Japanese firm Metaplanet hit a three-month excessive on Monday after saying its newest acquisition of Bitcoin (BTC). The corporate added 1,004 BTC to the Treasury, marking its third important buy this month.

Per week in the past, he obtained 1,241 BTC, surpassing the El Salvador reserve. Beforehand, on Might seventh, Metaplanet bought comparatively small quantities of 555 BTC.

Metaplanet shares are benefiting from buying bitcoin

In line with official disclosures, the most recent transaction was valued at 151.9 billion yen (roughly $104.3 million). Metaplanet's common buy value is 15.13 million yen, equal to $103,873 per BTC.

“From July 1, 2024 to September 30, 2024, the corporate's BTC yield was 41.7%. From October 1, 2024 to December 31, 2024, it achieved BTC yields from January 1, 2025 to March 31, 2025. It was 47.8%,” the assertion learn.

Metaplanet points common zero-coupon bonds to fund these purchases. In Might 2025, we issued bonds price $64.7 million. This consists of $24.7 million from the twelfth collection issued Might 2, $25 million from the thirteenth collection authorised Might 7, and $15 million from the fifteenth collection issued Might 13.

The corporate presently holds a complete of seven,800 Bitcoins, with a complete funding of 1003.8 billion yen or roughly $725 million. The common historic buy value for Bitcoin Holdings total is 13.5 million yen per BTC, roughly $91,343 per coin.

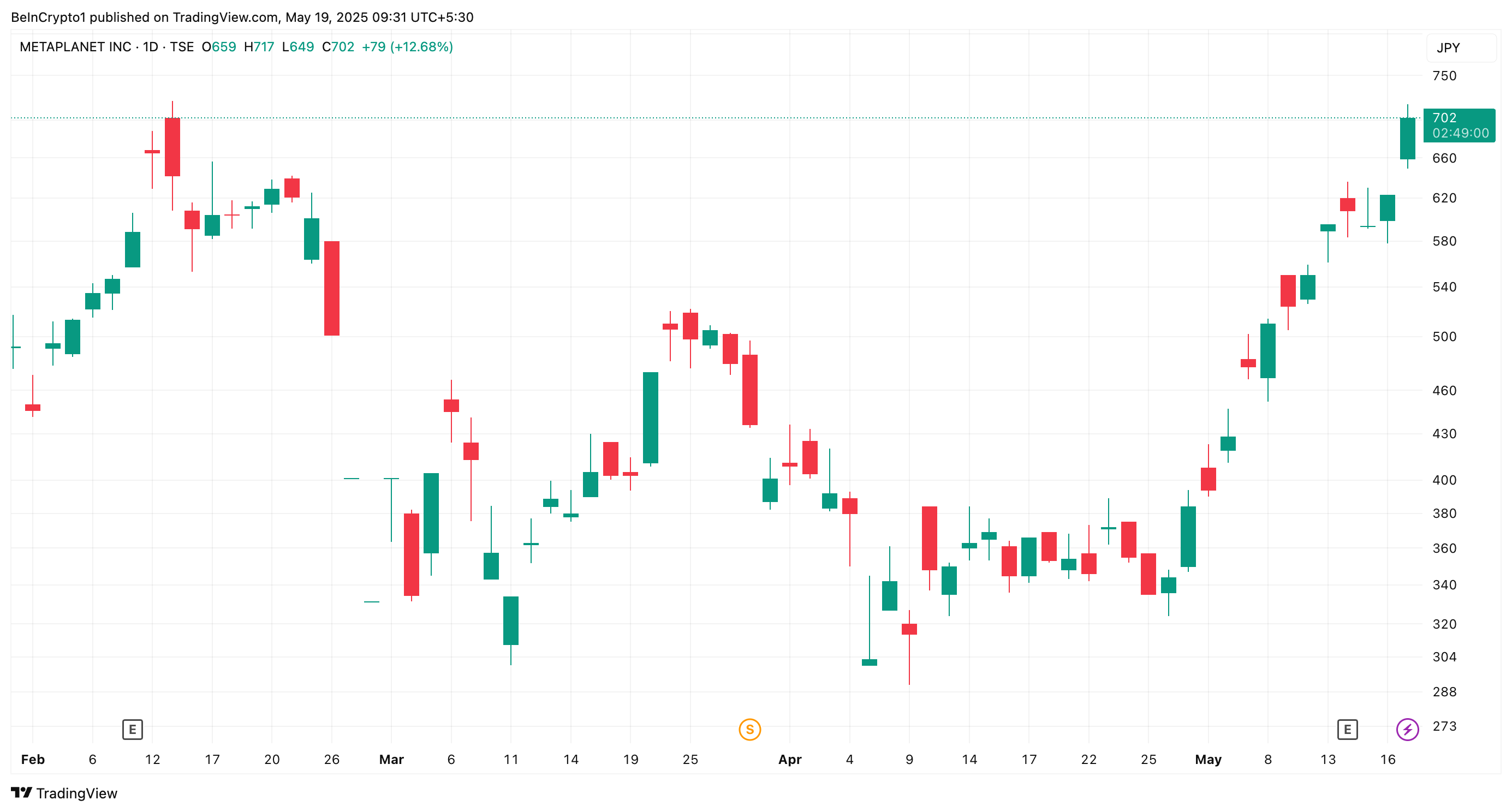

In the meantime, in response to Yahoo Finance knowledge, Metaplanet inventory 3350.T follows the information, and is very rated at 12.6%. On the time of urgent, the transaction value was 702 yen ($4.8), the final excessive we noticed on February thirteenth.

Metaplanet inventory efficiency. Supply: TradingView

Over the previous month alone, the worth of 3350.T has elevated by 101.7%, which has benefited enormously from Bitcoin's newest gathering. In actual fact, since adopting the Bitcoin Reserve technique, inventory costs have risen greater than 15 occasions.

The corporate's monetary efficiency additional helps this upward trajectory. In its first quarter income report, Metaplanet disclosed $6 million in income, with 88% derived from Bitcoin choices buying and selling.

This highlighted the vital position BTC performs in its financial success. As the corporate continues to combine Bitcoin into its financial technique, it’s setting new benchmarks for company crypto adoption within the area.