The heated inventory market lastly cooled after reaching a number of all-time highs, and Bitcoin fell on it.

Bitcoin slips when the inventory market slides

Shares lastly completed their record-breaking rally on Tuesday morning, as each the S&P 500 and Nasdaq fell 0.36% and 1.10% respectively. Bitcoin has been immersed in water for over per week, however on the time of writing it has been 1.50% soaked and 1.50% soaked. The lonely star maintained its upward momentum, rising 0.72% to 44,410.13 factors.

Tesla (NASDAQ: TSLA) led the inventory market downward slide, falling 5.15% after President Donald Trump wrote a poignant submit concerning the true social points concerning the authorities subsidies acquired by firm CEO Elon Musk and Tesla.

(Tesla was one of many massive losers on Tuesday morning as shares lastly hit the wall after a week-long rally/CNBC)

“Elon could get extra subsidies than another particular person in historical past with out subsidies, however Elon will in all probability want to shut his store and return to South Africa,” Trump wrote. “Possibly we must always have Doge take a more in-depth take a look at this? Nice cash to be saved!!!”

The friendship between Trump and Musk has taken a sudden flip after Musk, who can also be the richest particular person on this planet, criticized the president's “massive, lovely invoice,” which the Fee for the Accountable Federal Price range stated might add between $3 and $5 trillion to the nation's $36 trillion debt.

“It's clear on this invoice's insane spending. It will enhance the debt cap at a document $5 trillion during which we reside in a single social gathering nation. Porky pig social gathering!,” Musk wrote to X.

Market Metric Overview

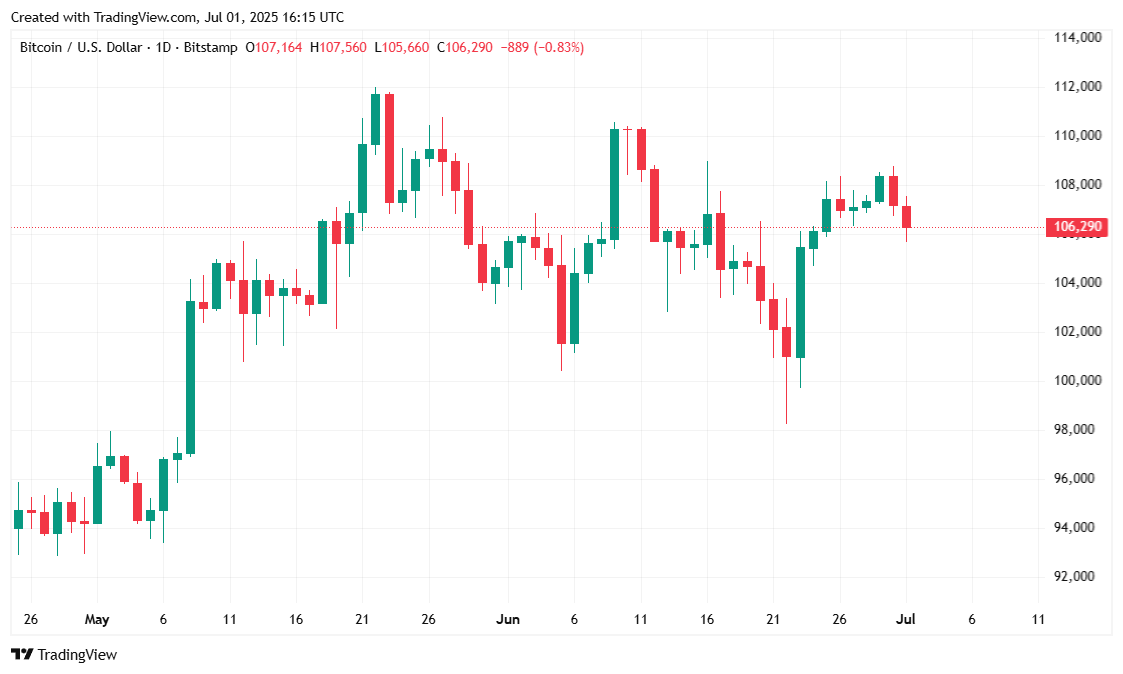

Bitcoin costs have fluctuated between $105,689.17 and $107,855.98 during the last 24 hours, buying and selling at $106,002.05 at a 1.50% lower on the time of reporting, in keeping with CoinmarketCap. Cryptocurrency has risen by simply 0.56% over a seven-day interval.

(BTC Value/Commerce View)

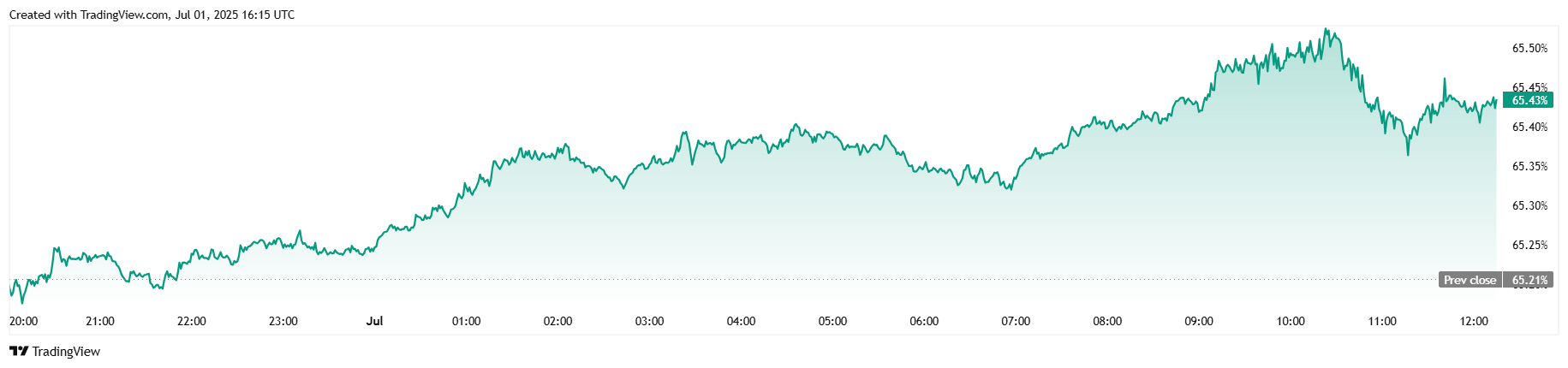

Buying and selling quantity rose 8.61% to $44.48 billion, whereas BTC's market capitalization fell 1.48% to $2.1 trillion. The distinction is mirrored within the Bitcoin management ratio, which rose from 0.32% to 65.43%.

(BTC dominance/commerce view)

The worth of the open futures contract fell 2.78% to $699.2 billion, indicating a decline in speculative urge for food. Coinglass information exhibits a $60 million liquidation that was settled during the last 24 hours, with the vast majority of the liquidation, or $55.08 million, coming from its benefits, whereas the bearish shortseller liquidation was $4.93 million.