Bitcoin and most altcoins outweighed shares after Donald Trump introduced the tariffs for the discharge day.

Bitcoin (BTC) ranged between $80,000 and $90,000, whereas Ethereum (ETH) was slightly below $2,000. Market capitalizations for all cryptocurrencies fell from $2.7 trillion to $2.6 trillion.

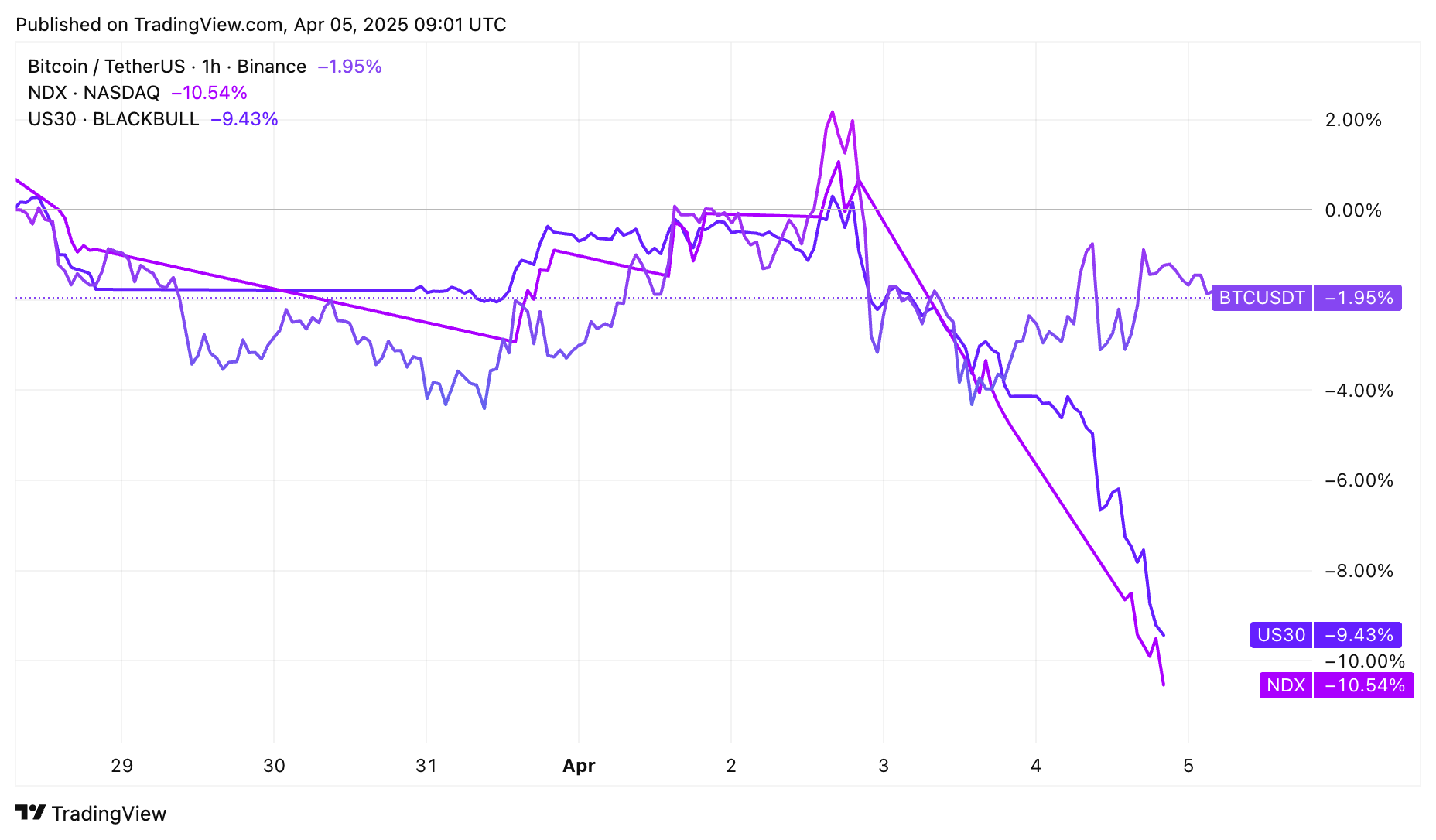

In the meantime, the inventory market had its worst week since 2020. The Blue Chip Nasdaq 100, S&P 500 and Dow Jones fell into fixes.

Bitcoin vs Dow Jones vs Nasdaq 100 | Supply: crypto.information

Affect feeding warnings relating to stagflation

Bitcoin, altcoin might be below stress after Federal Reserve Chairman Jerome Powell warned that Trump's tariffs are more likely to result in a rise within the US financial system and elevated development.

“Our responsibility is to totally safe long-term inflation expectations and be certain that one-time value ranges rise doesn’t change into an ongoing inflation situation,” Powell mentioned Friday.

Excessive inflation and excessive unemployment charges could cause stagnation as actions to right one situation, equivalent to lowering rates of interest to advertise development, exacerbate different points equivalent to inflation.

Powell warned that he was not in a rush to chop rates of interest as inflation remained excessive. His statements replicate the statements of different officers, equivalent to Raphael Bostic and Adriana Coogler.

However Trump disagrees.

“This would be the excellent time for Fed Chairman Jerome Powell to chop rates of interest,” Trump wrote on his social media platform, accusing Powell of “taking part in politics.”

The Fed's governor is an impartial governmental physique.

Observers ought to word that the extra takistic Fed can have a damaging affect on Bitcoin, altcoins and inventory costs as analysts predict a recession. Traditionally, these property work effectively if the Fed is chopping rates of interest.

On Saturday's examine, Bitcoin was buying and selling at round $83,435. See under.

Supply: Coingecko

You would possibly prefer it too: Bitcoin is steady amidst the inventory market battle, says a chainless analyst

Bond Market and Crude Oil Costs Supply Cushion

On the constructive aspect, the very best flash indicators counsel that the Federal Reserve will lower rates of interest sooner.

Crude costs have crashed over the previous few days, inflicting international benchmark Brent to crash at $64 on Friday. West Texas intermediates fell to $62.

Moreover, copper, which is usually thought of a barometer of the worldwide financial system, can also be nose-nosed. These property point out a potential recession as demand from people and companies is declining.

The bond market has despatched the identical message, with yields falling sharply to three.95% and three.5% over 10 and a pair of years.

That is my nomination for this week's most fascinating chart.

*Undoubtedly, the inventory market crashed this week

* JP Morgan says there’s a 60% likelihood of a recession

*File uncertainty

*Unprecedented authorities coverage relating to tariffs.So, given the above record, what’s 10 years… pic.twitter.com/ctm3t0blw

– Jim Bianco (@BianCoresearch) April 5, 2025

These alerts level to the potential Devish Fed and will rapidly lower rates of interest. In a press release earlier this week, Goldman Sachs raised the potential for a US recession, predicting the Fed will make a minimum of three cuts later this yr.

Historical past reveals that when the Fed cuts, dangerous property like shares, Bitcoin and altcoins will work. For instance, everybody surged in 2020, when the Fed lower emergency charges firstly of the pandemic. There was additionally a 10-year rallies in shares when the Fed lower charges considerably in the course of the international monetary disaster.

learn extra: Bitcoin costs might rise as US bond yields, concern and grasping indicators drop