Bitcoin costs have began the brand new month roughly, persevering with a tumultuous run from October. On the afternoon of Friday, November 7, the main cryptocurrency briefly fell under the psychological $100,000 degree for the second time previously week.

Bitcoin worth difficulties in latest weeks have been attributed to modifications within the habits of buyers, notably the category generally known as long-term holders (LTHs). Famend cryptocurrency knowledgeable at

The obvious demand development for BTC turned unfavourable.

In a latest put up on the Nevertheless, cryptocurrency specialists identified that the elevated gross sales exercise of LTH just isn’t new.

In line with Moreno, it is rather regular for long-term Bitcoin buyers to shed a few of their holdings throughout bull markets as they appear to take some income when costs are excessive. What was completely different this time was that there was no corresponding name to clear these offroads.

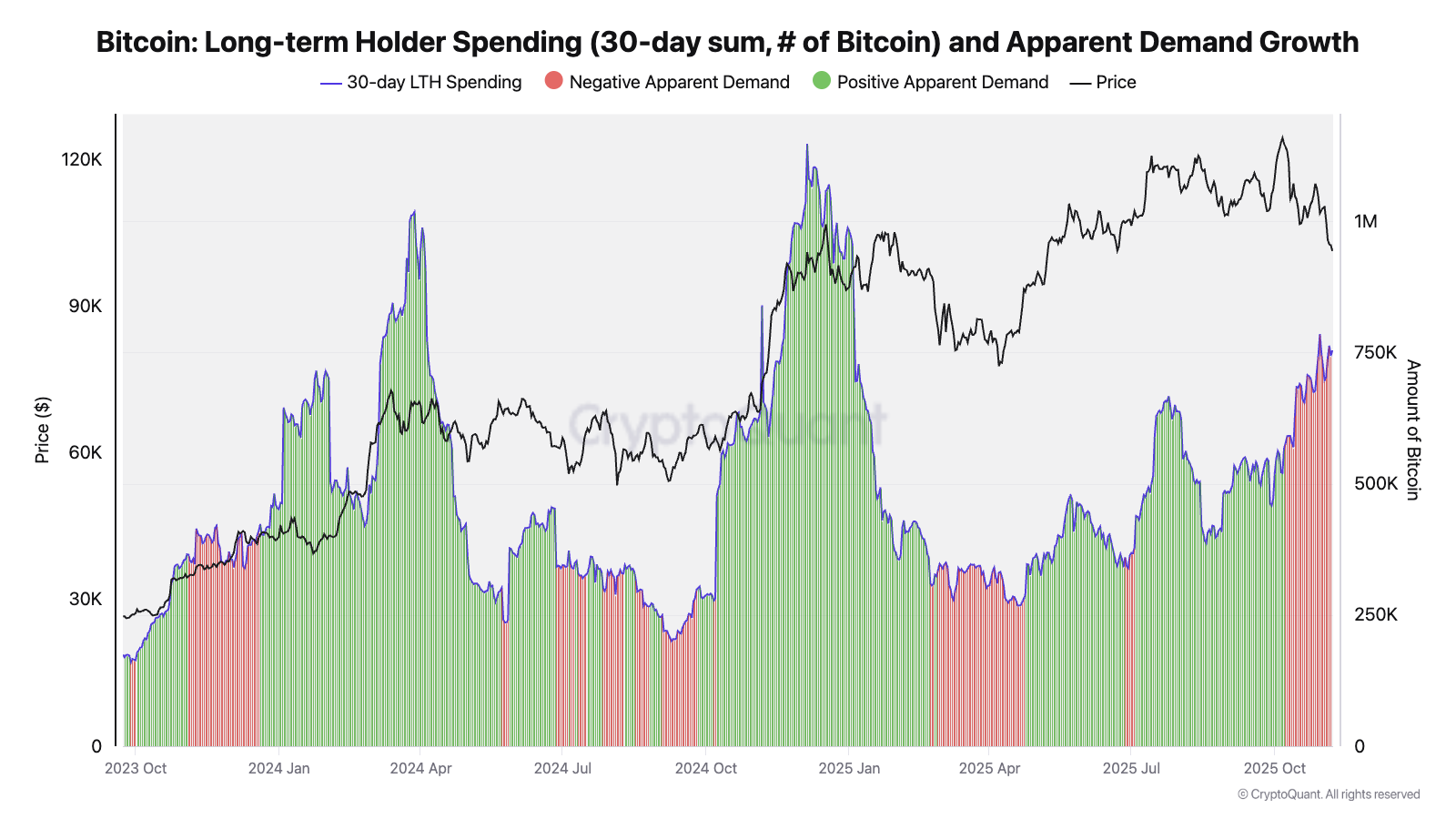

To again this up, Moreno shared a chart consisting of long-term holder spending and obvious demand development over the previous few years. For context, obvious demand development measures the distinction between the quantity of an asset (on this case Bitcoin) being acquired in comparison with the quantity being created (mined).

Supply: @jjc_moreno on X

CryptoQuant's head of analysis famous that Bitcoin costs have hit previous all-time highs throughout a interval of elevated promoting by long-term holders, albeit with a optimistic improve in demand. As you’ll be able to see within the chart, this occurred through the all-time rallies of January-March 2024 and November-December 2024.

The highlighted chart additionally reveals that long-term Bitcoin holders have been promoting since October, which isn’t notably fallacious. Nevertheless, obvious demand development is contracting, that means there isn’t any shopping for strain to soak up LTH provide at larger costs.

Finally, these on-chain observations recommend that much less focus ought to be positioned on the promoting actions of long-term Bitcoin holders. For the BTC worth to reverse within the coming weeks, there should first be a optimistic obvious improve in demand.

Bitcoin worth at a look

As of this writing, the flagship cryptocurrency has recovered again above $100,000 and is value round $103,700, up practically 3% within the final 24 hours.

The value of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

enhancing course of for focuses on offering totally researched, correct, and unbiased content material. We adhere to strict sourcing requirements and every web page is diligently reviewed by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of the content material for readers.