Metaplanet, a publicly listed Japanese firm, is attracting international monetary market consideration with its daring Bitcoin (BTC) acquisition technique.

Since its first buy in April 2024, Metaplanet has persistently elevated its Bitcoin Holdings, however inventory costs have skyrocketed dramatically, with greater than 15 instances inside a 12 months.

Metaplanet's Bitcoin accumulation journey

Extra not too long ago, Metaplanet introduced the acquisition of 555 Bitcoin, rising its whole holding to five,555 BTC, with cumulative acquisition prices of roughly $481.5 million. Not solely that, the corporate has issued $25 million interest-free bonds to proceed its Bitcoin accumulation efforts.

Metaplanet has additionally appointed Eric Trump to the Strategic Advisory Committee to reinforce Bitcoin-centric development and innovation.

“The unrealized revenue in Metaplanet's Bitcoin standing is 6 billion yen. For recognition: that’s 4 instances the complete capital letter earlier than switching to the Bitcoin customary!” X customers spotlight the most important financial impression of this technique.

In 2025 alone, Metaplanet has made a number of massive purchases. On April 14, 2025, the corporate invested $26.3 million in 319 BTC, exhibiting confidence regardless of the yields of the Japanese Ministry of Finance. Metaplanet acquired 497 BTC on March 3 for $43.9 million on March 3, and 156 BTC on March 12 for $13.5 million.

The corporate additionally acquired a number of Bitcoin acquisitions in February.

Metaplanet has turn into one of many largest publicly listed Bitcoin holders in Asia. Holdings are a lot smaller than micro-strategic holdings, however Metaplanet is known as the “Asian micro-strategic technique” and may lead a wave of institutional Bitcoin funding within the area.

“Anybody with a Tokyo Inventory Change account will be capable to be uncovered to Bitcoin with out regulatory danger,” mentioned Jason Fan, founding father of Solaventure, in an April 2024 collaboration announcement with Metaplanet.

The transfer demonstrates Metaplanet's perception in crypto, prompting whether or not such a technique can set new precedents for conventional monetary firms.

Influence of Bitcoin Buying Technique on Metaplanet's Inventory Costs

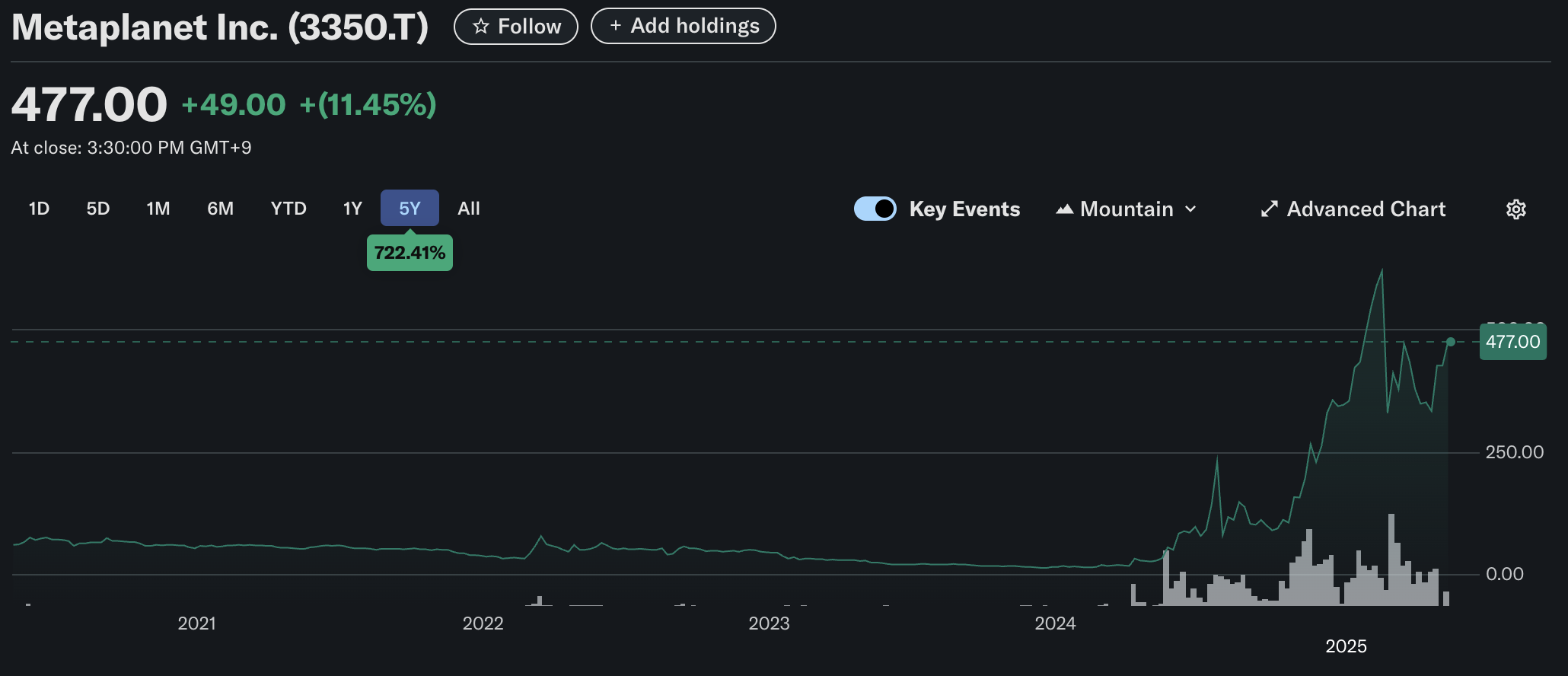

Metaplanet's Bitcoin acquisition technique has had a serious impression on inventory costs. Based on Yahoo Finance, following the announcement of the acquisition of 555 BTC on Might 7, 2025, Metaplanet's share worth jumped 11.45% to 477 JPY (roughly $3.33).

Metaplanet inventory worth efficiency. Supply: Yahoo Finance

Much more shocking, for the reason that firm started buying Bitcoin in April 2024, the inventory worth has skyrocketed from round 34 JPY to its present degree greater than 15 instances, making Metaplanet one in all Japan's finest performing shares throughout this era.

The announcement of every Bitcoin buy has often triggered a big inventory worth rise. For instance, on March 12, 2025, the share worth rose 7.93% after the acquisition of 162 BTC and 19% after the acquisition of 497 BTC on March 5, 2025.

Metaplanet's Bitcoin acquisition technique may have a serious impression on the corporate and the broader monetary markets. First, the aggressive accumulation of Bitcoin displays Metaplanet's sturdy confidence within the long-term potential of cryptocurrencies, particularly amid international inflation and depreciation of the Japanese yen.

Second, a 15x enhance in inventory costs signifies that consolidating cryptocurrencies can convey vital worth to conventional monetary firms. This units precedents and encourages different firms in Japan and Asia to contemplate related methods.

Metaplanet has set an formidable aim of holding 10,000 BTC by the top of 2025 and 21,000 BTC by the top of 2026. By attaining these objectives, we are able to solidify our management within the accumulation of Bitcoin in Asia and set up a mannequin that different firms ought to comply with.