Throughout Myriad, Calci, and Polymarket, predictive merchants are rallying to a well-known conclusion. Bitcoin appears more likely to toy with six digits than collapse into deep drawdown territory quickly.

100,000 {dollars} or bust framed

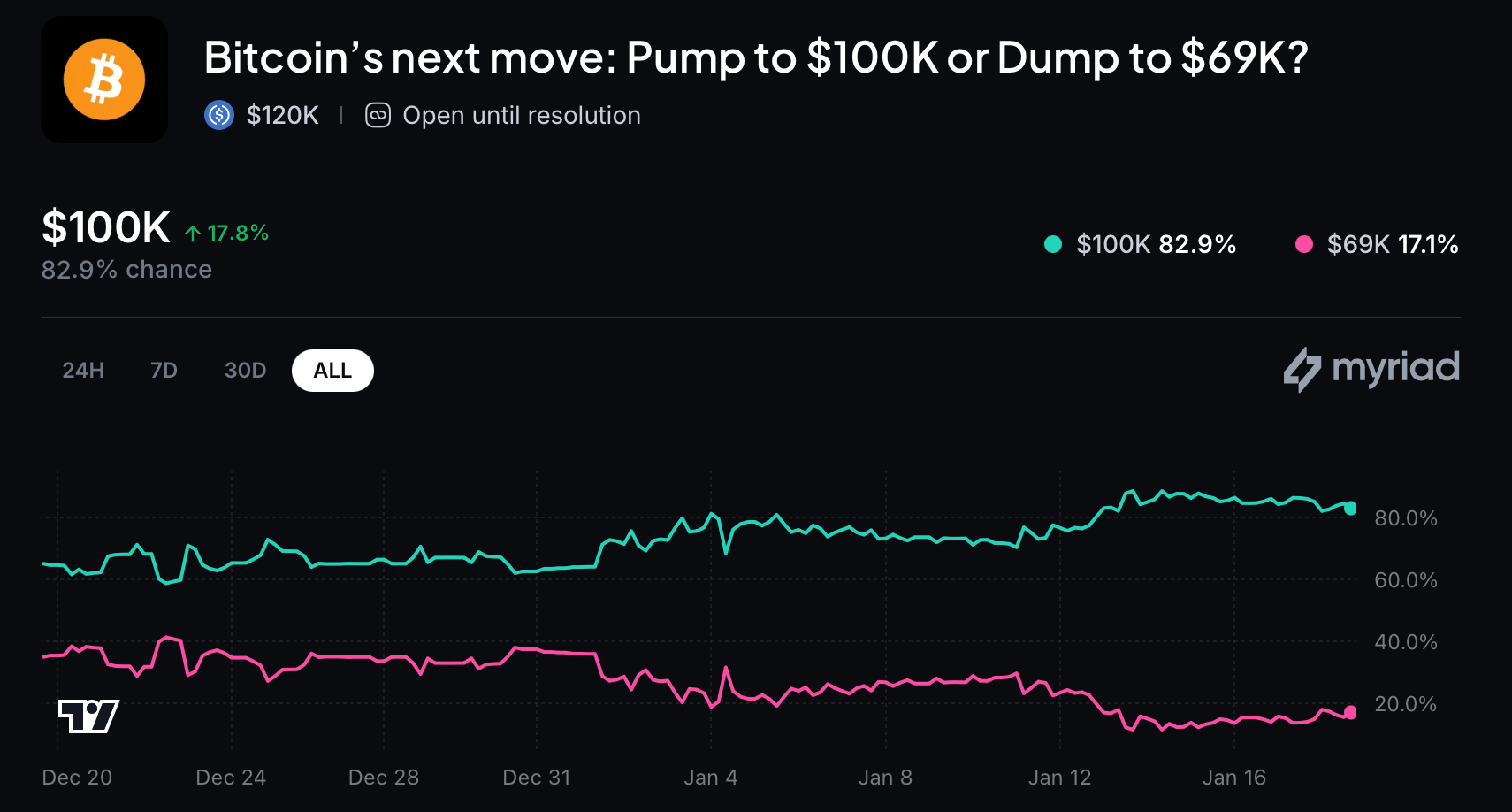

At Myriad, the market gave the market a blunt title: “Bitcoin's subsequent transfer: Pump as much as $100,000 or dump to $69,000?” This reveals that merchants overwhelmingly help the upside. Roughly 82.9% of members consider that Bitcoin will attain $100,000 earlier than testing $69,000, with solely 17.1% supporting a pointy drawdown state of affairs.

The market is decided strictly primarily based on the BTC/USDT spot worth on Binance utilizing the closing worth of one-minute candlesticks, making it a quickly altering barometer of sentiment slightly than a long-term prophecy.

