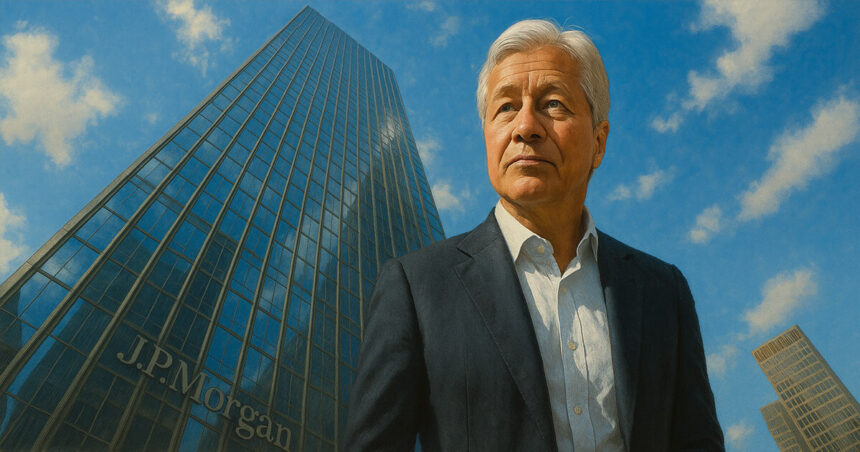

JPMorgan CEO Jamie Dimon mentioned Wall Road lenders shall be providing Bitcoin (BTC) to their clients in a tricky transition from his historic stance to digital property.

Throughout JPMorgan's Investor Day, Dimon repeated that he was “not a fan” of Bitcoin, however admitted that his shoppers would proceed to request entry.

He mentioned:

“I don't assume it is best to smoke, however I defend your proper to smoke. I defend your proper to purchase Bitcoin.”

He additionally made it clear that the banks don’t plan to supply custody companies.

Dimon maintains skepticism

Dimon's criticism of Crypto is in keeping with previous statements. In an interview in January, he known as Bitcoin “no value it.” He linked it to felony conduct and reiterated the issues raised in 2023 Senate testimony. Shut the trade fully.

He at Davos' 2024 World Financial Discussion board Bitcoin known as “Pet Lock” In April of the identical yr, Dimon The “Ponzi scheme” known as Crypto.

In his remarks on Could 19, he additionally mentioned that “blockchain is just not as essential as folks assume.” Nevertheless, JPMorgan continues to construct its infrastructure round blockchain know-how for institutional use.

Earlier this month, Kinexys accomplished a take a look at transaction that bridged its personal community to a public layer 1 blockchain utilizing tokenized short-term monetary property and real-time cost protocols. ChainLink and Ondo Finance joined the pilot.

Moreover, Kinexys will course of greater than $2 billion in transactions day-after-day and can develop its greenback and euro settlements utilizing JPMorgan's personal token, JPM Coin.

JPMorgan will increase crypto publicity

In his remarks concerning the supply of Bitcoin, jpmorgan's 13F submitting The US Securities and Alternate Fee (SEC) within the first quarter of 2025 confirmed a dramatic enhance in crypto publicity by Alternate Buying and selling Funds (ETFs).

As of March 31, the corporate had reported $16.3 million in crypto-related holdings. $1 million on the finish of 2024. Crypto-exposures for lenders are primarily made by way of Bitcoin and Ethereum-related units.

As of March 31, JPMorgan holds round 3,000 shares, simply over 263,000 shares of BlackRock's iShares Bitcoin Belief (IBIT). Bitwise's Spot Bitcoin ETF (BITB).

The lenders additionally held new allocations to Grayscale's Bitcoin Belief (GBTC) and Mini Belief ETF stakes, Constancy's Sensible Origin Bitcoin Fund (FBTC) and Bitwise and Franklin Templeton Ethereum merchandise.

The corporate's crypto-related holdings are only a small portion of the $4.4 trillion property underneath administration. On the finish of the primary quarter.

It’s unclear how a lot of the portfolio displays distinctive positioning and promotion in the direction of driving shopper demand. Banks beforehand revealed that retaining ETF allocations may develop into a part of market manufacturing companies.

It’s talked about on this article

(tagstotranslate)Bitcoin (T)Ethereum (T)BlackRock (T)Grayscale (T)US (T)Adoption (T)Banking (T)Crypto (T)ETF (T)Featured (T)Tradfi