Arenas of syphedSaifedean.com CEO and writer of Bitcoin Normal supplied a data-driven keynote. Bitcoin 2025 Conventioninevitable US greenback decline and positioning warning Bitcoin As solely an affordable hedge. “Defaults, devaluations, or defaults resulting from default devaluations are inevitable,” declared Ammous, including, “Tether can’t repair what ruined a century of Fiat democracy.”

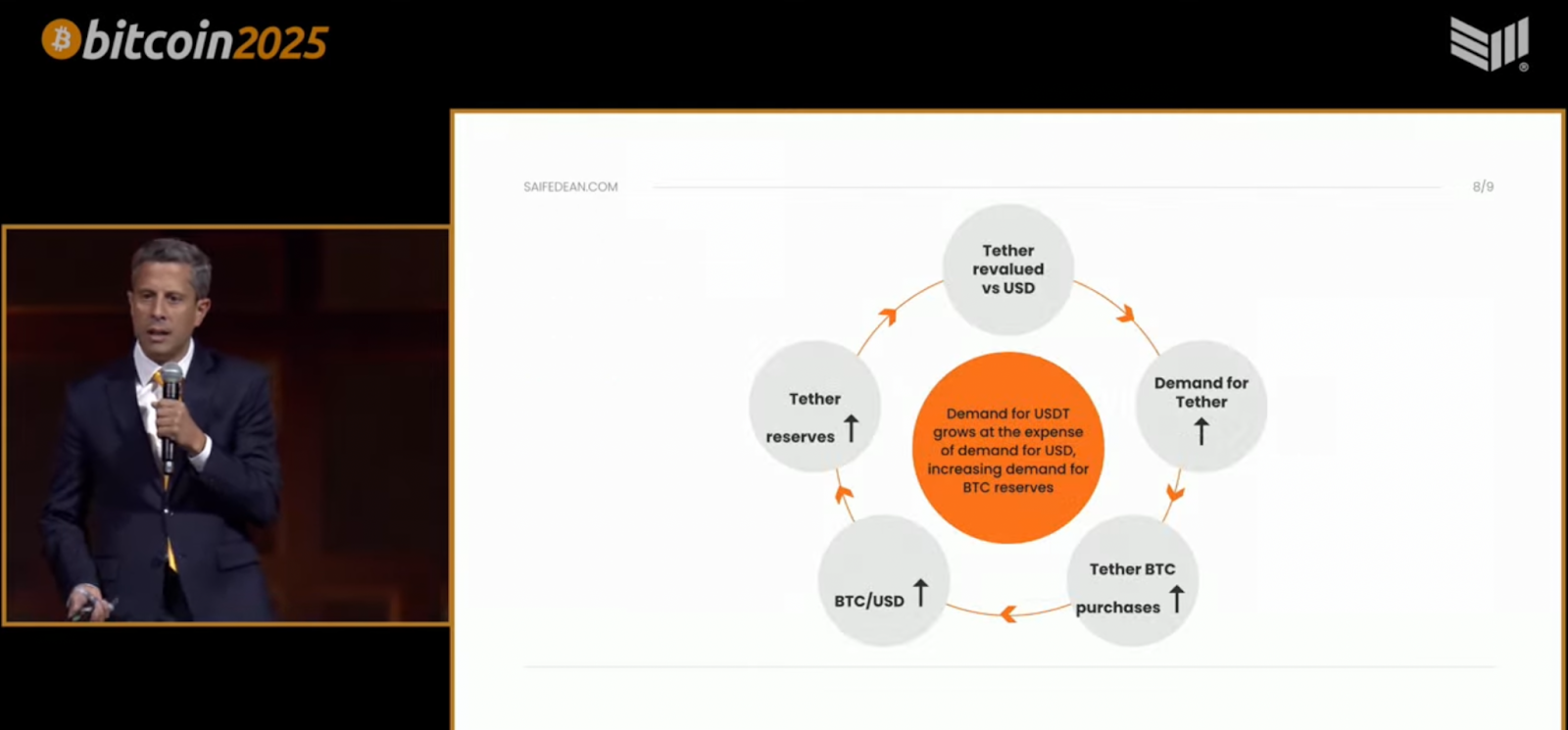

Utilizing projections and circulation charts, Ammous argued that Tether's Bitcoin technique may quickly surpass US greenback reserves. “The tether then breaks the peg upwards,” he stated, predicting a situation the place 1 USDT equals 1.02 USD, and that it may proceed to revive because the greenback weakens. “Because the greenback drops, the tethers turn into comparatively steady.”

The lecture emphasised that it’s described as a self-reinforcement loop. As demand for USDT rises, the necessity for BTC reserves that enhances the worth of Bitcoin will probably be equally reassessed. “This has a big impact in the marketplace,” he stated. “Shopping for Bitcoin is the neatest factor anybody can do.”

In a last, drastic assertion, Ammous predicted the top of the USD period. “In the long run, the USD reserve will probably be zero subsequent to the BTC reserve,” he stated. “USDT will proceed to be revalued upwards till it’s redeemable in Bitcoin. USDT→BTCT.” He known as Tether the “transition monetary system,” and concluded that “even essentially the most bullish situation of USD is much extra bullish for BTC.”

Ammous has the greenback trapped in a downward spiral whereas Bitcoin is rising with “numbers rising expertise.” “To go up is to overhaul what has fallen,” he stated.

This put up by Syphed Ammous: “Nothing to Cease This Prepare” – Tether, Bitcoin and Greenback Endgame first appeared in Bitcoin Journal and was written by Jenna Montgomery.