For the second time this month, Binance recorded over $1.5 billion inflow of Stablecoins and a significant Ethereum outflow. Each outcomes mirror traders' confidence according to bullish BTC value motion.

The massive inflow of stubcoins in Binance coincides with an aggressive ETH break-up, suggesting an thrilling future for cryptography.

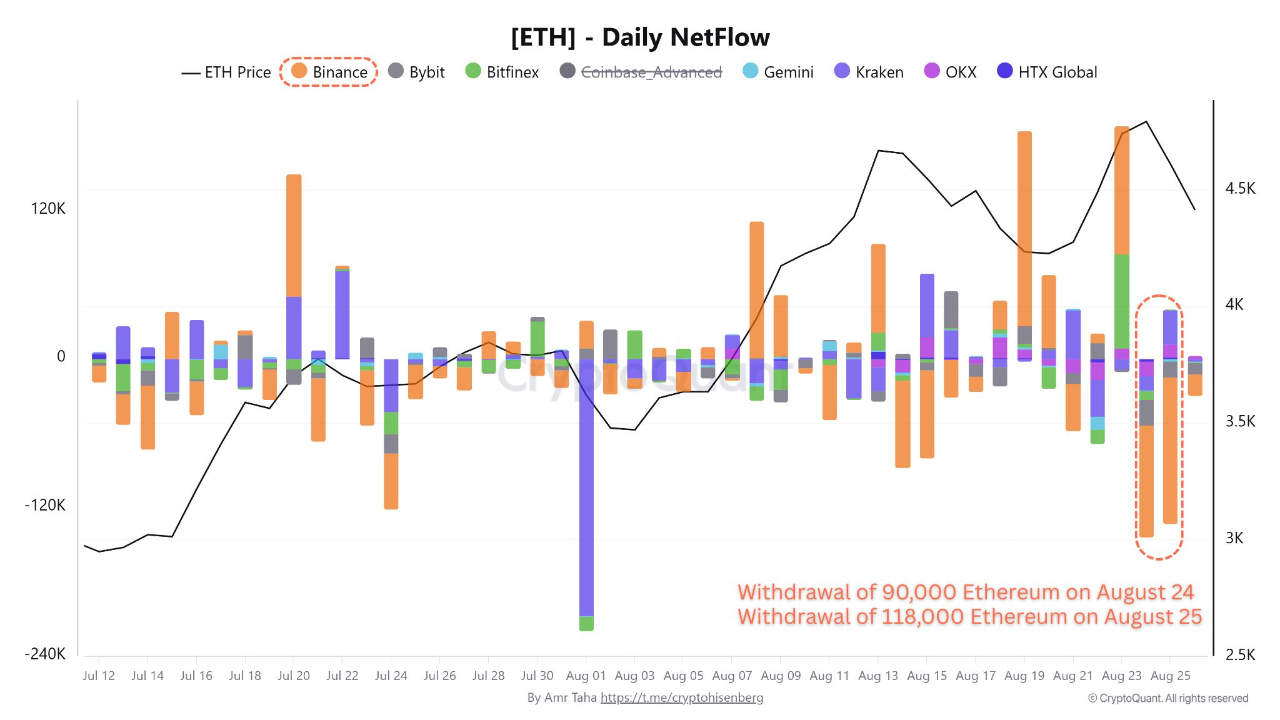

ETH Every day Influx Chart. Supply: Cryptoquant

Nevertheless, analysts additionally notice that Bitcoin's Taker Purchase and Promote Ratio indicator, adjusted to the 30-day transferring common, has just lately reached its lowest degree since November 2021.

Binance sees motion forward of pushing new markets

In line with latest on-chain information, Binance has seen a gradual surge of $1.65 billion, much like the withdrawal of Ethereum from the practically $1 billion trade.

The second time in August was proof that New Capital is getting into the spot market, because the trade's Stablecoin deposit exceeds the $1.5 billion threshold.

In parallel, Binance witnessed a large Ethereum spill for 2 consecutive days. The primary was August twenty fourth, with a most of 90,000 ETH being withdrawn, and a second 118,000 ETH being withdrawn from August twenty fifth.

Traditionally, a large withdrawal of ETH has been noticed to ensure that traders to maneuver belongings into chilly wallets for long-term holdings and cut back the obtainable trade provide. Up to now, such strikes have confirmed that Ethereum traders have gotten extra bullish and shifting belongings to long-term storage, corresponding to chilly wallets.

Over the subsequent few days, this might result in a lower in trade reserves as fewer ETHs are distributed for rapid gross sales.

The large inflow of stubcoins to search out interactions like Binance additionally displays bullish traders' behaviour. This means that liquidity is able to be deployed within the crypto market.

Binance Taker Purchase and Promote Ratios attain its lowest since November 2021

Binance's Taker Purchase and Sale Charge Chart. Supply: Cryptoquant

The purchase and promote ratio of taker measures the connection between purchase and promote orders at market value (taker). If the index stays above 1, the acquisition strain will probably be elevated, whereas whether it is beneath 1, the gross sales strain will probably be wider.

At this level, the symptoms are beneath historic averages. In different phrases, gross sales have persistently outperformed purchases. Which means that the market is paying pessimism and a spotlight to the latest viewing of Bitcoin.

The info is taken into account extremely related as Bitcoin reached the $69,000 vary earlier than being locked up in a long-term revision interval, because the final related degree was noticed on the peak of November 2021. Due to this fact, present gross sales strain will be in comparison with these recorded at a vital second within the cycle.

This motion means that traders aren’t joking about making earnings or lowering market publicity threat, reflecting the notion that the market could also be overexpanded. This displays a price-feeling discrepancy. It is a warning signal that might precede the bigger volatility part.

In brief, what Taker Purchase Promote's ratio says is proof that the market is in a area of excessive curiosity and there’s a weak point within the bullish value construction that shouldn’t be ignored.

Need your mission in entrance of Crypto's prime thoughts? That is an business report that reveals how information meets impression.