CryptoQuant CEO Ki Younger Ju simply made an necessary remark that will likely be necessary for Bitcoin worth developments as 2025 involves an finish.

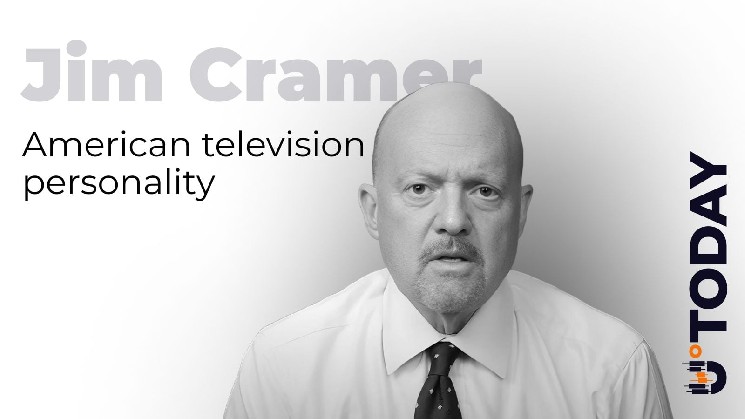

In a tweet, Ki Yong-joo identified that CNBC Mad Cash host Jim Cramer is 100% bearish on Bitcoin. Mr. Ju shared a chart that displays Mr. Cramer's sentiment, which is now utterly bearish.

BREAKING: Jim Cramer is 100% bearish on Bitcoin.

Merry Christmas 🎄 pic.twitter.com/qDr2Yx2U8X

— Younger Choose December 24, 2025 December 24

This stays necessary as Jim Cramer has constructed a repute within the funding world, significantly within the crypto market, with many taking his statements as indicators of contrarianism.

For instance, in late September, Kramer tweeted, “Purchase crypto.” Bitcoin hit a document of over $126,000 in early October, however crashed to almost $80,000 within the following weeks.

Bitcoin is headed for the fourth annual decline in its historical past, and the primary to not coincide with a significant scandal or trade meltdown.

On the time of writing, Bitcoin was buying and selling at $87,327, up barely by 0.34% over the previous 24 hours. Bitcoin is at present down about 7% for the 12 months.

The market continues to be struggling to regain its footing after the October crash, as buying and selling volumes stay skinny and retail hypothesis has declined. The U.S. Spot Bitcoin ETF turned web brief within the fourth quarter, shedding a significant supply of demand that had supported its rally.

Traders have raised greater than $5.2 billion from U.S.-listed spot Bitcoin ETFs since October 10.

Is Santa Rally coming?

Regardless of the present stagnation within the cryptocurrency market, buyers are nonetheless hopeful concerning the Santa Claus Rally. Santa Claus rallies usually embody the final 5 enterprise days of the 12 months and the primary two days of a brand new enterprise day.

Elsewhere, markets are sending very completely different indicators. U.S. shares entered a basic Santa rally as shares hit document highs in comparatively quiet pre-Christmas buying and selling on Wall Avenue and there have been growing indicators that the job market shouldn’t be deteriorating rapidly, reinforcing the view that the financial system is on the verge of a gentle touchdown.

Cryptocurrency merchants proceed to pay shut consideration to indicators about the place the market is headed subsequent. Greater than $23 billion in choices expirations have been within the highlight, though skinny liquidity in the course of the holidays has affected market exercise.