Bitcoin worth is strolling a tightrope November of this yr. The every day chart reveals the market digesting a blended bag of financial indicators from the US, with costs hovering simply above $103,000 after plummeting from $110,000. The Fed has minimize rates of interest, however information gaps created by the federal government shutdown have clouded the outlook, and that uncertainty is spilling over into dangerous belongings like Bitcoin.

Let's analyze what is definitely occurring.

Bitcoin Value Prediction: What's Driving the Market Proper Now?

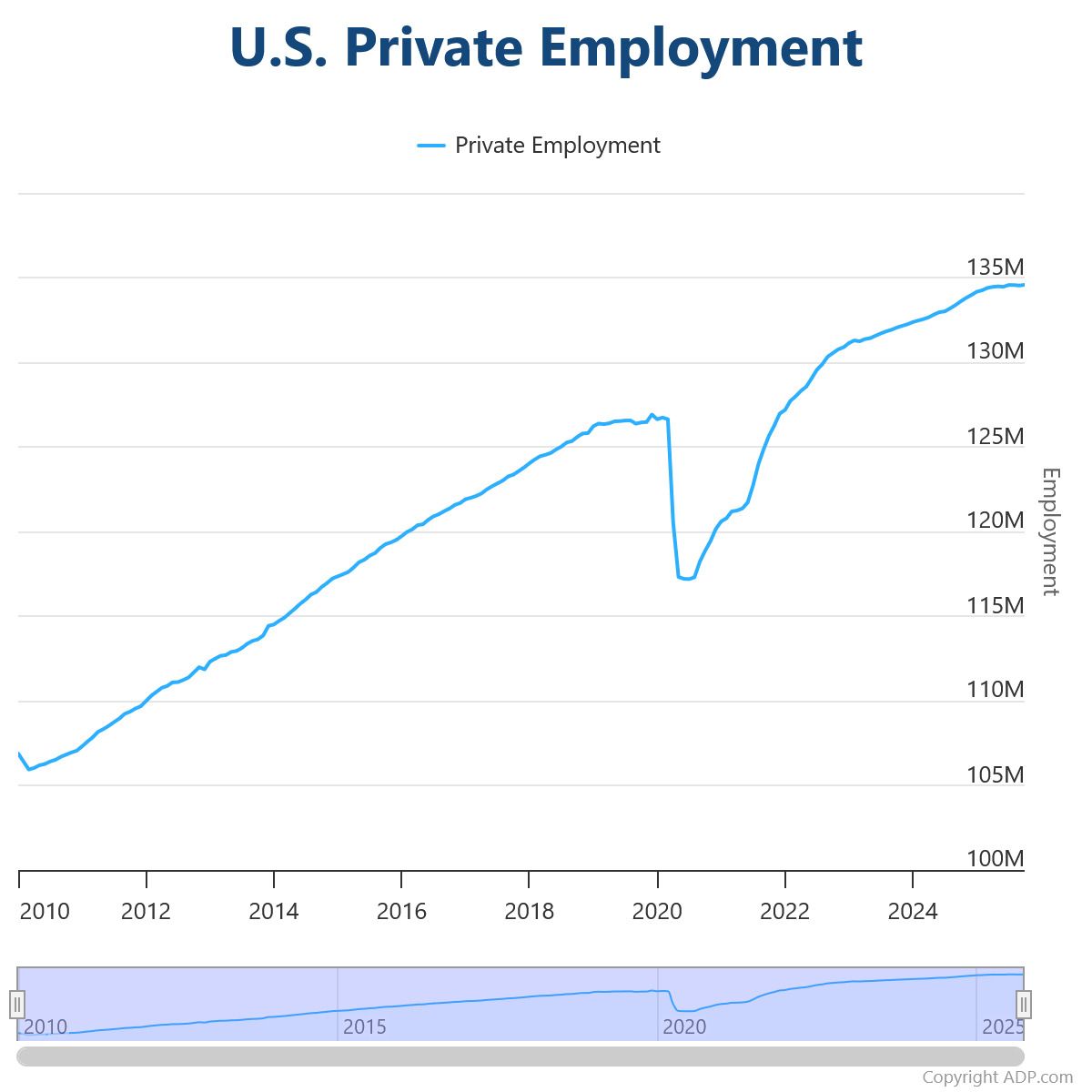

The principle issue this month was the Federal Reserve's resolution to chop rates of interest by 0.25%, regardless of the dearth of key authorities information. With businesses just like the Bureau of Labor Statistics offline, the Fed depends on personal information suppliers like ADP, Certainly, and PriceStats. In consequence, the financial system is working in a fog. Job development has slowed, indicators of inflation are contradictory, and discuss of stagflation is again on the desk.

That ambiguity is a double-edged sword for Bitcoin's worth. However, decrease rates of interest usually help threat belongings and crypto markets. However, considerations about stagflation (excessive inflation because of slowing development) might immediate buyers to take defensive positions, limiting upside momentum.

