Though Bitcoin has entered bear market territory, institutional adoption stays sturdy. Tokyo-listed Metaplanet not too long ago secured a hefty $100 million mortgage secured by its current Bitcoin holdings.

This funding will likely be used to accumulate further BTC and strategically launch a share buyback program. This aggressive motion highlights the rising hole between short-term value movers and long-term institutional traders. Believers view the present decline as an vital accumulation part.

Metaplanet makes use of Bitcoin holdings for strategic enlargement

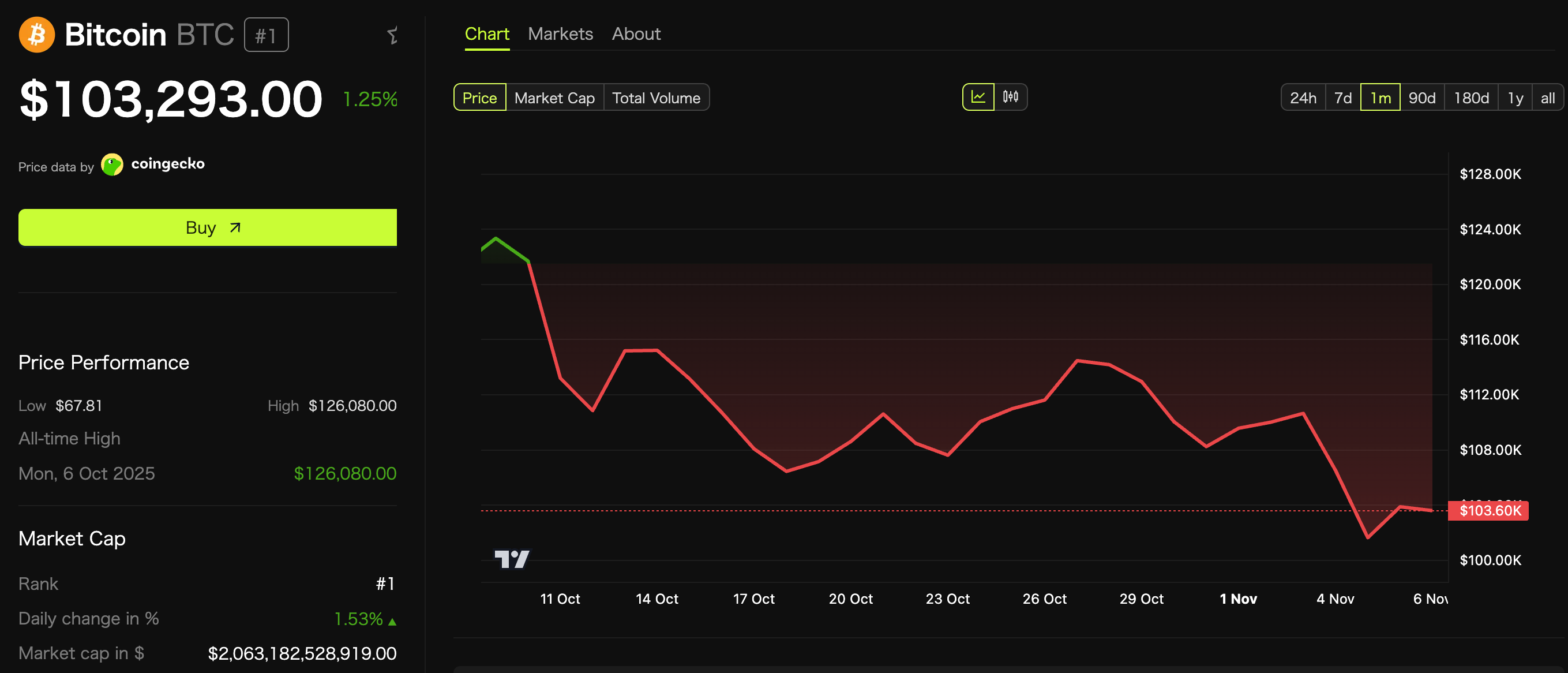

Bitcoin (BTC), the world's main cryptocurrency, has entered a bear market. This example is outlined by a fast value decline of greater than 20% from October's all-time excessive. Because of this, this slide briefly noticed property fall beneath the psychologically vital assist stage of $100,000.

Bitcoin Value Chart: BeInCrypto

In the meantime, in distinction to the adverse market sentiment, Tokyo-listed company finance firm Metaplanet has introduced a proactive and long-term dedication. In different phrases, the corporate secured a $100 million mortgage utilizing its giant Bitcoin reserves as collateral.

Metaplanet already holds 30,823 BTC (price roughly $3.51 billion). Importantly, new loans account for simply 3% of whole Bitcoin holdings. This safe collateral margin helps preserve stability even throughout extreme market downturns. The Japanese firm used these funds in three areas: increasing its revenue-generating operations, implementing share buyback packages, and buying further Bitcoin.

A portion of the funds will likely be used for Bitcoin choices buying and selling. This income-generating enterprise generates regular earnings whereas holding onto the underlying BTC. The corporate's Bitcoin-derived income has elevated considerably over the previous yr. This calculated transfer signifies the establishment's view. They see the present value surroundings as a strategic alternative relatively than a disaster.

The distinction: short-term volatility vs. long-term confidence

The actions of institutional traders like Metaplanet spotlight vital variations. This hole exists between short-term market noise and long-term deep conviction. Particular person traders usually react to day by day volatility. However subtle firms concentrate on the macroeconomic story of property as shops of worth.

These firms make use of sturdy monetary methods. Using debt financing throughout a bear market demonstrates unwavering perception in Bitcoin's future value trajectory. This financing will assist each improve capital worth and improve shareholder worth.

Metaplanet leverages current Bitcoin reserves to strengthen long-term monetary technique and secures $100 million in BTC-backed loans.

This funding will likely be used to broaden our $BTC holdings and assist broader capital initiatives. pic.twitter.com/BunhOhyS4i

— Cryptic (@Cryptic_Web3) November 6, 2025

Cryptocurrency analysts and on-line key opinion leaders (KOLs) agree with this opinion. “Metaplanet has secured $100 million in BTC-backed financing, leveraging current Bitcoin reserves to strengthen its long-term monetary technique,” @Cryptic_Web3 famous.

The submit MetaPlanet Defies Bitcoin Bear: Leveraging for Lengthy-Time period Treasury appeared first on BeInCrypto.