An enormous 201,435% liquidation imbalance hit the Bitcoin derivatives market on Tuesday, in keeping with Coinglas. Sarcastically, this occurred as Michael Saylor confirmed one other multi-billion greenback enlargement in strategic holdings. The software program firm has revealed it bought 4,048 btc for $449 million, a median of $110,981 per Bitcoin.

However somewhat than cheering in the marketplace, the announcement coincided with the sale, pushing the value of main cryptocurrencies to beneath $109,000, rattling leverage positions throughout a number of exchanges directly.

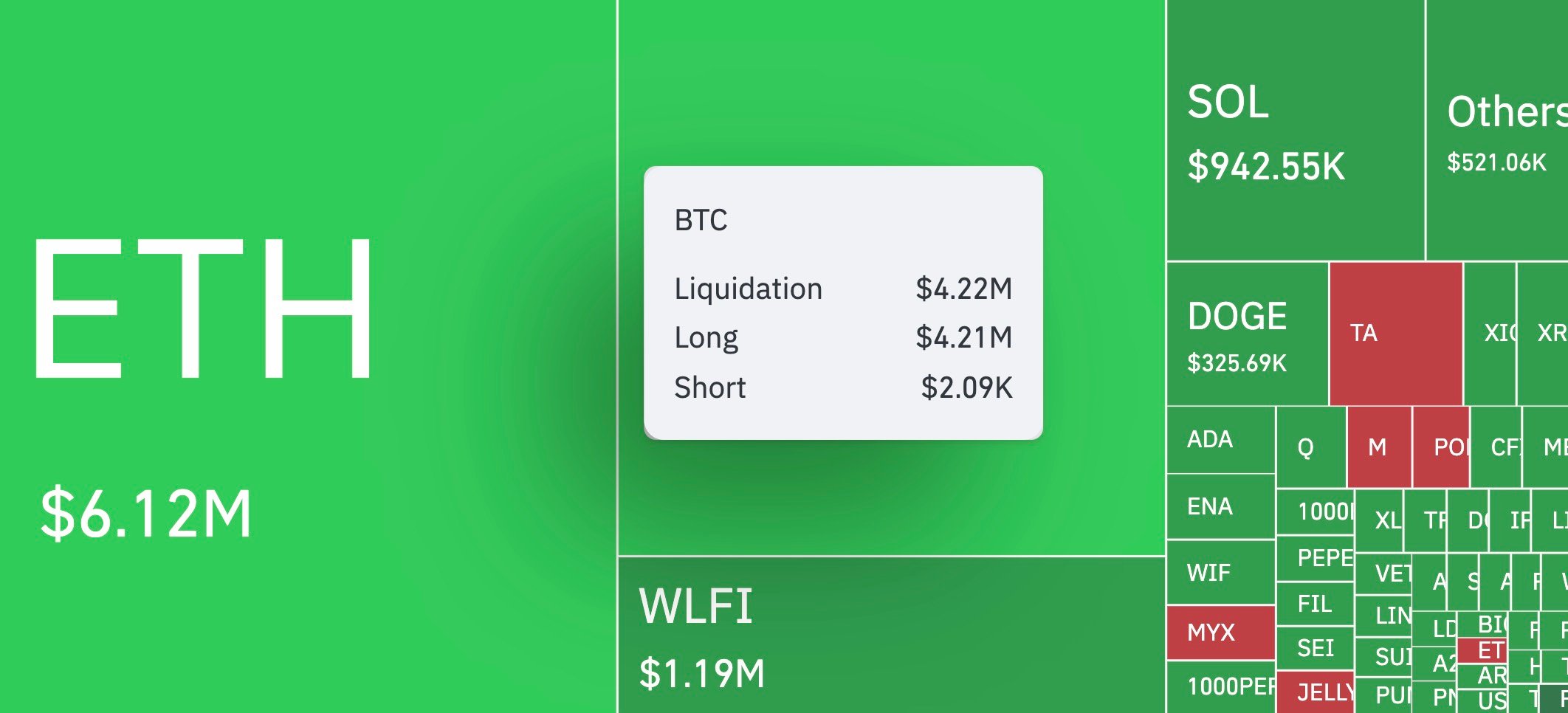

An hour after the announcement, Bitcoin Lengthy value $4.21 million was liquidated, however on the quick facet, the imbalance was visibly hidden, in comparison with simply $2,090.

Nevertheless, it’s not an remoted occasion as leverage positions over $393.9 million have been settled for over 24 hours.

Whose margin calls had been probably the most painful?

Binance noticed the largest liquidation of the day. That’s, it's an ETH/USDT place of practically $9.8 million. The strain unfold far past Bitcoin itself, drawing the Altcoin market into the storm.

Saylor's Firm at the moment holds 636,505 BTC at a median value of $73,765 per coin, with a complete stack of $46,950 million. Saylor & Co. Paper revenue of 25.7%.

The conclusion is that regardless of a big spot accumulation from Saylor and others, Bitcoin's present worth motion could possibly be decided by the place of derivatives somewhat than the acquisition of corporations. And the unbalanced numbers show that time at present.