Bitcoin Value Prediction: BTC Value Trapped Between Resistance and Actuality

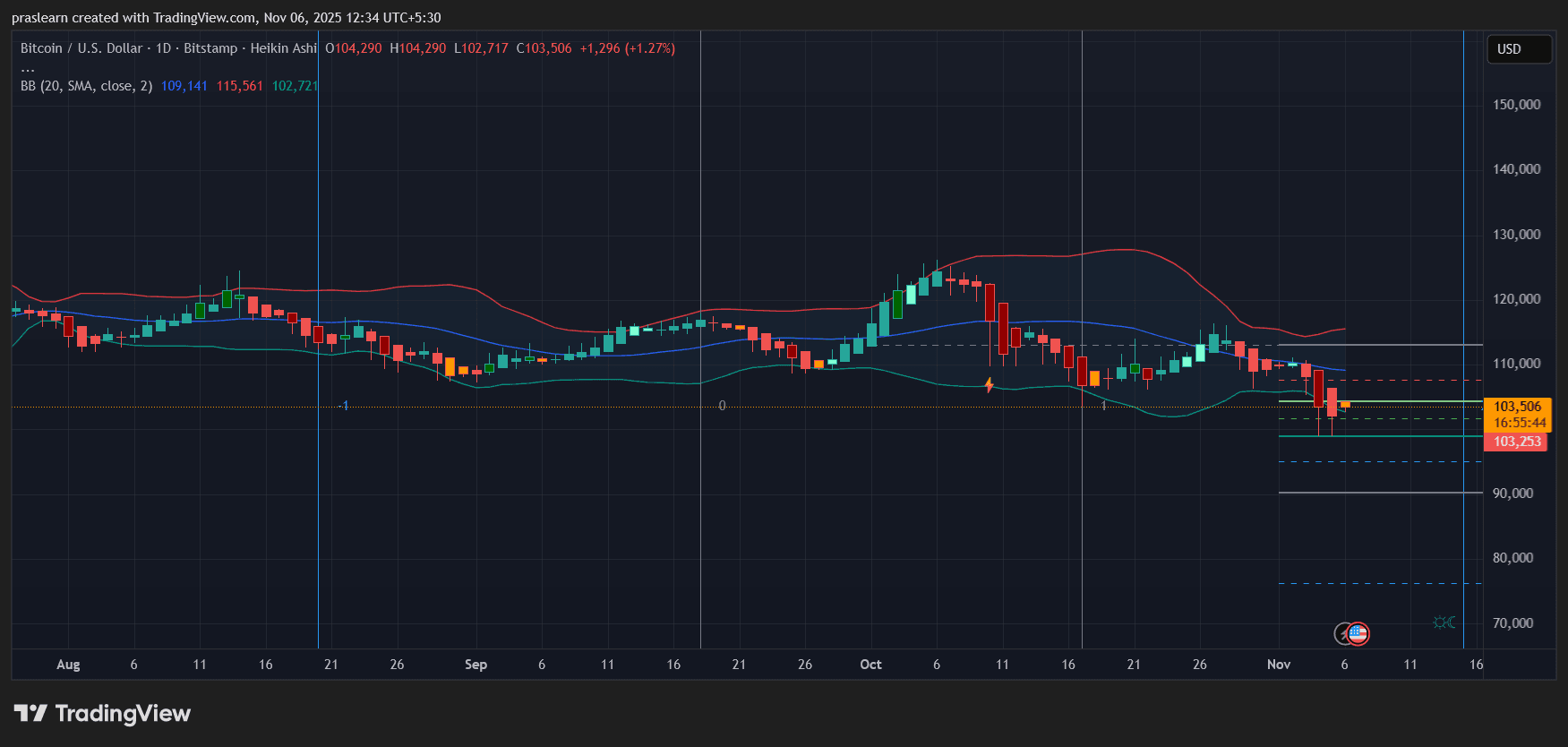

BTC/USD every day chart- TradingView

The every day Heikin Ashi chart reveals Bitcoin worth buying and selling inside a good Bollinger Band channel. The higher certain is round $115,500 and the decrease certain is round $102,700, a slim vary that happens earlier than an enormous transfer. BTC not too long ago examined the decrease band twice and confirmed resilience across the $102,000 help zone, however consumers have been unable to push the value previous the $109,000 mid-band.

This construction seems to be corrective quite than impulsive. All makes an attempt to interrupt above $110,000 have been rejected, suggesting a weakening bullish construction. Quantity fell, confirming that merchants are staying on the sidelines till macro transparency returns.

If the present candlestick closes above $104,000 and holds, BTC may try a relieving rebound in the direction of $107,000-109,000. Nonetheless, failure to maintain $102,000 may set off a fall to $97,500 and even $92,000. This stage corresponds to the decrease certain of the Fibonacci retracement that seems with this setting.

Financial Background: Fed Blind Spots and Market Fears

Buyers are flying blind alongside the Fed as a result of official inflation and employment figures will not be out there. Non-public sector employment rose by simply 42,000 jobs in October, a fraction of the month-to-month norm, based on the ADP report. In the meantime, PriceStats recorded inflation at 2.66% in September, the very best stage in practically two years, whereas Adobe's on-line worth index confirmed costs fell by practically 3%.

This contradiction is strictly what the market hates most: uncertainty. Bitcoin thrives on volatility however suffers from hesitation. In the mean time, merchants are questioning whether or not to deal with BTC costs as a hedge in opposition to inflation or as a dangerous asset uncovered to an financial slowdown.

Bitcoin worth prediction: cautious optimism or the calm earlier than the storm?

If the Fed confirms additional rate of interest cuts at its December assembly, shopping for curiosity in Bitcoin might improve once more. Decrease yields are inclined to make cryptocurrencies extra enticing in comparison with bonds and money. Nonetheless, if upcoming ADP and personal inflation information point out sustained inflation, the Fed may balk and markets may react negatively.

The important thing to look at this month is the $102,000 help zone. So long as $BTC stays above that, it may consolidate between $102,000 and $110,000. If it breaks above $110,000, it may pave the best way to $118,000 to $120,000 by late November. Nonetheless, a drop under $100,000 will result in panic promoting and the value will return to $92,000.

Bitcoin's November efficiency will rely upon how the market interprets the data-hungry Fed's resolution. Whereas this chart tells a narrative of financial restoration with a bearish tilt, the macro story leaves room for a pointy reversal if coverage turns decisively dovish. Merchants ought to brace for volatility and be ready to pivot shortly when transparency finally returns to Washington.