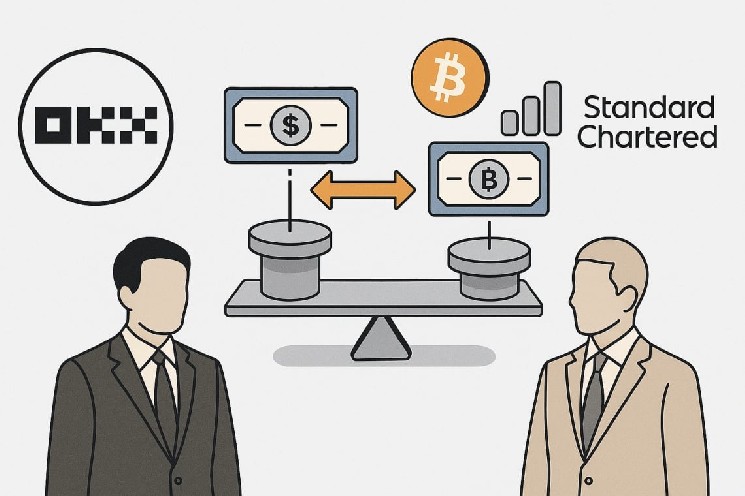

A brand new period of digital finance begins with a strategic alliance signed between OKX, one of many main international firms Cryptocurrency Change, and customary chartered, worldwide systematic banks.

Announcement of the launch of an modern collateral mirroring program. Brevan Howard and Franklin Templetongoals to redefine the best way by which institutional purchasers handle capital within the context of digital exercise.

Unprecedented initiatives within the monetary state of affairs between OKX and Customary Chartered

A brand new collateral mirroring program, a strategic software that permits property for use as collateral for operations aside from conventional buying and selling platforms (Change off), marks necessary advances.

That is very true Fund safety and Capital effectivity For institutional buyers.

Due to this initiative, customers can use cryptocurrency Tokenized Cash Market Fund As a collateral, will probably be considerably diminished Counterparty dangerone of many fundamental issues within the bull and bear market of digital property.

The programme makes use of the existence of an ordinary chartered as a regulated custodian at Dubai Worldwide Monetary Centre (DIFC). Dubai Monetary Companies Bureau.

The selection of Dubai as an operational hub is not any coincidence. This pilot part takes place throughout the regulatory framework established by the Dubai Digital Asset Regulatory Authority (VARA).

Emphasise the main focus particularly stable Laws and Safe custody of digital property by extremely certified entities.

OKX manages collateral by entities regulated by VARA, making certain that your entire course of is compliant with native and worldwide regulatory requirements. Safety Degree What’s offered by this regulated construction represents one of many strengths of the undertaking. Business Requirements.

Strategic Collaboration: Franklin Templeton and Brevan Howard

The synergy between OKX and Customary Chartered is enhanced by the participation of Franklin Templeton. This would be the first fund supervisor to supply cash funds within the context of a brand new program.

This collaboration makes it accessible to institutional purchasers On-Chain Property Developed by the US establishment's digital property crew and seamlessly combine them Monetary Technique and operation.

You may as well take part on this pioneering initiative Brevan Howard Digitalthe Crypto division of famend international various funding firm Brevan Howard, highlighting its enchantment, Reliability What this resolution has already acquired Massive institutional buyers.

Due to this collaboration, the OKX-SCB programme has been A sturdy platform There’s a chance that Rework capital administration With digital buying and selling.

The aim is evident: to supply Security, Regulatory, and Clear Entry right into a distributed finance (DEFI) software with out sacrificing the steadiness of traditional institutional buildings.

Participation in Regulated EntitiesMassive capital managers like Brevan Howard, similar to Franklin Templeton, are concrete demonstrations of rising curiosity in options that mix the world of cryptocurrency and conventional monetary worlds.

For institutional buyers, this implies:

- – Improved fund safety due to the help of well-known regulated custodians.

- – Entry New tokenized digital property Can be utilized as collateral.

- – massive Capital administration effectivityReduces the necessity to transfer it throughout the trade.

- -Cut back counterparty danger through the use of a Managed and accepted alternative off alternative construction;

- – Seamless integration between Conventional and digital finance instruments.

Examples of collaboration between international actors

This innovation will not be solely a results of market evolution, but in addition comes from cooperation between actors with a standard imaginative and prescient. Regulated Digital Asset Ecosystembelief and transparency make monetary providers extra accessible and environment friendly.

OKX leverages its expertise in cryptocurrency buying and selling to hitch forces with Customary Chartered, one of the vital revered and controlled banks on the earth. The bridge between Web3 and institutional finance.

Proposals launched by OKX could be milestones New Digital Financetokenized digital property and controlled custodian providers present synergistically coexistence A scalable and protected resolution.

Because the digital asset business continues to mature, Safe and controlled infrastructure It's turning into an increasing number of central. And this initiative will transfer precisely in that course and predict the wants of a quickly altering market.

Finally, the collateral mirroring program launched by OKX together with Customary Chartered, with the help of Franklin Templeton and Brevan Howard, is not going to solely be pioneering, but in addition seem as a repeatable mannequin on a world scale.

An answer that means that you can mark the trail of Institutional commerce in cryptocurrencymaking certain safety and sustainability on the similar time.

An alliance that appears to the way forward for finance, with sturdy rules and digital innovation.