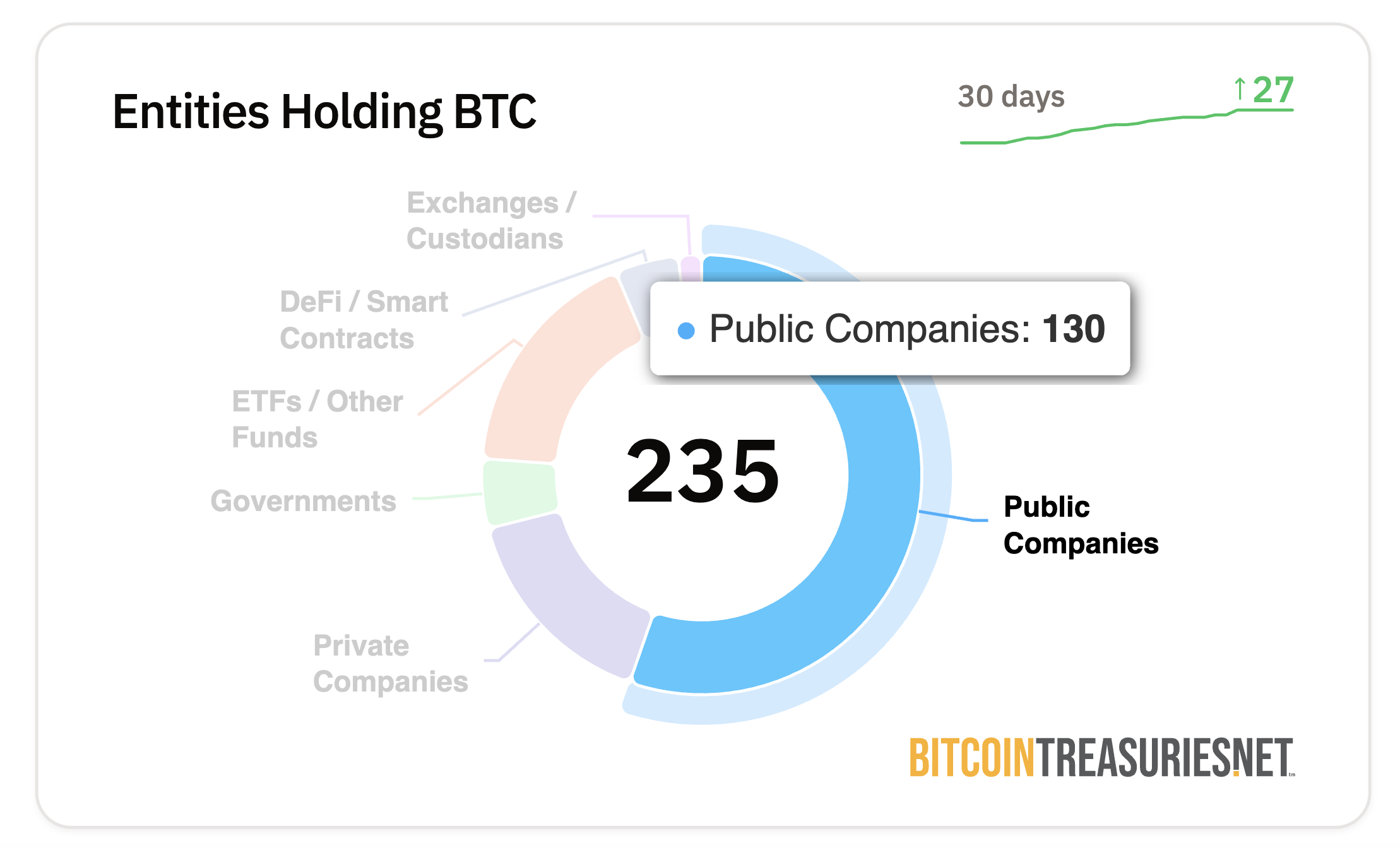

The variety of corporations collaborating within the firm's Bitcoin acquisition development is rising. Normal Chartered not too long ago reported that at the least 61 public corporations have bought the crypto, whereas Bitcoin Treasuries experiences that the quantity has reached 130.

