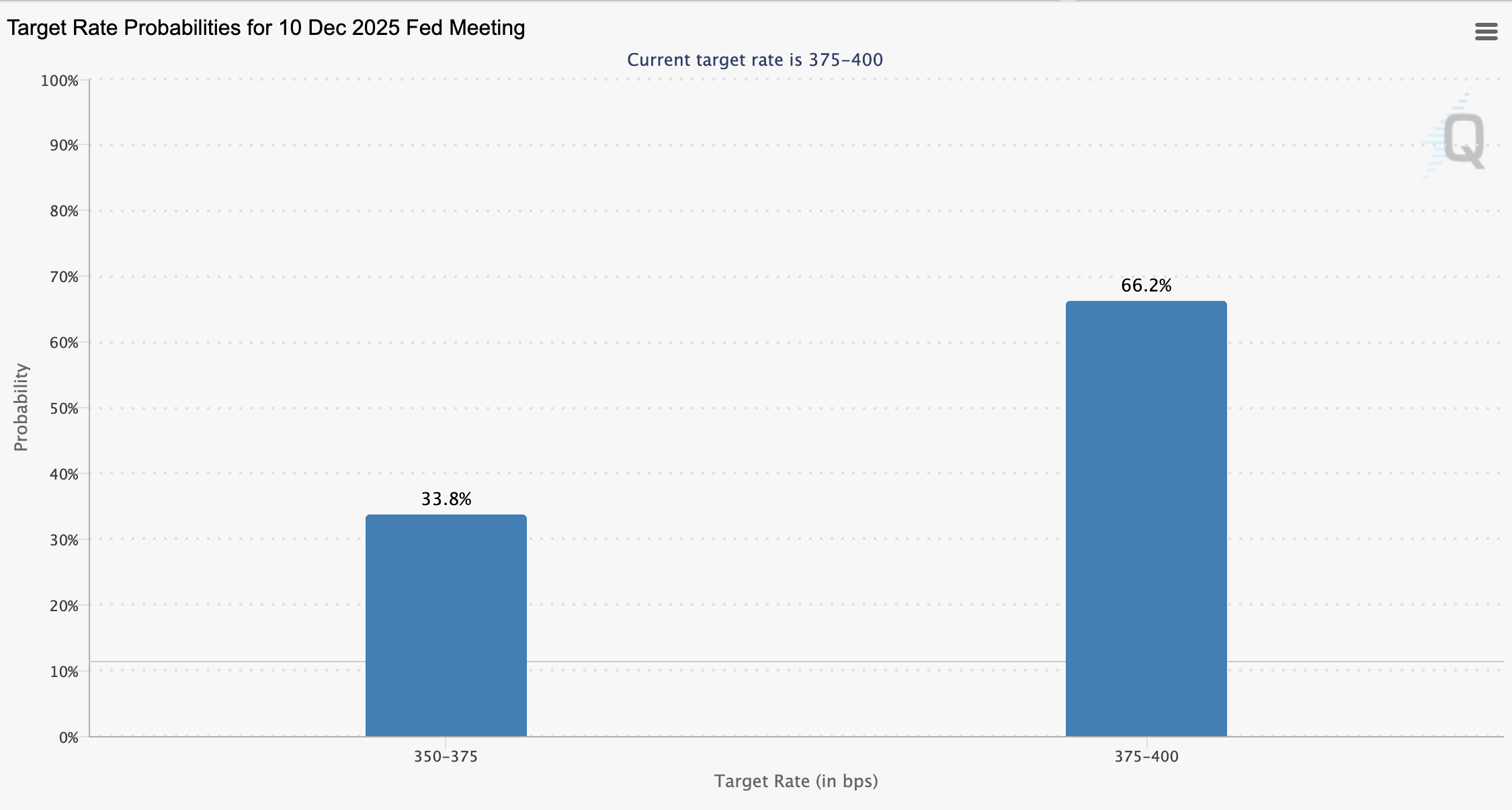

With “excessive concern” gripping the crypto market and the value of Bitcoin (BTC) beneath $89,000, the likelihood of a fee minimize on the Federal Open Market Committee (FOMC) in December has dropped to 33%.

Buyers had been pegging the likelihood of a December fee minimize at about 67% within the first week of November, however that likelihood fell beneath 50% on Thursday, in accordance with knowledge from the Chicago Mercantile Alternate (CME).

Merchants at prediction markets Calsi and Polymarket are pegging the likelihood of a December fee minimize at about 70% and 67%, respectively. Though increased than the CME, merchants seem usually reluctant to chop charges as a result of persistent issues about inflation, in accordance with the Kobessi letter.

Rate of interest goal likelihood for December FOMC assembly. sauce: CME Group

The sharp decline within the likelihood of a December rate of interest minimize and the drop in crypto costs has precipitated panic, with some analysts now warning that this drop may sign the start of a protracted crypto bear market and decline in asset costs.

BTC value dips beneath $89,000 as market sentiment stays simply above yearly lows

BTC value didn’t defend the important thing assist degree and fell beneath $90,000 once more on Wednesday, and has been buying and selling effectively beneath the important thing assist degree, the 365-day shifting common, for the previous six days.

Bitcoin’s 50-day exponential shifting common (EMA) additionally fell beneath the 200-day EMA. This sign, often called a “demise cross”, suggests an additional decline in BTC.

Bitcoin value developments on the time of writing this text. For the previous six days, the value has ended beneath the 365-day shifting common. sauce: TradingView

Some analysts at the moment are predicting that the value may fall to $75,000 and backside earlier than rebounding by the top of 2025, whereas others speculate that the highest of the cycle might already be in.

Market analyst Benjamin Cowen stated on Sunday: “If the cycle will not be over, the interval of Bitcoin's rebound will start someday subsequent week.”

“If a rebound doesn’t happen inside per week, we may see one other sharp decline earlier than an additional rebound, maybe to the 200-day easy shifting common (SMA), which might mark a macro draw back excessive,” Cowen added.

The Crypto Worry and Greed Index stays simply above its year-to-date lows, warning crypto traders. sauce: coin market cap

This prediction was introduced amid heightened cryptocurrency investor sentiment. Investor sentiment, as measured by the “Crypto Worry & Greed Index,” is at 16 on the time of writing, indicating “excessive concern” amongst traders.

In accordance with CoinMarketCap, this places crypto investor market sentiment only one level above the yearly low.