The decentralized finance (DeFi) sector has skilled a pointy contraction since early October, with Complete Worth Lock (TVL) falling by greater than 21%.

Coupled with waning curiosity from institutional buyers, this decline has heightened considerations about Ethereum (ETH) demand and worth trajectory in November.

Report double-digit TVL loss on DeFi protocols

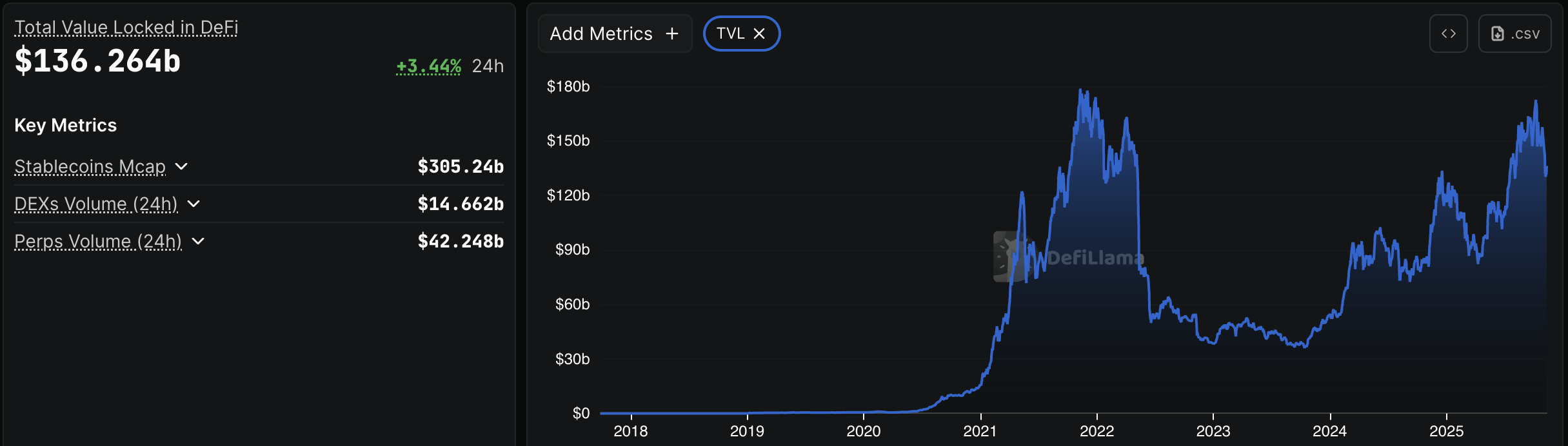

In keeping with information from DeFiLlama, the overall quantity of DeFi TVL reached over $172 billion in early October. This marked the best stage since late 2021. Nevertheless, this once-in-a-several-year peak didn’t final lengthy.

In keeping with the most recent statistics, TVL fell to round $136.26 billion in November, wiping out greater than $36 billion in worth.

DeFi TVL. Supply: Defilama

Main DeFi protocols have suffered important losses over the previous month. Aave, Lido, EigenLayer and Ethena reported declines in TVL starting from 8% to 40%, highlighting a broader slowdown within the sector.

One of many important elements behind this decline is Ethereum's worth correction. After the market crash in October, ETH continued to face difficulties, with its worth dropping to almost $3,000 in early November.

Nonetheless, the weak point deepens. ETH-denominated TVL has been steadily reducing since April. This occurred regardless of the ETH worth rising. This divergence means that ETH’s rise was pushed by elements apart from DeFi progress.