Public corporations proceed to purchase Bitcoin. sauce. Bitcoin treasure.

The technique (beforehand the micro-strategy) continues to build up billions in unrealized income from aggressive Bitcoin acquisitions, which have been strengthened by rising Bitcoin costs, so extra corporations could observe go well with.

“The Wilshire 5000 Fairness Index actually consists of 5,000 public corporations solely within the US. It's very doubtless that there can be a serious acceleration within the Treasury adoption of Bitcoin this yr and in 2026.”

There are a number of instances extra causes to advertise his beliefs.

How does Bitcoin volatility evaluate to different property?

Though risky, Bitcoin has traditionally demonstrated a really excessive return in comparison with conventional asset lessons equivalent to shares and gold.

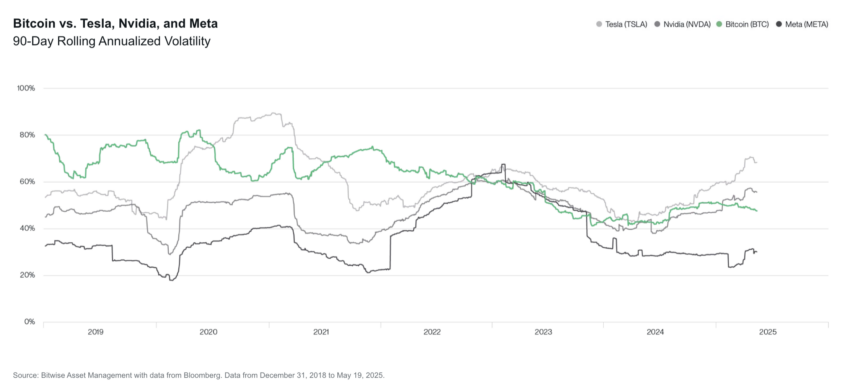

“One of many knowledge factors that’s notably attention-grabbing is the volatility of Bitcoin in comparison with main tech shares equivalent to Tesla and Nvidia. Many buyers “by no means spend money on one thing as unstable as Bitcoin,” mentioned Ryan Rasmussen, analysis director at Bitwise, “On the identical time, most buyers personal Tesla and Nvidia, and undergo both Tesla and Nvidia, through Nvidia, or by way of both Tesla and Nvidia (Nasdaq-100). In latest months, each Tesla and Nvidia have been extra risky than Bitcoin.”

Bitcoin vs. Tesla, Nvidia, and Meta shares. Supply: Bitwise.

Previous efficiency doesn’t assure future returns, however the present efficiency of Bitcoin, notably steady, may inspire extra corporations to purchase property.

“Bitcoin's volatility has declined over time, a development that may stay within the close to future. When Bitcoin discovers a real value, volatility will method zero. It would sluggish demand. The Komodo platform advised Beincrypto.

In the meantime, as world markets deal with financial challenges, Bitcoin may grow to be a beautiful possibility to enhance weak monetary stability sheets.

Does Bitcoin make up for conventional secure havens?

The US and the worldwide world financial system are battling geopolitical tensions, rising inflation and a worrying price range deficit. Bitcoin, thought of a “digital gold” and a valued sovereign impartial retailer, has piqued the curiosity of various shareholders, particularly after the victory of the technique.

“Strain from present shareholders will definitely enhance over time, particularly if inflation begins to re-accelerate attributable to rising geopolitical dangers and elevated monetization of fiscal debt by central banks.

He predicted that Bitcoin will ultimately surpass conventional secure havens just like the US Treasury invoice and gold. A surge in adoption will scale back Bitcoin volatility and grow to be an total aggressive asset.

Bitcoin's historic volatility. Supply: Bitwise.

“Bitcoin volatility has been a structural downtrend from the beginning, and the principle purpose behind this structural decline is that it will increase rarity attributable to elevated hulling and adoption, which tends to undermine volatility.

Bitcoin's technical background, then again, provides it a extra aggressive edge than different asset lessons.

“We consider that the technical benefit over gold is more likely to finally destroy the Treasury storage in the long run, like gold and different Treasury ministries.

Nonetheless, not all corporations are created equally. Some folks profit, however others don't.

Differentiating an organization's Bitcoin technique

In accordance with Rasmussen, there are two forms of Bitcoin finance corporations.

