Within the historic milestone of the cryptocurrency market, all Bitcoin (BTC) holders are reaching profitability (or not less than damaged).

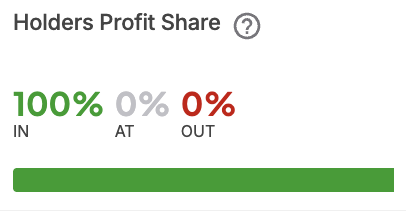

Particularly, the newest on-chain information from the Crypto On-Chain Analytics platform Intotheblock It makes clear that 100% of Bitcoin holders are both worthwhile.

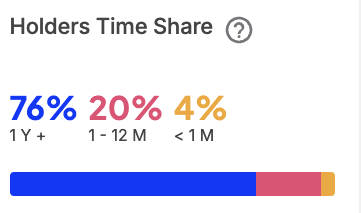

This information additional reveals the holder-based composition of Bitcoin, displaying that 76% of wallets remained in place for greater than a yr, 20% of homeowners for 1-12 months and simply 4% representing current market contributors.

This means that almost all of present holders have taken positions at low costs, significantly these accumulating Bitcoin beneath the $50,000 stage between 2023 and early 2024.

Bitcoin worth evaluation

As of press time, Bitcoin was buying and selling at $117,688, a rise of 1.55% over the previous 24 hours. Notably, the flagship cryptocurrency touched on an all-time excessive of $118,661 early within the day, briefly claiming the place of the worldwide fifth largest asset, leaving Amazon (NASDAQ: AMZN), Silver and Google (NASDAQ: GOOG) within the mud.

Bitcoin averaged 30-day each day buying and selling quantity at round $61.666 billion, considerably outpacing conventional inventory markets. Within the context, Finbold's evaluation confirmed that this quantity was 88.75% larger than Nvidia (NASDAQ: NVDA) over the identical interval.

Bitcoin is at the moment situated for its third consecutive weekly revenue, so the belongings stay bullish in direction of the weekend, supported by sturdy buying and selling volumes and ongoing institutional participation.

Particular pictures by way of ShutterStock.