This week, the highest shares in Crypto shares carried out higher than the broader inventory market this week, backed by comparatively steady cryptocurrency costs.

Inventory markets have skilled two days of disruption after President Donald Trump introduced the brand new tariffs on April 2. By Friday night:

- S&P 500 closed 6%

- Nasdaq composites fell by 5.8%.

- The Dow Jones industrial common plummeted over 2,200 factors, or greater than about 5.5%.

- The Russell 2000 Index, a small-cap index, slid over 4%.

The Nasdaq has fallen 22% since its December excessive. Since heights in February, the S&P has fallen by about 17%.

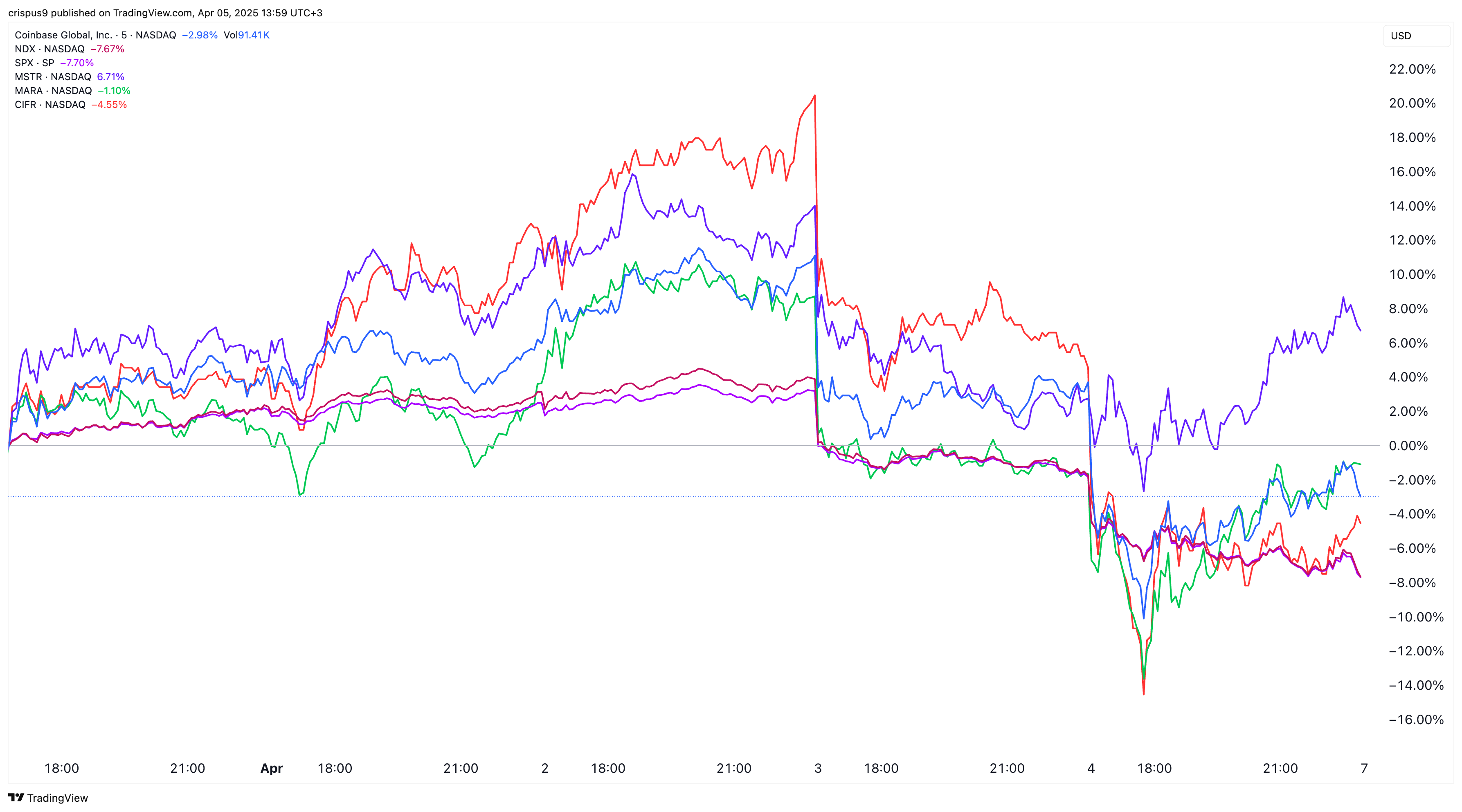

Some crypto shares outperformed these shares within the week. For instance, the technique rose by greater than 6.7%. The corporate, previously often called MicroStrategy, was based by Bitcoin Bull Michael Saylor.

Coinbase, the most important crypto alternate within the US, fell by simply 3%, whereas Marathon Digital, Cipher Mining and Riot Platform fell by lower than 5%.

Crypto Shares vs S&P 500 and Nasdaq 100 Index | Supply: TradingView

These shares had been higher than the S&P 500 and NASDAQ 100 indexes, as different main cryptocurrencies resembling Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Binance Coin (BNB) remained comparatively unchanged.

Bitcoin costs have risen 2.5% over the previous 5 days, whereas XRP has risen 2.7%. The ether and BNB remained within the integration stage. Traditionally, these crypto shares have tracked the efficiency of Bitcoin and different main cash.

Bitcoin vs XRP vs BNB vs ETH | Supply: crypto.information

A possible catalyst for highly effective Bitcoin efficiency was a bullish assertion from BlackRock Head Larry Fink. In an annual letter to buyers, Fink warned that the US greenback faces a rise in threat from Bitcoin. He cited rising US debt as a serious threat to the US economic system.

Bitcoin was additionally steady as buyers view it as a gold various.

You would possibly prefer it too: Bitcoin is steady amidst the inventory market battle, says a chainless analyst

Crypto shares usually are not uncovered to AI and customs duties

One other main cause why crypto shares have been comparatively profitable is their lack of publicity to the bogus intelligence business.

Traders and analysts are involved that the AI theme that has pushed the inventory market over the previous few years is slowing down. This explains why high AI shares resembling AMD, Nvidia and Soundhound are performing within the broader market.

These dangers rose this week after Microsoft reportedly slowing its funding in information facilities worldwide. Some analysts warned that there was an oversupply of knowledge facilities in comparison with demand.

The crypto shares had been additionally steady as they weren’t uncovered to the Donald Trump commerce battle. Mutual tariffs don’t have an effect on these firms as a result of nature of the enterprise. For instance, a very powerful enterprise of technique is accumulating Bitcoin, and its software program providers play a minor function.

Crypto inventory remained steady after the percentages that Paul Atkins was confirmed to be the subsequent head of the Securities and Change Fee when he moved ahead from the Banking Fee.

learn extra: Senate committee passes Trump's Decide Paul Atkins as SEC chair