They’re worthwhile corporations that make investments further money, equivalent to Coinbase or Sq., or corporations that guarantee debt or equity to purchase Bitcoin. No matter kind, their accumulation will enhance demand for Bitcoin and enhance costs within the brief time period.

Worthwhile companies utilizing extra money to purchase Bitcoin are uncommon and wouldn’t have a whole-body danger. Rasmussen expects these corporations to proceed to build up Bitcoin over the long run.

Corporations that depend on debt and fairness could face one other destiny.

“Bitcoin fundraisers exist solely as a result of the general public market is keen to pay multiple greenback for Bitcoin publicity. That is an unsustainable long run except these corporations are in a position to enhance Bitcoin per Bitcoin.

The success price of those corporations is dependent upon the quantity of income they should pay again their money owed.

Mitigating Bitcoin danger for corporations

Giant and established corporations all the time have extra sources to handle their debt than smaller corporations.

“Giant and well-known Bitcoin finance corporations equivalent to Technique, Metaplanet, GameStop ought to have the ability to concern capital to refinance money owed or elevate money to repay money owed comparatively simply.

In accordance with Dragosch, the important thing to avoiding such a situation for small companies is to stop overvaluation. In different phrases, borrow one thing you may afford to pay again.

“The important thing issue that always breaks any type of enterprise technique is probably dangerous amongst different corporations that replicate MSTR's Bitcoin acquisition technique, beginning on a better price foundation. This will increase the chance of compelled liquidation and chapter within the subsequent naked market, particularly if these corporations accumulate an excessive amount of course of and extreme debt,” he mentioned.

Nonetheless, these liquidations reduce the market influence.

“It would create short-term volatility in Bitcoin and be dangerous to the inventory costs of these corporations, however it isn’t an explosion danger for the broader crypto ecosystem. It would in all probability be a comparatively small variety of small corporations.

The precise drawback arises when a big participant decides to promote his holdings.

Is large-scale holding a scientific danger?

Extra corporations will add Bitcoin to their stability sheets, at the least on the market degree. The technique is now not the one firm using this technique.

Nonetheless, the technique holdings are huge. Right now, it owns practically 600,000 bitcoin, 3% of the full provide. Such a centralization really carries liquidation dangers.

“At present, over 10% of all Bitcoin is held within the ETF's managed wallets and the Ministry of Company Treasury. A major share of the full provide. This focus poses a scientific danger. If any of those centrally managed wallets are infringed or false, the fallout can ripple by way of the complete market.

Some specialists consider that such a situation is unlikely. If that occurs, Stadelmann predicts that the preliminary adverse final result will finally be steady.

“If a micro technique sells a big portion of Bitcoin, initially they may develop plans to take action with out affecting the market. Finally, folks will acknowledge what’s going on and hold the value of Bitcoin much more in depth.

Nonetheless, a big quantity of Bitcoin held by some massive corporations raises new considerations about centralising the property themselves quite than competitors.

Centralization as a trade-off of adoption

The buildup of huge corporations raises considerations in regards to the centralized possession of a restricted provide of Bitcoin. This challenges the ideas of the core and creates anxiousness in regards to the confusion in its underlying construction.

In accordance with Dragosch, that's not the case. You can not personal most provides and alter the principles of Bitcoin.

“The fantastic thing about Bitcoin's Work Proof Consensus Algorithm is that you just can’t change Bitcoin guidelines by proudly owning a big portion of the provision that’s completely different from different crypto property like Ethereum. Within the case of Bitcoin, nearly all of the hashrate is critical to vary consensus guidelines or to deprave/assault the community.

Second, Periker sees some reality in these considerations. Nonetheless, he sees them as trade-offs for different advantages of widespread adoption.

“This centralization contradicts the spirit of Bitcoin's self-strong possession of people, however institutional detention nonetheless may very well be essentially the most sensible path to widespread adoption, offering the regulatory readability, liquidity and ease of use that many new individuals anticipate,” he mentioned.

As companies are more and more utilizing Bitcoin for strategic monetary good points, the trail to changing into a broadly accepted reserve asset is accelerating. For now, it seems to incorporate the chance of market collapse.