One other meticulous synovial whale suffered a loss from its lengthy place. Recognised as some of the skilled merchants in Cryptospace, the whale has switched to a brief place with 20x leverage.

One other excessive lipid whale was pushed out of its lengthy place following a stoop in BTC costs. The whale, acknowledged as @Aguilatrades, is among the oldest recognized individuals within the BTC market. Not like Wynn, this dealer has barely made choices and trades publicly and isn’t in search of reputation. The brand new pockets was recognized a couple of days in the past and tagged by investigators on the chain.

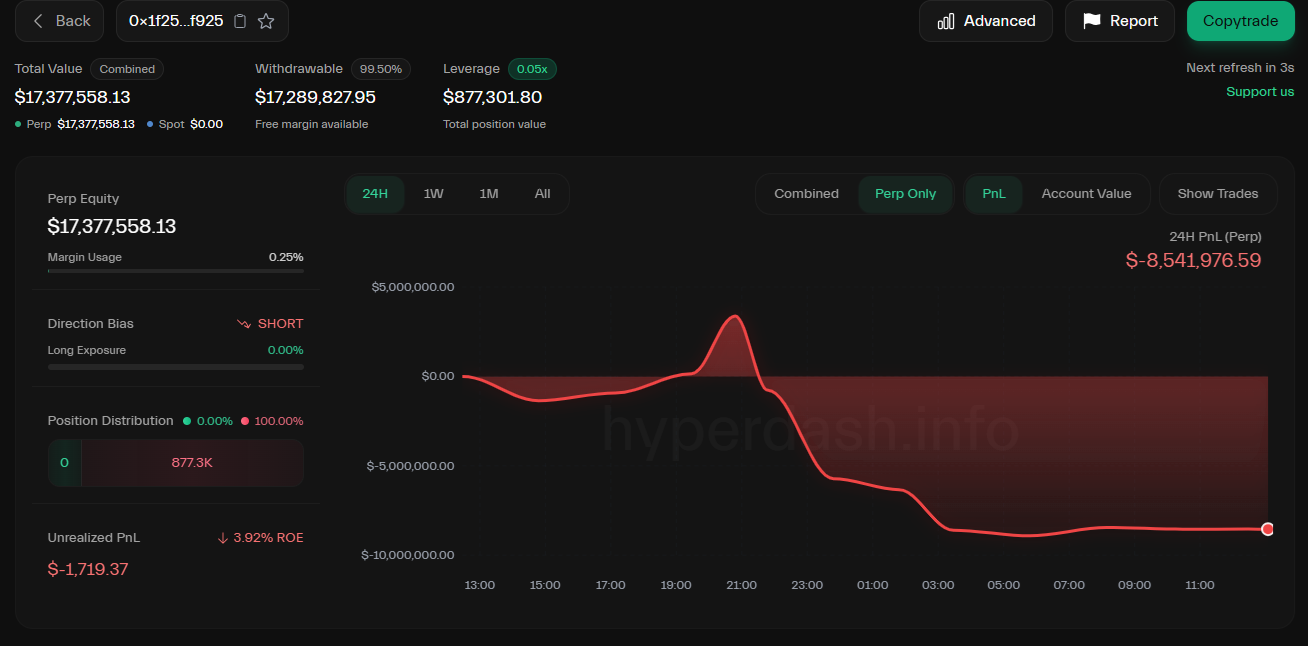

Aguilatrades (@aguilatrades) is in need of his $BTC lengthy place with a lack of over $12.4 million.

Will he proceed to earn losses or will this purple make his shot shorter? https://t.co/dsitg8oy3n pic.twitter.com/l04a0fynte

– lookonchain (@lookonchain) June 13, 2025

Excessive lipid whales undergo from latest liquidation

On-chain information exhibits merchants have closed 40x leveraged dop in BTC and absorbed a lack of $12.4 million. Quickly after that, the whale opened a 20x leveraged quick place It's price greater than 878K.

At one level, Aguilatrades took over the alternative place of harmful merchants James Wynn. The inflow of whale merchants is Andrew Tatewas shortly liquidated in a dangerous market.

I lately obtained Win too Liquidation It additionally contains meme tokens like Pepe in a number of positions. Countertrading Win was nonetheless a profitable technique, like if they’d made $8 million after shortening BTC in time for the recession.

The excessive lipid whales intently monitored the emotional adjustments because the lengthy place was attacked once more. |Supply: Hyperliquid

The sequence of liquidation affected a number of whales who voted for confidence within the BTC or who had lengthy gone to ETH. The BTC traded at $104,763, and ETH slid into the $2,500 vary and beat makes an attempt to regain $2,800. Market momentum has modified as grasping buying and selling shifted in direction of a extra impartial angle.

The lengthy whale liquidation coincided with the market-wide recession and the lengthy place liquidation. Inside the final 24 hours, roughly $1 billion has been settled from the crypto market, $451 million Liquidation of BTC pairs.

Excessive lipid exercise stays near peak ranges

However, Hyperliquid's exercise is approaching peak ranges and goals to keep up its exercise from April and Could. Excessive lipids are normally extra lively within the time of the coin in a transparent course on the high, and whales are well-known positions.

Following latest peak exercise, the hype peaked at $43.76 earlier than sliding all the way down to $40. The tokens will see further buying stress from whales, which may probably return the worth to $45. Whales additionally use lipids Construct a place Native tokens, and presently scorching meme tokens. hyperliquid stays a high-risk venue that also produces whales with substantial revenues primarily based on DEX. Leaderboard.

The well-known deal partially disguised the efficiency of whales that might nonetheless win within the present market. Excessive lipids nonetheless mirror the overall vitality of the market. Nevertheless, there are skeptics who use liquidation to shake up the asset worth whereas nonetheless retaining the reverse place in one other trade, however view the trade as a venue for cash laundering.

Moreover, excessive lipid customers nonetheless count on a possible second airdrop and keep their exercise within the hopes of receiving a better cost.

Excessive lipids are primarily attributable to the load of native hype tokens, but in addition stay the ninth largest ecosystem by locked values, on account of small collections. Meme. The ecosystem is locked at a worth of $1.6 billion, with virtually an inflow of USDC information over the previous few days. DEX nonetheless accommodates greater than $3.1 billion in USDC, breaking into new highs over the previous week.