Privateness coin zcash skilled a pointy value collapse, dropping to $316 on December 2nd, a drop of over 30% since November twenty sixth. Technical evaluation stays bearish, with one analyst anticipating the coin to proceed declining in the direction of the $297-$311 help vary earlier than a doable reversal.

Double-digit loss as a result of ZEC market capitalization contraction

Privateness coin Zcash (ZEC) fell to $316 on December 2nd, its lowest value in virtually a month. The worth drop comes because the sturdy privateness claims that fueled latest inventory positive aspects have light, resulting in hefty losses.

ZEC rose to simply below $380 at one level, helped by a rally within the broader crypto market triggered by headlines about asset administration big Vanguard. Nevertheless, that momentum rapidly dissipated, indicating the coin’s fragile technical help stage and the momentary nature of the sentiment-driven rally. Privateness Coin was again under $350 at press time (1:30 p.m. ET).

ZEC was one of many few digital belongings to publish detrimental returns for seven days. In reality, it had the notable distinction of being the one high-cap altcoin with double-digit losses. Since peaking at $700 on November 20, ZEC’s market cap has shrunk from almost $11.5 billion to $5.67 billion, shedding its place as essentially the most capitalized privateness coin within the course of. The reversal has fueled claims of a coordinated “pump-and-dump” scheme, with critics arguing that the rally was pushed by hype moderately than fundamentals.

Governance programs below assault

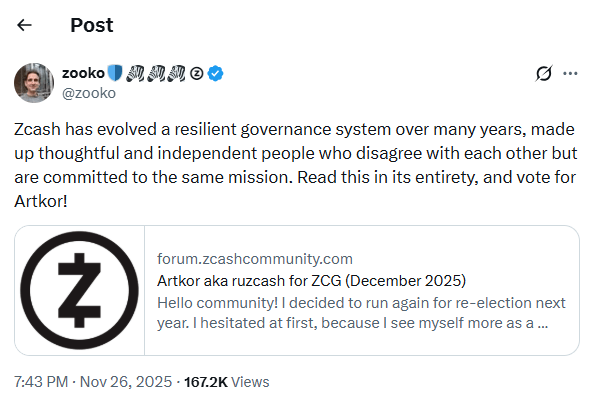

Analysts have pointed to Zcash's controversial governance mannequin as a key issue behind the privateness coin's latest struggles, with the system drawing harsh criticism from outstanding trade voices. The flashpoint got here on November twenty sixth, when co-founder Zooko Wilcox defended the present committee-driven off-chain governance construction in a publish about X. This framework, backed by our bodies such because the Zcash Neighborhood Grants Committee (ZCG), locations decision-making energy within the palms of a small group of appointed people, an strategy many argue undermines decentralization.

Wilcox argued that the system works as a result of it depends on “considerate and impartial” people who find themselves devoted to the protocol's mission. This protection instantly sparked a backlash. Navy's Ravikanth, whose previous feedback seem to have triggered ZEC's parabolic rally, accused the governance system of being “outdated”. He argued that the system was flawed, saying:

“A ‘trusted’ third get together is a safety flaw, and it doesn’t matter if they’re ‘considerate and impartial.’ All governance of decentralized protocols should be on-chain and personal.”

learn extra: Privateness coin ZEC soars after announcement of Thorswap help and Grayscale Belief

Ethereum co-founder Vitalik Buterin added to the refrain of disapproval by claiming that “token voting is dangerous in each sense of the phrase.” “Privateness is strictly the type of factor that can erode over time in case you go away it to the median token holder,” Buterin mentioned.

A public debate in regards to the elementary way forward for Zcash's governance coincided with the plummeting value. ZEC has fallen greater than 30% since Wilcox's publish on November twenty sixth. Nonetheless, some expertise analysts predict additional declines in privateness cash. Analyst Aldi gave a bearish outlook in a Dec. 2 publish, saying he expects the decline to proceed till a key help stage is reached.

“We’re heading headlong into the $297-$311 magnet. The RSI (squeezed right here) however value is barely reacting. This implies sellers are nonetheless choking the market. When the symptoms scream 'purchase' and costs don't transfer something, the flush normally goes even deeper,” the analyst defined.

Aldi confirmed that it’s going to keep its quick place except ZEC regains the $380 stage.

Incessantly requested questions 💡

- Why did ZEC fall to $316? The rise of privateness cash has light because the hype has run out of steam.

- How a lot was the loss? ZEC has fallen greater than 30% since November 26, with its market capitalization shrinking from $11.5 billion to $5.67 billion.

- What position did governance play? Zcash’s off-chain fee system drew harsh criticism from trade leaders corresponding to Naval Ravikant and Vitalik Buterin.

- What does the long run maintain? Analysts warn of additional declines except ZEC regains the $380 resistance stage.