The Florida Lawyer Common has launched an investigation into Robin Hood's crypto enterprise, claiming the corporate misinterpreted its clients about the price of buying and selling digital belongings.

Fintech firms have been accused of portraying buying and selling apps as the most affordable means to purchase cryptocurrency.

In keeping with a information launch, the Lawyer Common's Workplace has despatched a subpoena calling for inside information associated to Robin Hood's crypto merchandise and the way it units charges and charges.

Within the launch, Florida Chief Monetary Prosecutor Brad Usmeyer stated, “Cryptocurrency is a key part of Florida's monetary future, and President Donald Trump's efforts to advance the crypto market will make America stronger and wealthier.”

He provides, “When customers purchase and promote crypto belongings, they deserve transparency of their transactions. Robinhood has lengthy been claiming that it’s the greatest cut price, however believes that their expressions are misleading.”

The subpoena calls for a variety of supplies. These embrace reporting traces inside Robinhood, particulars of earlier and present employees within the Advertising and marketing and Buying and selling Division, Fee Orders (PFOF) preparations, coaching guides, evaluation of opponents, general crypto and transaction knowledge, and information of transactions made by Florida residents. It additionally contains promoting plans and inside discussions of charges and charges.

Robinhood should adhere to the tip of July, the assertion stated.

The Robinhood enterprise mannequin routes buyer orders to exterior firms somewhat than operating transactions on their very own books. These third events pay Robinhood for the privilege to course of the order. Often called PFOF, the corporate can supply transactions with out a committee whereas incomes earnings from accomplice firms.

The probe examines whether or not the system hides prices, undermines equity, or results in elevated consumer charges.

Final yr, the Securities and Alternate Fee adopted guidelines requiring securities firms serving retail traders to disclose detailed info on commerce execution and pricing, together with PFOF particulars. This modification got here throughout an overhaul of market transparency.

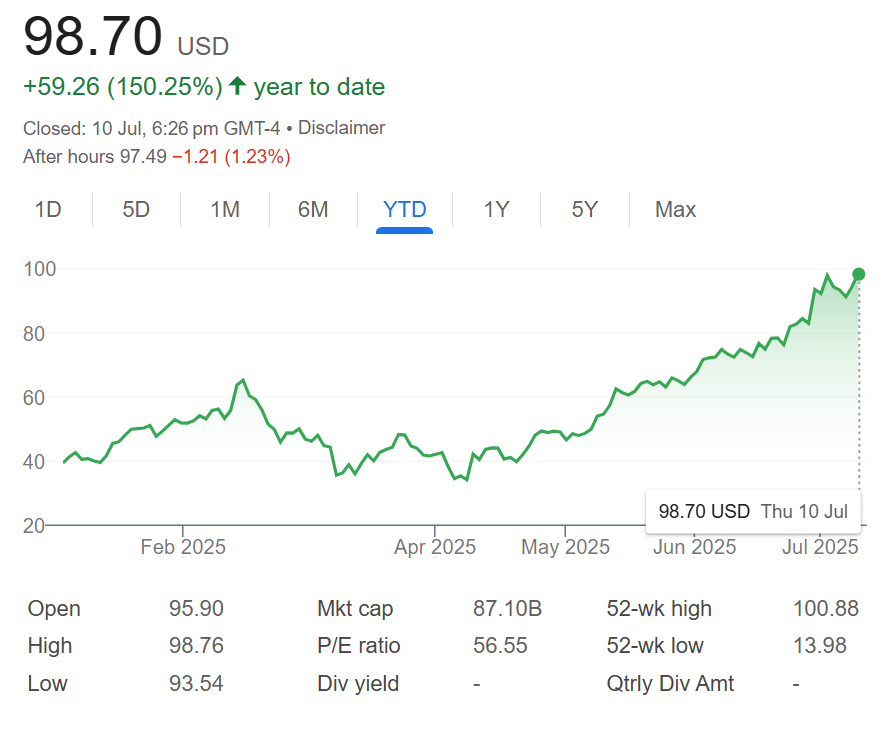

Robinhood shares have grown 150% this yr

Robinhood shares have skyrocketed round 150% thus far this yr. The soar displays robust buying and selling volumes from retail clients, and we hope that regulated cryptocurrencies will drive contemporary investor curiosity.

Robin Hood inventory worth. Supply: Google Finance

A few 1/fifth of the inventory's revenue adopted the Southern France occasion, when co-founder and CEO Vlad Tenev launched new crypto options and distributed $1 million tokens tied to Spaxex and Openai.

In keeping with a S&P Capital IQ ballot, Robinhood's earnings per share elevated by roughly 10% per yr till 2028.

Robinhood has recorded internet earnings from its public record in only one yr, making future earnings forecasts troublesome, particularly given the unstable nature of the crypto market and its shifting coverage below President Trump.

If revenues rise as anticipated, Robinhood shares will commerce at roughly 56 instances its 2028 revenue. As compared, our direct competitor, interactive brokers, have a better fame, and Charles Schwab is 14 instances extra valued. Along with the opinions of interactive brokers, Robinhood will want twice the anticipated income over the following three years.