Bitcoin miners simply triggered one of many greatest exits in years, however few persons are speaking about it. Hashrate has fallen greater than 40% from its all-time excessive, with some consultants calling it the largest failure for miners since China's ban in 2021.

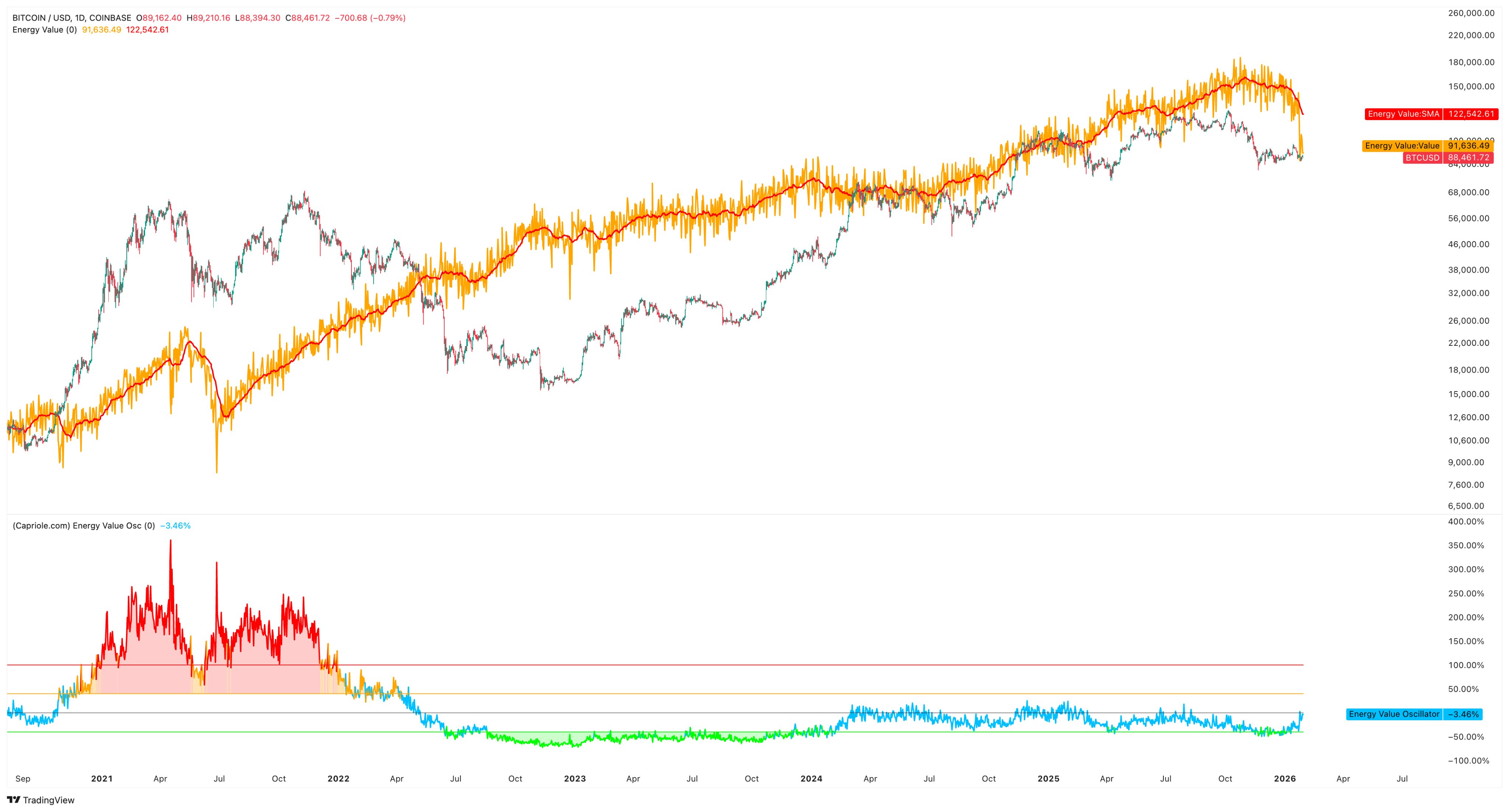

Purple flag? Bitcoin's power worth doesn't get a lot consideration, however it's truly a fairly predictable metric. I researched this indicator very arduous.

Charles Edwards, creator of the Vitality Worth Mannequin, was the primary to sound the alarm. His view is that main BTC miners are being shut down. Once more, don't reduce, retreat all collectively.

The metric, which hyperlinks hashrate and power prices to truthful worth, exhibits Bitcoin's value is nearly 4% under its energy-based benchmark. And the shifting common line has reversed for the primary time in over a 12 months.

However not everybody accepts the doom.

“Crypto Winter” remains to be winter

Opponents argue that the drop in hashrate isn’t a capitulation, however merely a winter. Energy costs throughout the key U.S. energy grids soared to greater than $100 per MWh as winter storm Fern disrupted provide and led to load shedding. On this model, the miner doesn’t exit, it simply pauses.

So most of that hashrate may recuperate inside two weeks, and Edward's chart has simply captured a climate phenomenon.

Some see rising power prices as a possibility quite than a menace. As smaller gamers withdrew from the competitors, massive industrial-scale miners have been in a position to seize extra market share and higher revenue margins. This modified Edwards' bearish view of the mining firm consolidation idea.

Nonetheless, the magnitude of the decline can’t be ignored. The final time power values fell this sharply, cryptocurrencies spent six months in a demise spiral earlier than discovering backside. However that doesn't imply we're headed for a repeat of the previous. Right now's setting contains ETFs, nation-state consumers, and structurally larger demand.

However the warning indicators are flashing once more.