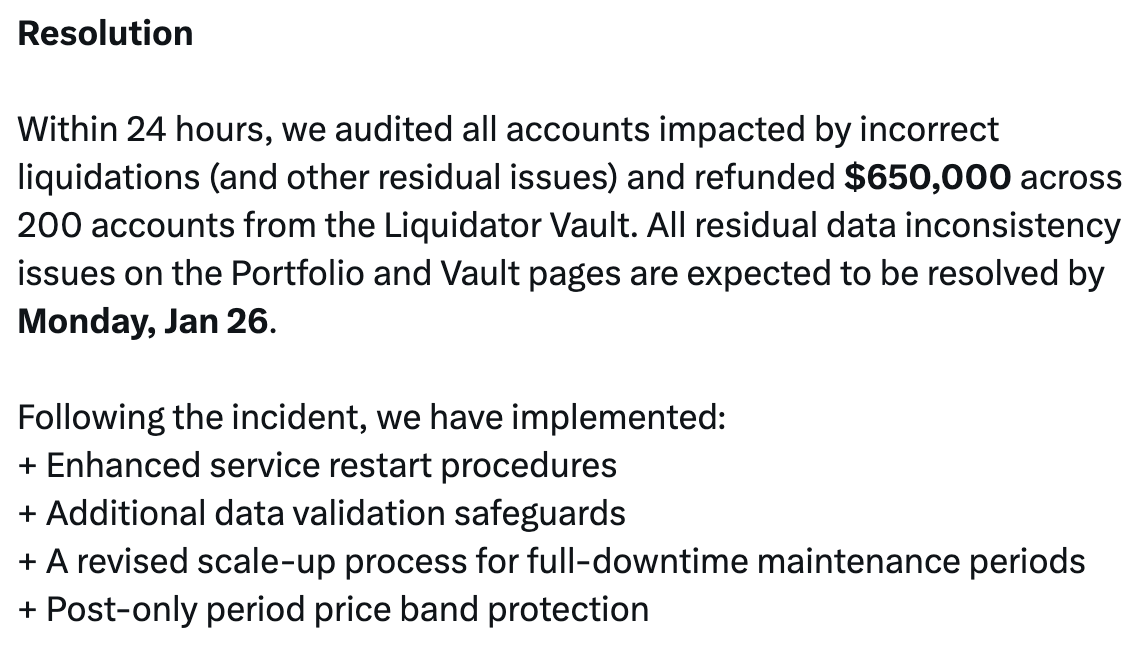

On-chain derivatives platform Paradex has refunded roughly 200 customers $650,000 after a maintenance-related software program error precipitated unintended liquidations in a number of markets.

Based on a autopsy shared by Paradex on X on Friday, the incident occurred throughout a scheduled 30-minute database improve on Monday, when a “race situation” precipitated corrupted market information to be written on-chain. Paradex stated the difficulty was an operational subject and never the results of a hack or safety breach.

In response, Paradex briefly disabled entry to the platform, canceled all open orders besides take-profit and stop-loss orders, and rolled again the chain to a snapshot taken earlier than the upkeep interval started.

sauce: paradox

Paradex is an on-chain derivatives platform that enables merchants to take everlasting leveraged positions whereas managing their funds reasonably than storing them on a centralized trade.

The incident marked the primary rollback for Paradex Chain, which the trade described as an “undesirable however crucial measure to guard our customers and restore the integrity of our community.”

Paradex stated it has applied modifications to forestall a recurrence, together with updating its service restart procedures, including information validation checks, revising its scale-up course of to accommodate a full downtime upkeep window, and defending its value vary throughout post-only buying and selling intervals.

Associated: 80% of hacked crypto tasks won’t ever 'totally get better', specialists warn

Interruption of buying and selling resulting from technical failure

Latest incidents spotlight how operational or infrastructure failures, reasonably than hacks, can disrupt derivatives buying and selling and entry to crypto markets.

In October, decentralized trade dYdX suspended buying and selling for roughly eight hours resulting from code order errors that delayed oracle restarts, leading to incorrectly priced trades and liquidations. The trade proposed a governance vote to compensate affected merchants as much as $462,000 from the protocol's insurance coverage fund.

Technological disruption can also be impacting conventional derivatives markets. In November, the Chicago Mercantile Alternate (CME) halted buying and selling for about 10 hours after a cooling failure at its CyrusOne information middle in Illinois disrupted operations and prompted complaints from merchants.

sauce: CME Group

Web infrastructure supplier Cloudflare reported “degradation of inner companies” in November. The difficulty disrupted entry to the entrance ends of a number of main cryptocurrency platforms, leaving customers briefly unable to entry exchanges, wallets, and information dashboards.

The outage affected cryptocurrency corporations corresponding to Coinbase, Blockchain.com, BitMEX, Ledger, and DefiLlama.

journal: A “tsunami” of wealth is headed in the direction of cryptocurrencies: Nansen’s Alex Svanevik