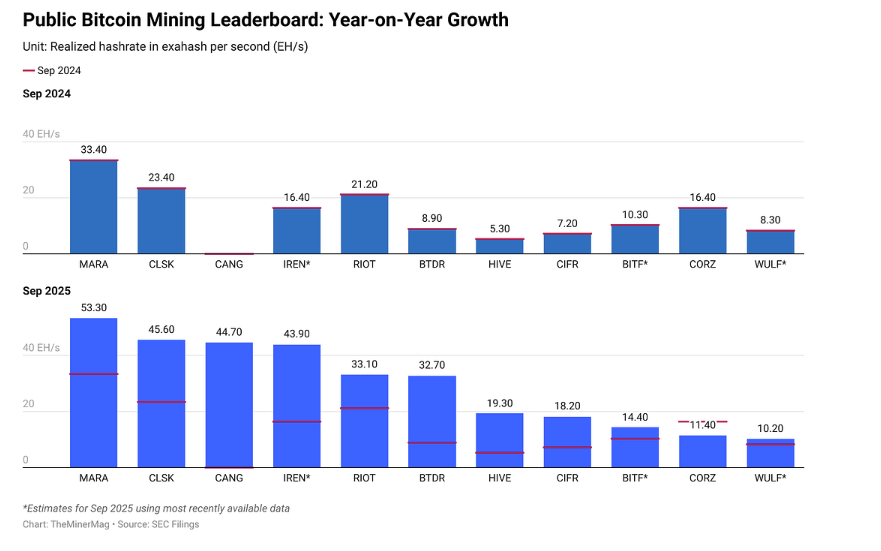

The Bitcoin mining business is turning into more and more aggressive, with so-called Tier 2 operators closing the hole on the incumbent leaders in achieved hashrate, an indication of a extra degree taking part in subject after the halving in 2024.

In line with The Miner Magazine, corporations like Cipher Mining, Bitdeer, and HIVE Digital are quickly increasing their realized hashrate after years of infrastructure development, closing the hole with prime gamers like MARA Holdings, CleanSpark, and Cango.

“Their rise highlights how middle-class public miners, as soon as far behind, are quickly increasing manufacturing for the reason that 2024 halving,” Miner Magazine wrote in its newest Miner Weekly E-newsletter.

Whereas MARA, CleanSpark, and Cango maintained their positions as the highest three public miners, rivals comparable to IREN, Cipher, Bitdeer, and HIVE Digital recorded important year-on-year will increase in realized hashrate.

In whole, prime public miners reached 326 exahashes per second (EH/s) in realized hash price in September, greater than double the extent recorded the earlier yr. Collectively, they at the moment account for almost a 3rd of Bitcoin's whole community hash price.

12 months-on-year enhance in realized hash price. Supply: The Miner Magazine

Hashrate represents the overall computational energy that miners contribute to securing the Bitcoin blockchain. Nevertheless, the achieved hashrate is precise On-chain efficiency, or the velocity at which legitimate blocks are efficiently mined.

For listed miners, it additionally serves as a extra correct indicator of operational effectivity and income potential, making it a key metric forward of the third-quarter earnings season.

Associated: Solo Bitcoin miner earns $347,000, 'pure self-sovereignty at work'

Bitcoin miners intensify hash conflict

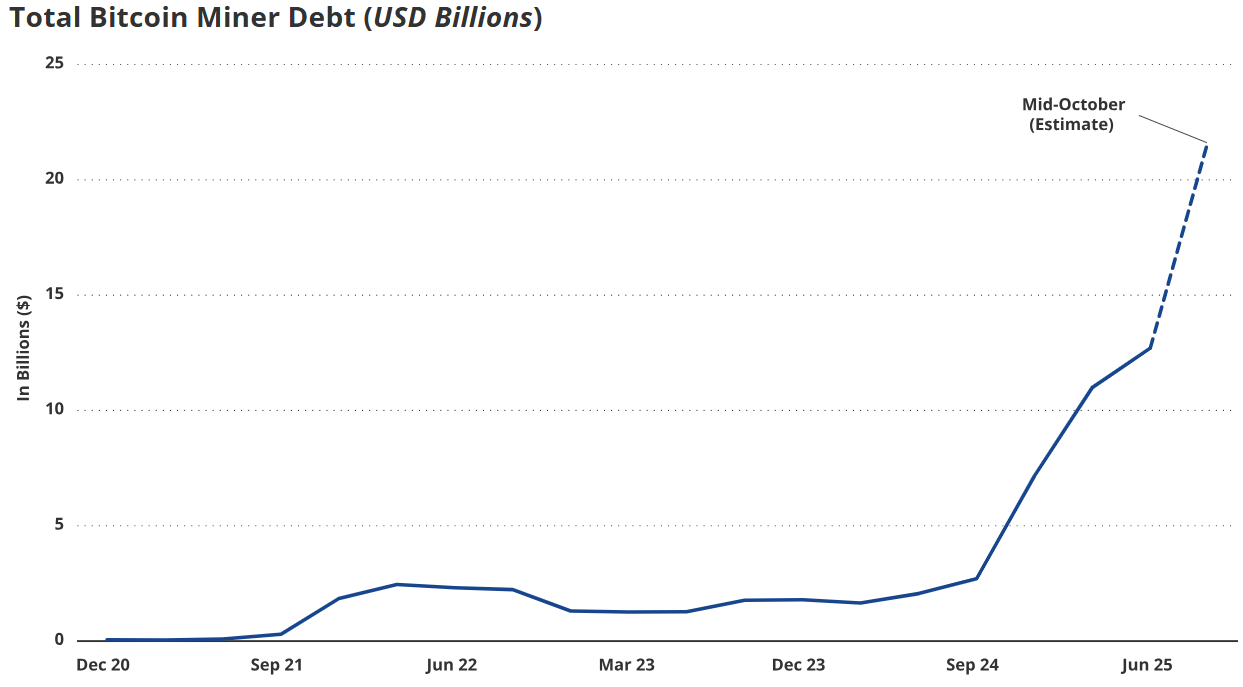

Within the race for market share, Bitcoin mining corporations are taking over report ranges of debt as they broaden into new mining tools, synthetic intelligence infrastructure and different capital-intensive companies.

Whole debt throughout the sector has jumped to $12.7 billion from $2.1 billion simply 12 months in the past, in line with VanEck analysis. The researchers famous that miners might want to frequently spend money on next-generation {hardware} to take care of their share of Bitcoin's whole hashrate and sustain with opponents.

Bitcoin miners' debt will increase. sauce: Van Eck

Some mining corporations are turning to AI and high-performance computing workloads to diversify their income streams and offset revenue declines following the 2024 Bitcoin (BTC) halving, which noticed the block reward drop to three.125 BTC.

Associated: HIVE Digital accelerates AI pivot with $100M HPC enlargement — Cointelegraph Unique