Ethereum value beneficial properties misplaced momentum this week, rising from a January 13 excessive of $3,387 to the present $3,288 as issues over the market construction invoice mount.

abstract

- Ethereum Costs have fallen in latest days as demand for cryptocurrencies has declined.

- Ethereum has promising fundamentals, together with elevated community exercise.

- The token has fashioned an ascending wedge chart sample on the day by day chart.

Ethereum (Ethereum) token has fallen 33% from its all-time excessive final August, reflecting the efficiency of the broader cryptocurrency market.

The token has fallen regardless of its sturdy fundamentals. For instance, the Spot Ethereum ETF has added greater than $584 million in inflows this yr, bringing cumulative web inflows to greater than $12.9 billion, in line with knowledge compiled by SoSoValue. All of those funds have greater than $20 billion in property, and BlackRock's ETHA has greater than $11.7 billion in property.

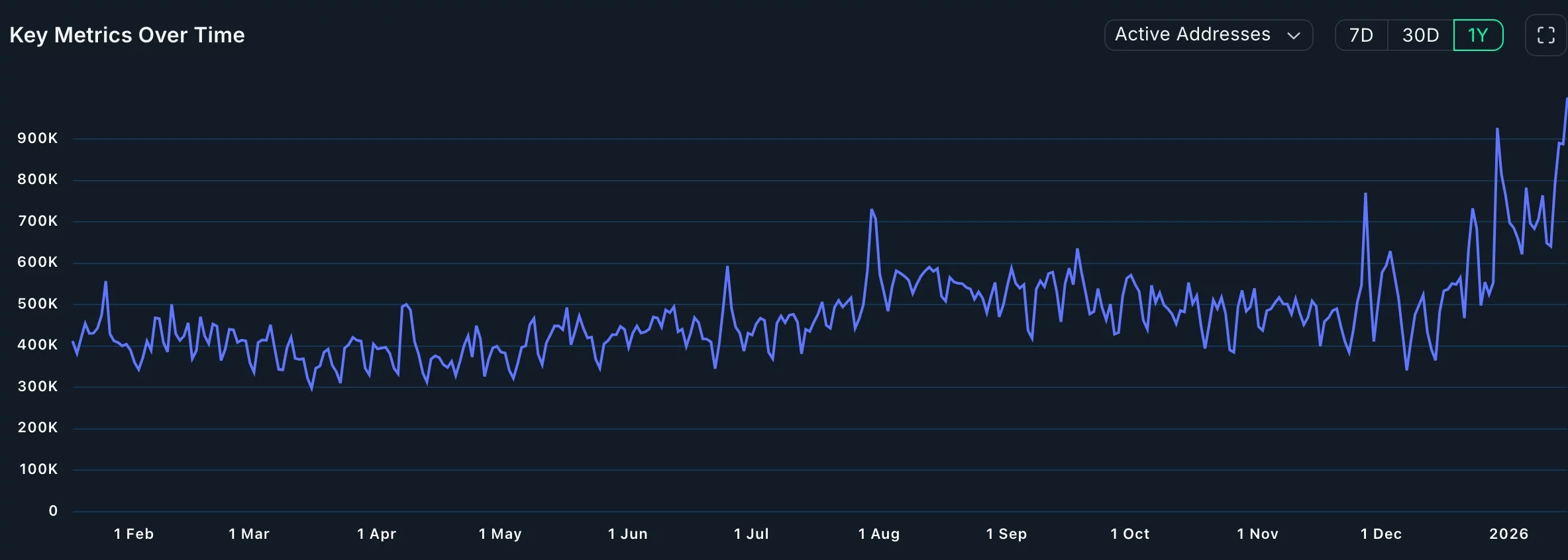

The Ethereum community can also be doing nicely, with the variety of transactions and customers persevering with to develop. Over the previous 30 days, the variety of transactions has elevated by 30% to over 58 million, and lively addresses have elevated by 64% to 13.1 million.

Ethereum lively addresses |Supply: Nansen

Ethereum stablecoin transactions have continued to surge this yr, with the provision of those tokens growing to $170 billion and buying and selling quantity to $977 billion previously 30 days. The community’s stablecoin transactions elevated to greater than 50.4 million.

You may additionally like: Monero value eyes $930 as Fibonacci extension breakout continues

Additional knowledge reveals that Ethereum buyers transferring round staking swimming pools are incomes round 2.85% in annual returns. In response to the information, the staking market has elevated by $1 billion previously 30 days, surging to greater than $118 billion. This can be a bullish stance as BitMine continues to stake its huge Ethereum property.

Ethereum value technical evaluation

Ethereum Value record |Supply: crypto.information

The day by day timeframe chart reveals Ethereum value retreating from final yr’s excessive of $4,946 in August to the present $3,290. The value failed to interrupt above the 200-day exponential transferring common, indicating that the bulls are shedding momentum.

The token has fashioned an ascending wedge sample, which is characterised by two rising and converging development strains. The wedge is likely one of the most typical bearish reversal patterns.

It additionally fashioned a bearish pennant and bearish divergence sample. Subsequently, the coin may make a powerful bearish breakout to the November twenty first low degree, a key help degree at $2,623. This goal is roughly 20% decrease than present ranges.

Conversely, a transfer above the important thing resistance degree at $3,500 would invalidate the bullish outlook and level to additional upside.

You may additionally like: NFT consumers enhance 120% regardless of gross sales flat at $61.5 million