Ethena Labs has introduced the creation of Stablecoinx Inc, a monetary firm targeted on the brand new Ethena (ENA), developer of the $7.5 billion whole worth lock (TVL) artificial greenback protocol.

In response to a July twenty first publish on X (previously Twitter) Ethena Labs, Capital Raids incorporates $260 million in money. This will likely be used to buy locked ENAs from Ethena Basis's subsidiary, and features a $60 million ENA donation from the muse. Money is utilized by subsidiaries to buy ENAs at open markets.

Beginning at present, roughly $5 million price of ENA will likely be bought day by day over the following six weeks. At present costs, $260 million accounts for round 8% of ENA's distribution provide, the Put up mentioned.

“It is crucial that the Ethena Basis has the fitting to reject $ENA gross sales by means of Stablecoinx in its sole discretion. Ideally, tokens is not going to be offered with a give attention to accumulation.”

Stablecoinx's monetary technique focuses on a “intentional multi-year capital allocation” method designed to assist companies profit from elevated demand for digital {dollars}, growing the quantity of ENA tokens held per share “for shareholder advantages.”

“The Ethena Basis's mission is to guard Ethena's longevity and decentralization,” mentioned Mark Piano, director of the Ethena Basis, in a press launch asserting the deal. The piano continues:

“By partnering with Stablecoinx below a disciplined, locked, swaying framework, we be certain that capital getting into the ecosystem is long-term and extremely beneficial, growing ecosystem capital effectivity.”

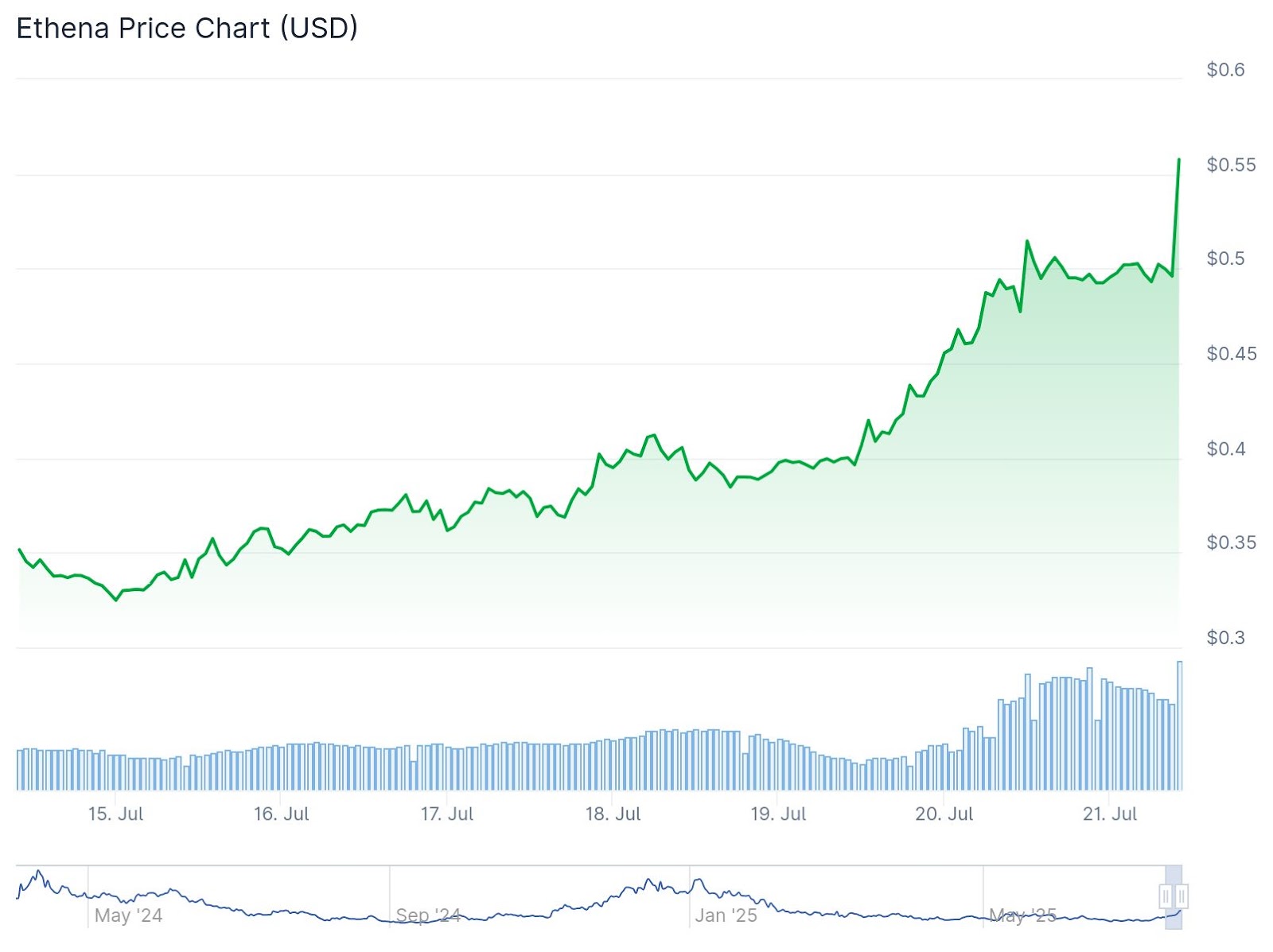

The ENA is at present buying and selling for round $0.54. The day has elevated by 13%, with rallying beginning at practically $0.40 beginning the weekend earlier than official bulletins are held for every Coingecco information. This additionally reveals a 57% improve over the previous week, suggesting that some insiders might have been anticipating the information.

The information about Stablecoinx's monetary technique is because the broader Stablecoin market has continued to develop for practically two years. Defiant beforehand reported that Stablecoins now account for a few third of financially generated income.

In the meantime, Stablecoins' general market capitalization is above $261 billion, a rise of practically 3% over the previous week attributable to elevated person adoption. Tether's USDT holds a market share of 62%, with a market capitalization of $162 billion based on Defillama.

A current report from the Animoca model confirmed that shares in public firms using the Altcoin Treasury technique are likely to rise sharply, however Altcoins itself doesn’t present the identical worth motion.