Bitcoin's latest turmoil continues, forcing liquidity to shift from catching the subsequent breakout to different sectors of the market.

Particularly, market customers secretly Bitcoin In the direction of belongings that may generate secure earnings. In consequence, market liquidity has begun to stream away from purely speculative buying and selling to sectors that supply utility, and lending tokens are gaining traction.

Essential factors

- Bitcoin's latest turmoil continues, forcing liquidity to shift from catching the subsequent breakout to different sectors of the market.

- Liquidity is beginning to stream from purely speculative buying and selling to sectors that supply utility, and lending tokens are gaining traction.

- Bitcoin has seen some large fluctuations not too long ago, plummeting to $60,000 on February sixth, solely to get better to $72,000 on the identical day.

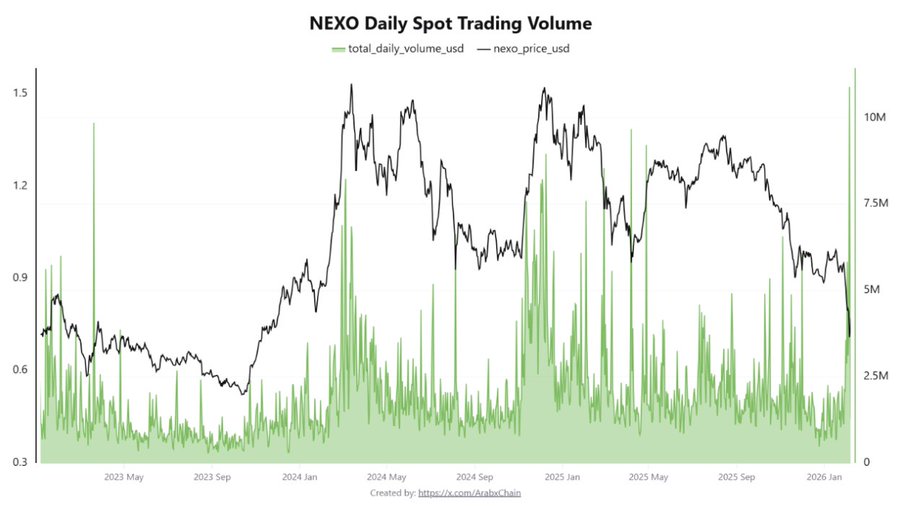

- $NEXOwhich payments itself because the premier digital asset asset platform, not too long ago recorded every day buying and selling quantity of roughly $10.9 million, the best stage within the firm's historical past.

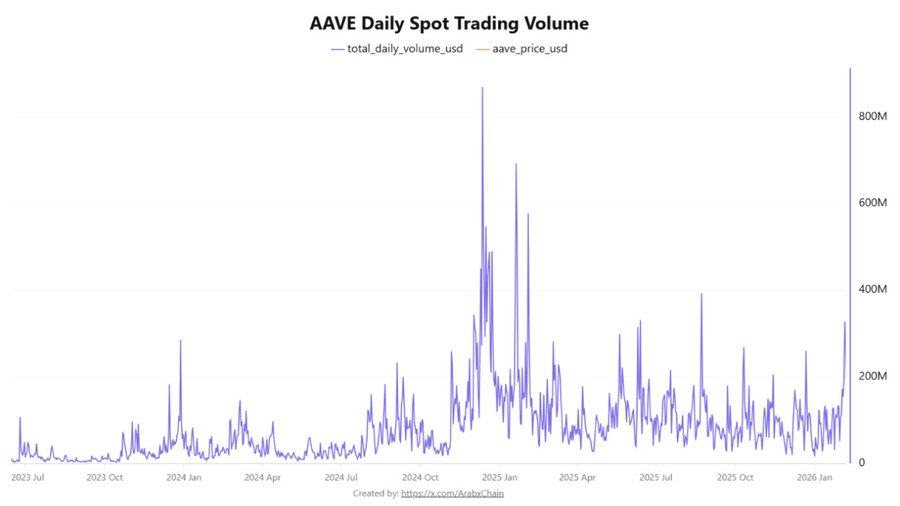

- Decentralized lending protocol Aave additionally noticed elevated buying and selling exercise, with every day buying and selling quantity reaching roughly $327.8 million.

- The co-occurrence of Bitcoin’s volatility and the speedy development of lending companies signifies a partial shift in liquidity in the direction of extra “operation-oriented or yield-oriented” belongings.

Bitcoin volatility redirects liquidity

Friday evaluation A paper by Arab Chain, certainly one of CryptoQuant's validation authors, exhibits that Bitcoin reveals important fluctuations on sure days. For instance, the apex cryptocurrency fell to $60,000 on February sixth, however rebounded sharply to $72,000 on the identical day. It has fallen once more over the previous few days, and its present value is $67,000.

Since then, Bitcoin has been buying and selling inside this $60,000 to $72,000 vary, and that is evident. indicators of consolidation. This lack of perception has affected the broader crypto market, which has not too long ago skilled value fluctuations. As a serious cryptocurrency, BTC has struggled to determine a transparent value route, prompting a reassessment amongst merchants.

When costs seem unstable, merchants usually grow to be cautious and cut back their threat. Moreover, begin in search of alternate options that help you keep income with out relying solely on value will increase. CryptoQuant evaluation exhibits that market lovers are shifting their consideration to protocols targeted on lending and borrowing.

lending token, $NEXO And Aave positive aspects traction

The report says the info already highlights a transparent shift in the direction of bigger lending platforms. $NEXOwhich payments itself because the premier digital asset asset platform, not too long ago recorded every day buying and selling quantity of roughly $10.9 million, the best stage within the firm's historical past. ArabChain says this surge suggests an rising use of the token inside its ecosystem, whether or not as collateral or as a liquidity administration device.

Nexo every day buying and selling quantity/CryptoQuant

In the meantime, every day buying and selling quantity on the time of writing was $11.66 million, up 32% up to now 24 hours, in line with CoinMarketCap knowledge. This affected the worth, which rose 4.5% to $0.842 up to now 24 hours.

On the similar time, buying and selling exercise on decentralized lending protocol Aave has additionally elevated, with every day buying and selling quantity reaching roughly $327.8 million. It additional rose to $456 million, however fell 3% up to now 24 hours, in line with CoinMarketCap.

That is nicely above latest averages and means that whereas broader market sentiment stays unsure, each retail and institutional buyers could also be leaning in the direction of decentralized lending platforms.

Aave Day by day Buying and selling Quantity/CryptoQuant

The evaluation concluded that the simultaneous prevalence of Bitcoin volatility and speedy development in lending companies signifies a “partial shift in liquidity away from core belongings and into subsectors” with an elevated “give attention to operations and yield.”