Ripple, the blockchain funds and infrastructure firm behind XRP, is as soon as once more the main target of IPO hypothesis.

Latest claims circulating amongst crypto watchers recommend the corporate could also be engaged in late-stage discussions for a possible preliminary public providing in 2026.

These claims come regardless of clear statements from Ripple administration that the corporate has no plans to go public anytime quickly.

Ripple IPO rumors resurface

Copy hyperlink to part

Cryptocurrency researcher SMQKE lately shared findings that he factors to as a documented signal that Ripple is contemplating going public.

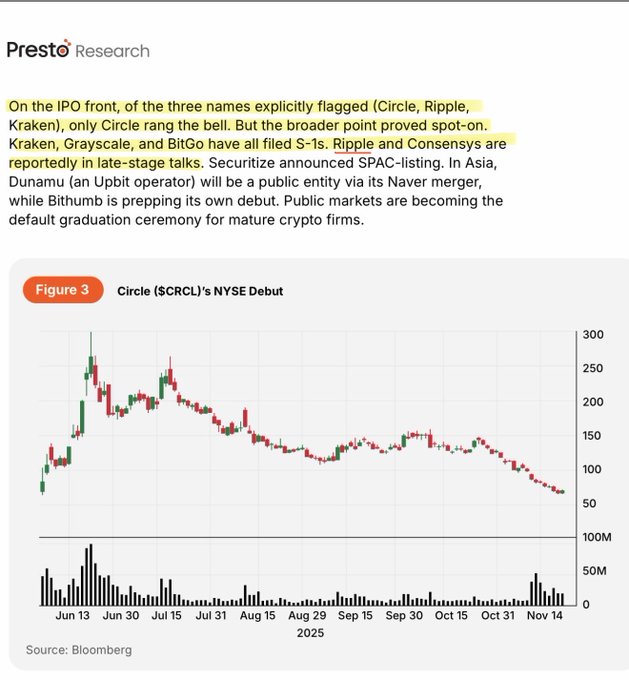

Photographs and excerpts from Presto Analysis are cited as proof that Ripple is being grouped with different crypto firms making ready to enter the general public market, together with Kraken, ConsenSys, and BitGo.

‼ ️ Ripple is reported to be in ultimate stage negotiations for IPO in 2026!! ️Documented. 📝👇

6:25 PM · December 21, 2025

The examine identifies IPOs as a rising development for mature crypto firms, making going public a pure development for firms in search of broader validation and long-term progress.

Proponents of this narrative spotlight the efficiency of firms like Circle, which lately went public on the New York Inventory Change.

SMQKE references these developments to clarify that crypto-related public choices are now not theoretical, suggesting that Ripple's potential transfer might observe an analogous path.

This declare has sparked curiosity inside the crypto group, with some decoding the potential IPO as an indication of regulators' confidence moderately than a market-driven determination.

Ripple CEO says there are “no plans” for an IPO

Copy hyperlink to part

Regardless of the hypothesis, Ripple President Monica Lengthy has repeatedly said that the corporate has “no plans or timelines” for an IPO.

Talking on the Swell convention in New York in November, Lengthy emphasised that Ripple is well-capitalized and doesn’t want the general public market to fund its progress.

CEO Brad Garlinghouse echoed this sentiment earlier, noting that the corporate doesn’t want to boost capital via a public itemizing and that discussions about an IPO are prone to be a long-term consideration moderately than a direct technique.

This cautious method stands in distinction to different crypto firms which have entered the general public market.

Corporations comparable to Coinbase, Robinhood, and Circle have skilled blended efficiency after going public, with market volatility and regulatory oversight impacting efficiency.

Ripple seems intent on avoiding these pitfalls, insulating itself from the stress of quarterly earnings forecasts and the affect of fairness traders unfamiliar with crypto token traits.

Ripple will develop strategically with out going public

Copy hyperlink to part

Ripple's determination to stay non-public can be according to its ongoing growth efforts.

The corporate raised $500 million in latest months at a $40 billion valuation, not out of necessity however as a solution to safe strategic partnerships.

Ripple has additionally made a sequence of acquisitions, together with prime brokerage Hidden Highway, stablecoin platform Rail, monetary administration software program GTreasury, and crypto asset custody supplier Palisade.

These strikes are geared toward complementing its concentrate on funds and increasing into new market frontiers, though CEO Garlinghouse recommended acquisition exercise might sluggish in 2026.

By remaining non-public, Ripple is ready to management its vital XRP reserves and keep governance flexibility.

A public market would impose extra scrutiny on token administration, doubtlessly creating pressure between shareholders and the crypto group, however Ripple is at the moment avoiding this problem.

Moreover, regulatory uncertainty stays a priority. Though Ripple gained a landmark lawsuit towards the SEC in 2023, the broader regulation stays unresolved and a public providing will seemingly require elevated disclosure.