- Courtyard dominated NFT gross sales in April. This amounted to over $62 million, and Dmarket noticed probably the most buying and selling exercise.

- A number of different earlier NFT tasks, such because the boring Ape Yacht Membership and Cryptopunks, skilled weak spot in efficiency and gross sales.

- Dogezuki attracted most consumers, whereas Solana Monkey Enterprise bought the bottom quantity.

Current information from Phoenix Group reveals that the most well-liked NFT assortment in April was the courtyard, with complete gross sales of $62.4 million. This determine is 12.19% greater than the earlier month in March, the one huge assortment that has recorded double digits for month-to-month development charges. Now we have additionally registered 497,749 transactions and 33,970 distinctive consumers to reinforce our place as a market chief.

High #NFT Assortment by Month-to-month Gross sales Quantity

#courtyard #dmarket #cryptopunks #guildofguardians #pudgypenguins #taprootwizards #boredapeyachtclub #sorare #panini #dogezuki #solanamonkeybusiness pic.twitter– Phoenix – Crypto Information & Analytics (@pnxgrp) April 29, 2025

DMARKET was second within the interval with 39.91mm gross sales, however fell 4.28% from earlier month's gross sales. It was quick, nevertheless it was nonetheless probably the most trade-centric, with over 1.15 million NFT gross sales and 59,384 consumers, making it the perfect in all the assortment.

Cryptopunks was third within the firm, with an estimated buying and selling quantity of $19.23 million. Nonetheless, this assortment witnessed very low exercise, with solely 147 transactions and 90 completely different consumers. The substantial distinction between gross sales worth and participation shouldn’t be the overall market because it signifies a one-time buy with no return go to.

Guild of Guardians Slide, Tapluto Wizard climbs

The Guild of Guardians recorded gross sales of $1575 million. This represents a month-to-month decline of 11.01%. Moreover, market protection was restricted, with solely 7,706 consumers and 16,519 transactions. In the meantime, Taproot Wizard gross sales quantity elevated, bringing gross sales development charges of $7 million and three.37%. That is evidenced by the truth that 651 transactions had been recorded from 305 completely different consumers, suggesting that there was a optimistic interplay with the neighborhood.

The stocky penguins confirmed the least variability, reporting a 0.39% decline of $7.93 million. The boring APE Yacht Membership additionally fell additional, closing at $5.59 million, down 15.94%. It solely bought 134 models of the Blue Chip Assortment, indicating a lower in client attraction for earlier manufacturers related to the collection.

On the intense facet, the Mutant Ape Yacht Membership confirmed extra promising outcomes, with every day gross sales growing by 10.48% to $4,188. We recorded 879 purchases from 375 consumers. That is extra evident in market help than in guardian collections.

Dogezuki stays robust as Solana Monkey Enterprise Plummets

Dogezuki was very lively by way of buying and selling, promoting about $3.43 million, a quantity of 1.07% greater than the earlier month. This undertaking had the best demand for focus, with 73,066 wallets being utilized in all collections. It additionally ran about 75,000 transactions, indicating that the camp has had vital contact with a big shopper base.

The performances of Panini and Solore over the previous month had been combined. Panini's gross sales collapsed at 39.70, reaching $3.5 million and Sorare reached $3.9 million, reaching 23.99%. Panini nonetheless data 128690 transactions, whereas Sorare recorded 352204 regardless of its comparatively low quantity, indicating a vibrant ecosystem.

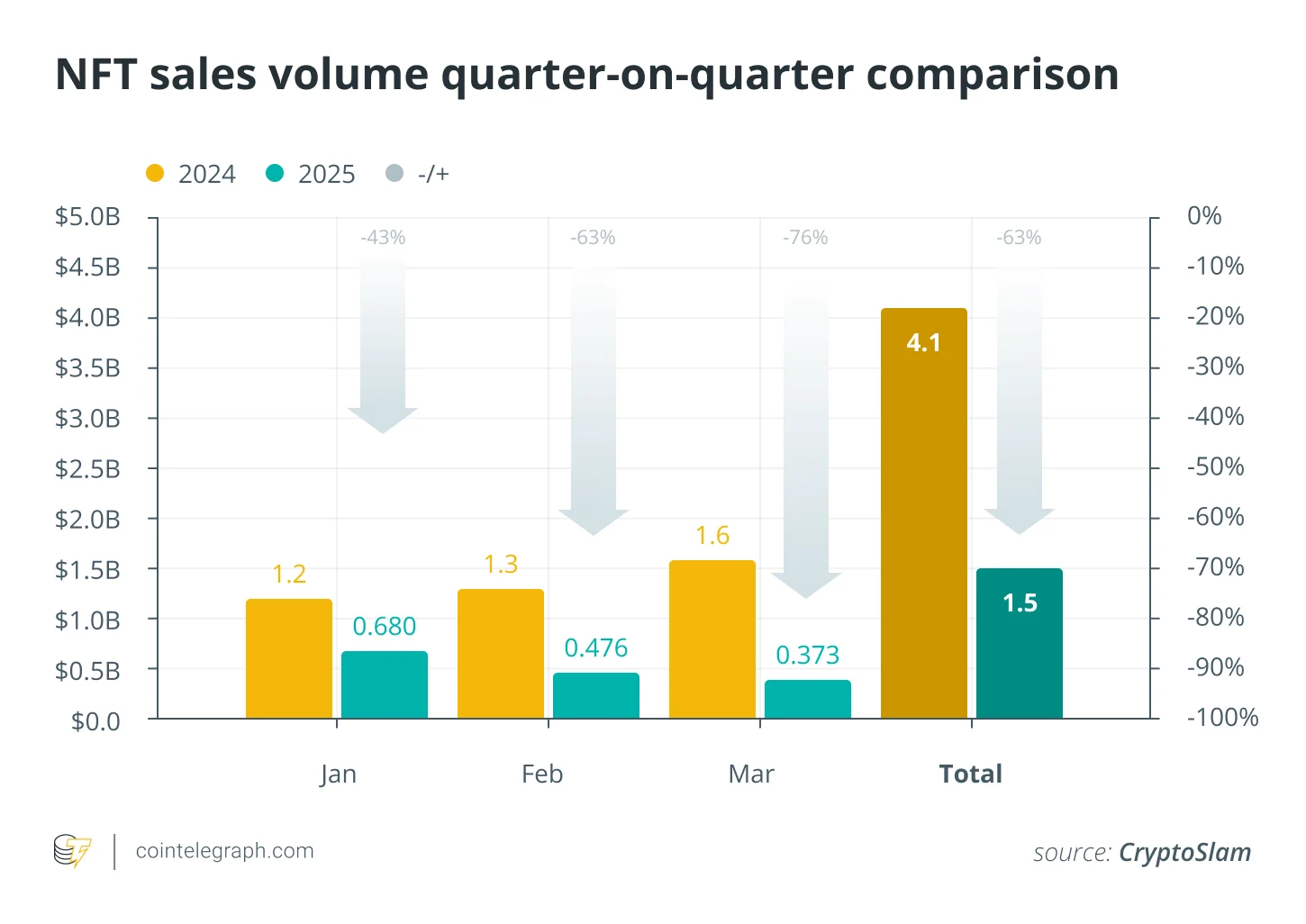

Solana Monkey Enterprise's general buying and selling quantity was $2.89 million, down 36.95% in comparison with the earlier month. It recorded 892 transactions and attracted 164 consumers. This proved that collectors are dropping reputation. Nonetheless, NFTS market gross sales fell within the first quarter of 2025, down 63% to $1.5 billion, from $4.1 billion posted between January and March 2024.

Supply: Cryptoslam