The BTC (Bitcoin) market was very optimistic final week and the value elevated by greater than 10%. Amongst these optimistic developments, there was a outstanding investor exercise, which identified the demand with out demand to assist steady costs.

BTC Provide Shake-up: Elevated long-term holders, new consumers are over $ 92K

Lately, the favored Crypto Pundit Axel Adler Jr. shared attention-grabbing on -chain insights within the Bitcoin market.

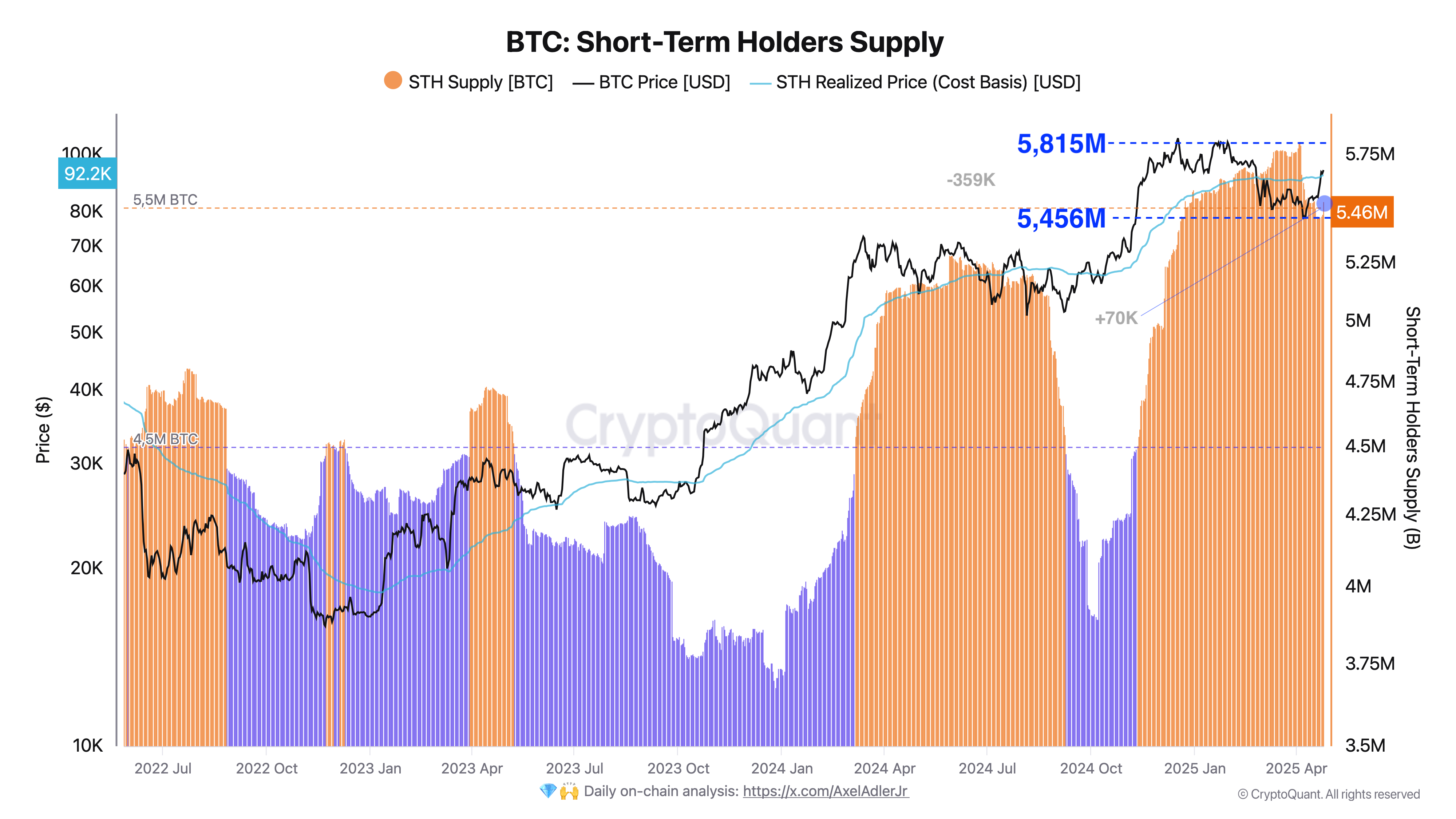

Adler has reported that the short-term market provide has decreased by 359,000 BTC, which is $ 380 billion, which is $ 380 billion over April 4-21, utilizing Cryptoquant's information. Apparently, this lower was not a stress gross sales, however somewhat as a result of coin maturity, and the transition to a protracted -term holder class occurred.

This can be a optimistic market sign that holders are satisfied of Bitcoin's lengthy -term prospects. The holders are opposing gross sales to strengthen the essential market demand and supply a strong basis for the longer term value rally.

In one other attention-grabbing improvement, AXEL ADLER JR mentioned that the provision of BTC quick -term holders has elevated by 70,000 BTC for the final two days following Bitcoin's newest value rally.

The analyst has proven that this improve has gained the pursuits of lengthy -term holders by means of redistribution. As the value rises. Importantly, quick -term holders successfully soak up this new provide and present sturdy demand within the bitcoin market.

This demand is tremendously mirrored within the potential to take care of greater than $ 92,200 of Bitcoin, which is the price of quick -term holders, which represents the common acquisition value of its retention. This exhibits sturdy market belief as new consumers actively enter the market and broaden STH cohorts.

Total, the mixture of coin maturity, well being redistribution, and bitcoin elasticity, which is way more than the fee requirements of quick -term holders, emphasizes structurally sturdy market demand. BTC has a steady propulsion for a brief time period with the lengthy -term holders who successfully soak up the provision and lengthy -term holders who present new calls for.

Bitcoin value define

On the time of writing, Bitcoin is $ 94,408, reflecting a 0.78% discount within the final day. Nonetheless, every day asset buying and selling quantity decreased by 55.53%, displaying weak market participation.

However, the BTC is anticipated to take care of the value improve of $ 91,000, which has been supported by different sturdy improvement, together with a complete of $ 3.6 billion in revival, to $ 91,000 final week.

The following resistance is $ 96,000, you’ll be able to transfer the previous to a $ 100,000 path for a further value improve. Nonetheless, the rejection of the value is pressured to make a spread of $ 92,000, making it successfully creating a spread of bounds.

Chart of TradingView, the primary picture of Financial Instances

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We assist the strict sourcing customary and every web page is diligent within the prime expertise specialists and the seasoned editor's crew. This course of ensures the integrity, relevance and worth of the reader's content material.