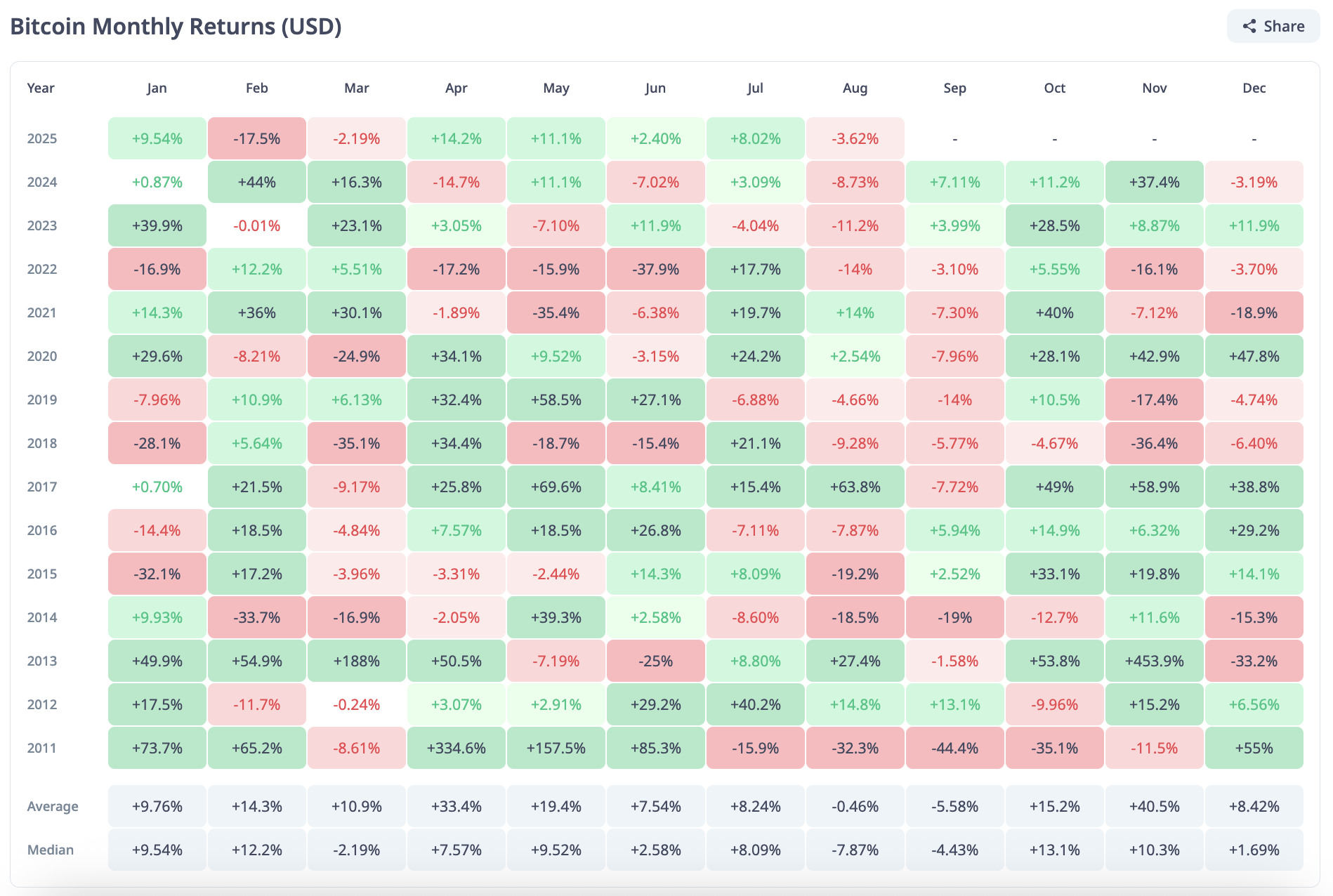

Bitcoin value historical past leaves little debate. September was not the suitable month to make optimistic funding selections in main cryptocurrencies. Over greater than a decade of knowledge, this actual month stands out because the weakest level on the calendar, with a median return charge of -5.58% and a median of -4.43%.

Purple runs throughout the cycle: bull market, bear market, sideways. Normally September was a retreat. Curiously, as was the case in August, there’s a bearish sequence that unfolds in Bitcoin value historical past.

That is why it makes it troublesome to disregard the present BTC value chart setup. Extending the pullback that started when the July rise went above $120,000, August has already proven a loss price 3.9%, rolling right into a month that gives one other level for folks with extra ache traditionally better ache.

How cussed the sample is clearly proven by its observe file. In September 2022, 3.1% closed. In 2021, the drop was 7.3%. In 2018, the speed was -5.7%, and in 2014, the speed was -19%.

A handful of inexperienced prints – +5.9% in 2016 and +2.5% in 2015 – seems to be an exception than the development. Even Bitcoin's greatest years, equivalent to 2017 and 2020, September nonetheless led to purple.

Conclusion

What I hold repeating is how this month works like a reset. The fluidity decreases, uncommon summer time gatherings fade, and exterior pressures grow to be heavier. This combine has made September one among BTC's worst entry factors, confirmed by value historical past.

The distinction happens in October. This averaged +15.2%, usually inverting the script rapidly. However earlier than that, September stays a month to keep away from.