Ethereum (ETH) has had a bumpy 12 months, falling 24% since January 1st, 48% beneath peak value. However don't depend ETH but. The forecast market is bustling with optimism. At Polymarket, 25% of merchants wager that ETH will attain $3,000 by the tip of the month, however Kalshi's bets present numerous love for Crypto World's No. 2 participant.

Ethereum's Future splits forecast markets – $1k crash or $6K rally?

Ether's $306 billion market capitalization accounts for 9.3% of Crypto World's complete $3.27 trillion, however not all daylight and rainbows. In comparison with final month, it has soaked 0.5% and falls 24% because the begin of the 12 months, beneath 36%, which was standing six months in the past. It is usually traded at round 0.02402 BTC at a value of $2,532 per ETH. Nonetheless, the Polymet wager with $4.58 million motion reveals that there’s a 25% likelihood that $3,000 per ETH will seem on the desk by June thirtieth.

Round 12% of merchants wager on hitting Ethereum $3,200, whereas a big 56% say $2,300 is a believable consequence. Polymarket's particular person forecasts are $6.45 million in quantity, which estimates the value of ETH on the finish of the 12 months, with a odds of $4,000 tag at 38%. Additionally, Ethereum, which is more likely to be 24%, will rise to $5,000, with a 16% likelihood of flying as much as $6,000. That mentioned, the equally weighted 16% wager predicts that ETH may fall to $1,000 by December thirty first.

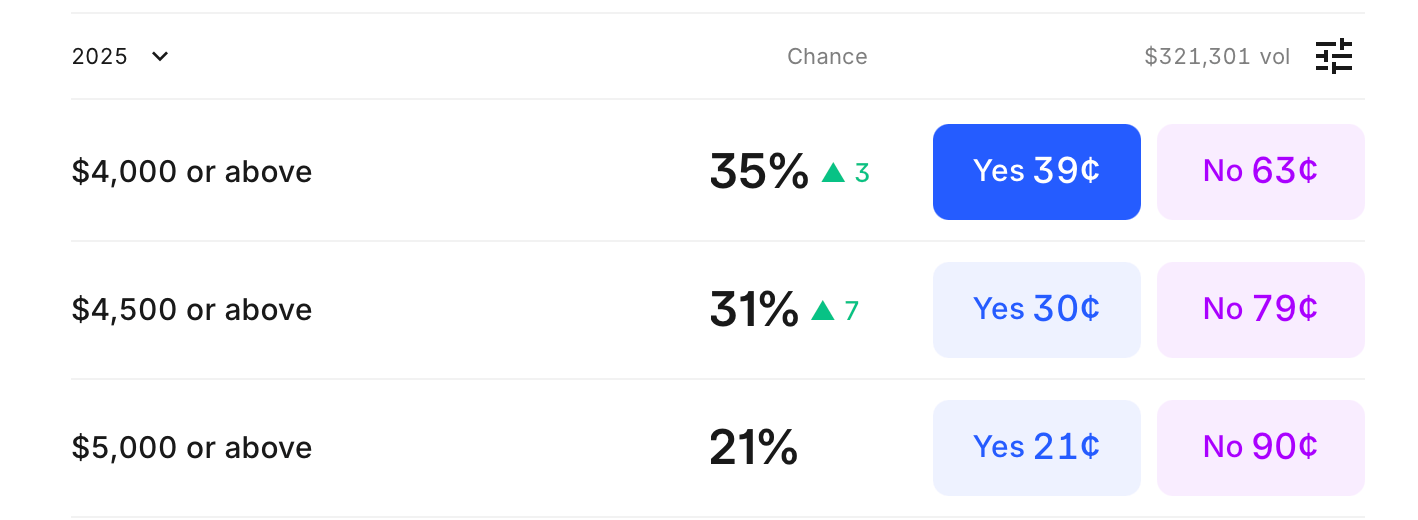

Kalshi will wager on the value of ETH by December 31, 2025.

On Kalshi's forecast platform, Ethereum is presently rising its odds by 3 factors, reaching 35% in 2025 to over $4,000. The forecast for the transfer to $4,500 has grown to 31%, reflecting a 7-point improve. In the meantime, the $5,000 aim seems to be unconvincing, with solely 21% of individuals believing that this 12 months. To date, $321,301 has been wagered throughout these outcomes.

Ethereum's development is not going to be resolved as they experience on hundreds of thousands of potential outcomes. The stress between bearish short-term efficiency and bullish long-term hypothesis reveals markets captured by uncertainty, however it’s potential. Whether or not ETH is rebounding or retreating, one factor is evident. Merchants haven’t retreated from betting that huge strikes are nonetheless forward.