Securitize is contemplating going public by way of a merger with a particular function acquisition firm. RWA tokenization firm may attain $1 billion valuation after merger with Cantor Fairness Companions II Inc.

Securitize, a number one blockchain firm specializing within the tokenization of conventional investments, is reportedly in talks to go public by way of a merger with a particular acquisition function firm (SPAC) launched by Cantor Fitzgerald LP. The deal is predicted to worth Securitize in extra of $1 billion.

Securitize, contemplating itemizing by way of merger

The potential merger entails Cantor Fairness Companions II Inc., a clean test firm that raised $240 million by way of an preliminary public providing in Might. Brandon Lutnick, chairman of Cantor Fitzgerald, serves because the SPAC's chief government officer.

Although discussions are ongoing, sources emphasised that Securitize might select to stay personal.

However as soon as it's lastly determined, transaction This might be a serious milestone for the real-world asset (RWA) tokenization sector, which is among the most promising real-world functions of blockchain expertise. Tokenization permits buyers to realize partial publicity to conventional belongings reminiscent of shares, bonds, and actual property by way of blockchain-based digital tokens which are simpler to commerce, switch, and observe.

The RWA market is booming

Tokenization of real-world belongings has develop into a sizzling subject amongst asset managers and monetary establishments trying to mix the transparency and effectivity of blockchain with the reliability of regulated funding merchandise. That is a method blockchain can obtain mainstream adoption.

Securitize is a number one participant within the rising tokenization area, attracting funding from main monetary corporations reminiscent of BlackRock Inc. and Morgan Stanley.

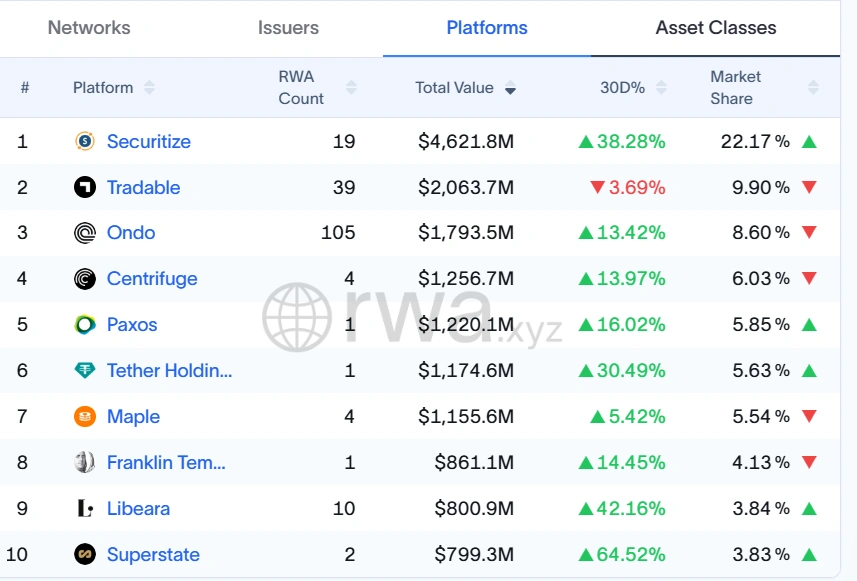

Securitize may capitalize on the expansion of the RWA market, doubtlessly resulting in a $1 billion public providing. Supply: RWA.xyz

Securitize's platform permits buyers to realize tokenized publicity to conventional belongings such because the S&P index. BlackRock’s tokenized fund BUIDL can be obtainable by way of the platform. Different backers of the corporate embody ARK Enterprise Fund, Tradeweb Markets Inc., and Nomura Holdings, Inc.

Securitize is registered as a switch agent with the U.S. Securities and Trade Fee (SEC) and might handle possession data for tokenized securities. We additionally maintain licenses to function in sure European jurisdictions and keep operations in Japan.