Bitcoin costs have resumed their upward development this week as they surpassed key resistance at $97,000 and reached their highest degree since February.

Bitcoin (BTC) had traded about $96,500 on Saturday's verify. It is a 30% improve from the April low. On this article, we glance into a number of the high three causes that would surge to the brand new all-time highs this yr.

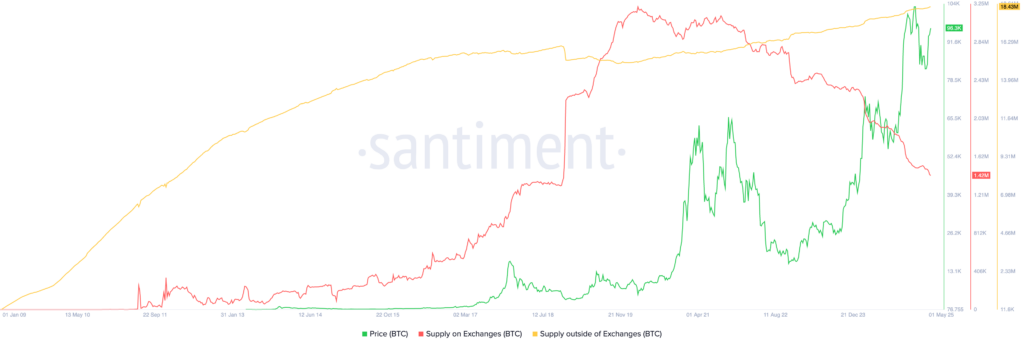

Bitcoin provide for exchanges is declining

The primary main bullish facet is that Bitcoin provide in exchanges fell to 1.42 million, the bottom degree in over six years. Presently, there are 1.42 million cash within the central trade, the bottom degree since November 2018. The best degree in 2018 was 3.21 million.

Extra knowledge exhibits that non-exchange Bitcoin provide has jumped to 18.43 million. These numbers imply that traders usually are not promoting cash. This may result in provide strain as demand continues to rise.

A number of the high Bitcoin holders usually are not going to be promoting them anytime quickly. Michael Saylor's technique, which holds greater than 2% of the whole provide, continues to be bought. Equally, high firms like Coinbase, Tesla, Galaxy Digital and Block haven’t instructed promoting.

Change BTC Provide | Supply: Santiment

Retail and institutional demand is excessive

One other main motive for Bitcoin costs to proceed to rise is the continued improve in retail and institutional demand.

One indicator of that is the influx of Bitcoin trade gross sales funds. Sosovalue's knowledge exhibits that Bitcoin ETFs haven’t been leaked for 4 months since they launched final January.

Bitcoin ETF influx | Supply: SosoValue

These funds have collected over $40 billion in property. BlackRock's IBIT has $6 billion in property, whereas Constancy's FBTC and ARKB at ARK Make investments have $20 billion and $19 billion, respectively.

The rise in ETF inflows is an indication of institutional demand within the US, and there are additionally indicators that the following part of demand shall be introduced from international locations seeking to diversify from the US greenback.

These provide and demand dynamics clarify why analysts are so bullish on Bitcoin. Customary chartered analysts have seen the coin leap to $200,000, however Ark Make investments expects it to leap to $2.4 million in 2030.

Moreover, Bitcoin demand is anticipated to rise as commerce tensions ease.

Bitcoin worth know-how evaluation

BTC Worth Chart | Supply: crypto.information

Lastly, Bitcoin costs have sturdy know-how and may be a lot larger in the long term. Since August fifth final yr, it has surpassed the ascending trendline.

Bitcoin is above key resistance ranges at $88,690, the neckline of the double backside sample. It additionally surpasses the exponential transferring averages of fifty and 100 days.

So there are indicators that it's gaining momentum, and it’ll first push past $100,000 after which to the best ever.

learn extra: Melania Meme Coin Group abandons 9.99m tokens in 8 days and up to now has netted 170K Sols