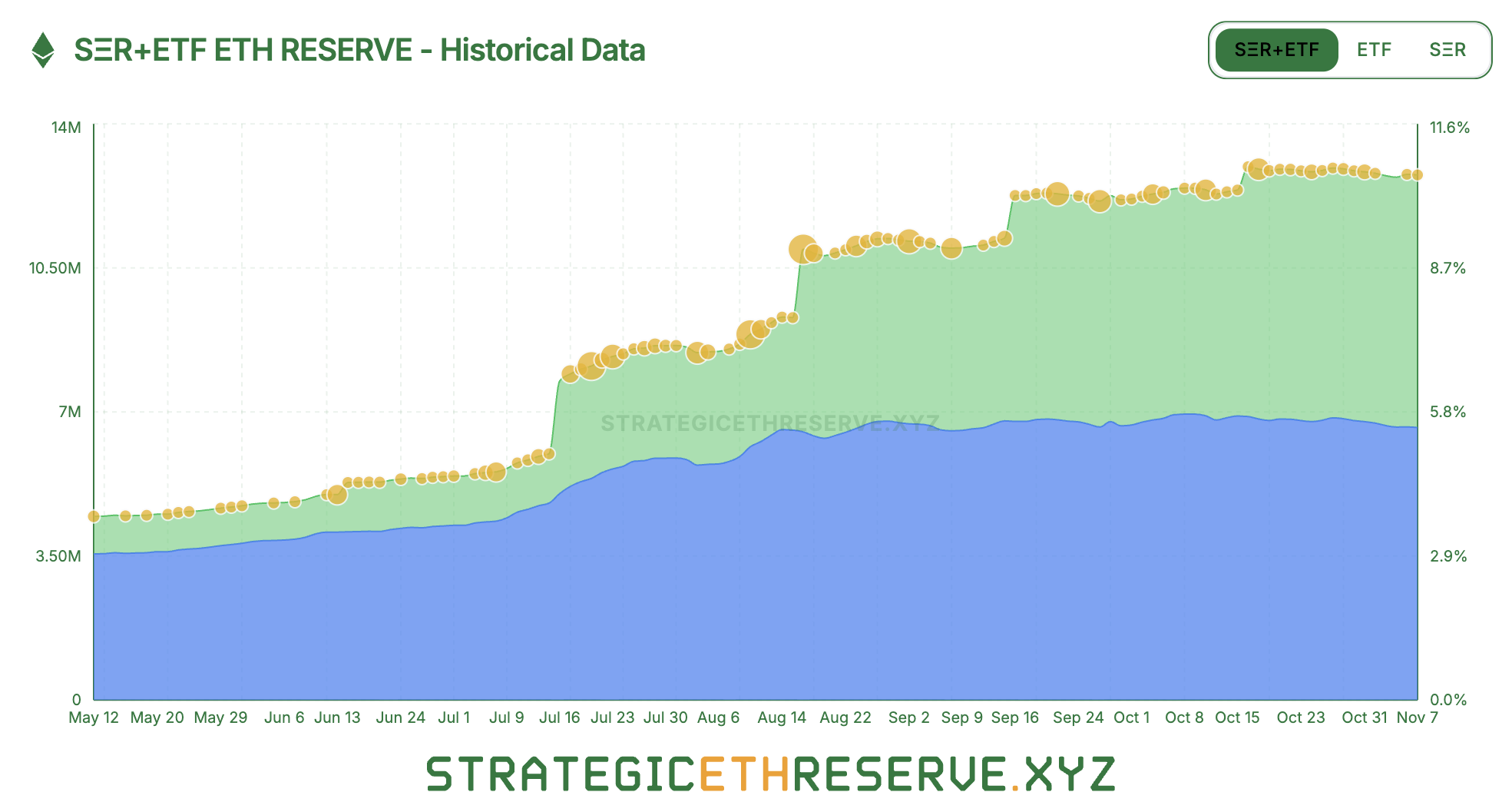

Specifically, two main elements drove ETH demand: digital asset treasury funds (DATs) and exchange-traded funds (ETFs). In 2025, ETFs recorded sturdy inflows whereas giant institutional buyers elevated their publicity to ETH.

However this accumulation can also be slowing. In keeping with figures from Strategic ETH Reserve, mixed DAT and ETF holdings fell from 12.95 million ETH in October to 12.75 million ETH in November.

ETH holdings by ETFs and DATs. Supply: Strategic ETH Reserve

Moreover, BeInCrypto reported final week that the ETH ETF had an influx of $12.1 million on November sixth after six consecutive days of outflows. Nonetheless, this pattern reversed the following day. In keeping with SoSoValue information, on November 7, outflows have been $46.6 million.

Weaker demand on each the retail and institutional fronts may make Ethereum weak to additional downward stress. Nonetheless, latest macroeconomic boosts have led to a slight restoration in ETH. As of this writing, ETH is buying and selling at $3,609, representing a 6.6% enhance in comparison with the previous day.

Ethereum worth efficiency. Supply: BeInCrypto Markets

Analyst Ted Pillows pointed to $3,700 as a key stage for Ethereum.

“ETH is at present approaching a key resistance stage. If Ethereum closes the day by day candlestick above the $3,700 stage, it may transfer greater in direction of the $4,000 stage,” Pillows posted.

The analyst famous that if Ethereum fails to interrupt out of this stage, it may see a pullback in direction of the $3,400 help space.

The put up Over $36 Billion in DeFi Worth Disappears — What Does It Imply for Ethereum? appeared first on BeInCrypto.