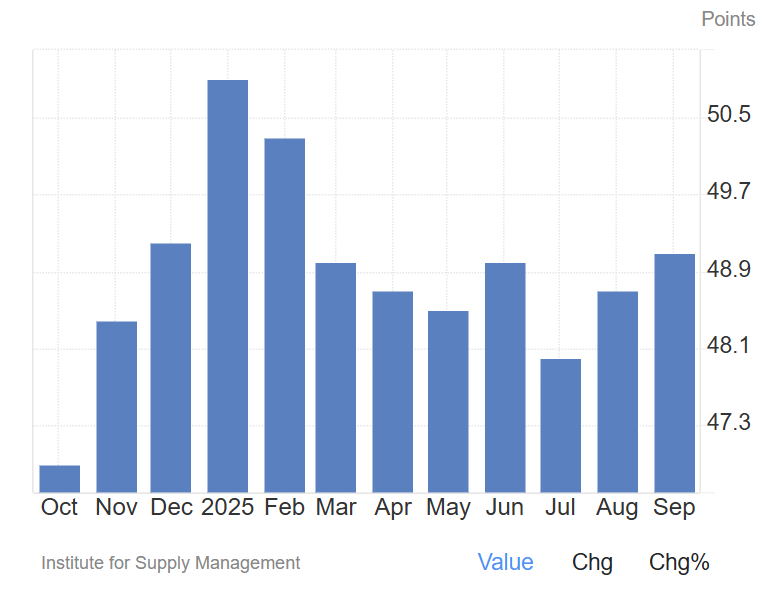

The Institute for Provide Administration (ISM) Manufacturing Buying Managers Index (PMI) has traditionally coincided with main peaks in Bitcoin market cycles, and if this sample repeats, this cycle might be longer than standard.

The correlation between the ISM PMI and Bitcoin (BTC) worth was first popularized by Raul Pal of RealVision and has since gained traction amongst macro-focused cryptocurrency analysts.

Analyst Colin Tokes Crypto famous that Bitcoin market highs repeatedly overlap with PMI's cyclical highs, noting that “all the previous three Bitcoin cycle highs have intently matched this month-to-month transferring index.”

If that relationship holds, Colin added: fairly It’s a longer cycle than the Bitcoin cycle usually runs. ”

sauce: Colin talks about digital foreign money

The ISM Manufacturing PMI, which measures U.S. industrial exercise, has remained beneath the impartial 50 for seven consecutive months, suggesting an financial contraction. A sustained transfer above 50 has traditionally been related to improved Bitcoin worth efficiency and would recommend that the economic system is increasing once more.

Earlier this yr, the PMI briefly rose above 50, however then returned to contractionary territory, highlighting continued weak point within the manufacturing economic system.

ISM Manufacturing PMI. sauce: commerce economic system

Associated: Willem Schroe says Bitcoin authorities bonds can earn you extra Bitcoins

U.S. manufacturing struggles to take care of momentum amid tariffs and weak demand

Manufacturing PMIs point out a powerful restoration in enterprise confidence in the beginning of the yr, pushed partially by optimism surrounding the incoming Trump administration and expectations for business-friendly insurance policies.

Nonetheless, the continued impression of excessive tariffs, commerce coverage uncertainty and weak international demand is weighing on the sector, doubtlessly prolonging moderately than accelerating the cycle.

ISM's newest report reveals that imports and exports contracted whereas costs rose, with modest good points in September, suggesting the state of affairs is uneven throughout manufacturing subsectors.

ISM famous that regardless of the weak point, manufacturing's shrinking share of U.S. financial output means a contraction within the PMI doesn’t essentially point out a recession. ISM has beforehand noticed that sustained readings above 42.3 typically correspond to total financial development.

Buying executives within the transportation tools business instructed ISM in September that “enterprise continues to be severely depressed,” citing “exorbitant taxes” within the type of tariffs which can be decreasing income and elevating prices throughout the availability chain.

“Worth pressures on each our uncooked supplies and our clients' output are rising as firms start to move on tariffs by way of surcharges, elevating costs by as much as 20%,” they added.

Associated: CryptoBiz: Bitcoin Whales Swap Keys for Consolation