Supply: Myriad, January 19, 2026.

The controversy about Kalsi's draw back is a coin toss, not a collapse name.

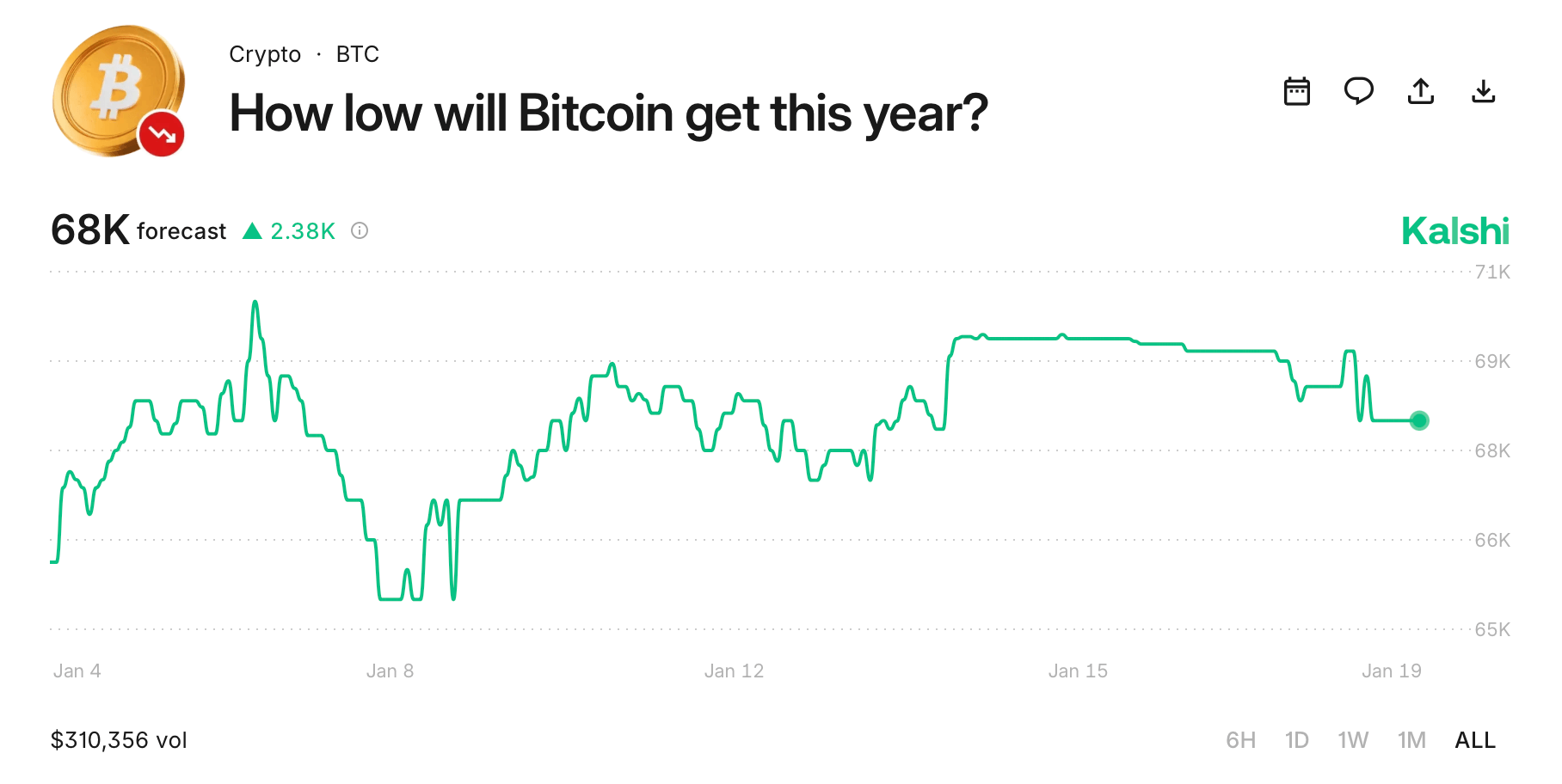

In relation to Karshi, the query shifts from “if” to “how a lot.” “How low cost will Bitcoin fall this 12 months?” The chance that Bitcoin will fall under $70,000 in some unspecified time in the future in 2026 is sort of even (about 52%). Because the ache turns into extra extreme, it turns into much less convincing: the chance of a decline under $65,000 drops to about 47%, whereas the chance of a gradual decline under $72,000 will increase to 55%. The purpose is refined. Though draw back threat is acknowledged, panic promoting is just not the bottom case.

Supply: Kalsi, January 19, 2026.

How excessive is just too excessive? The ceiling of Karshi comes into view.

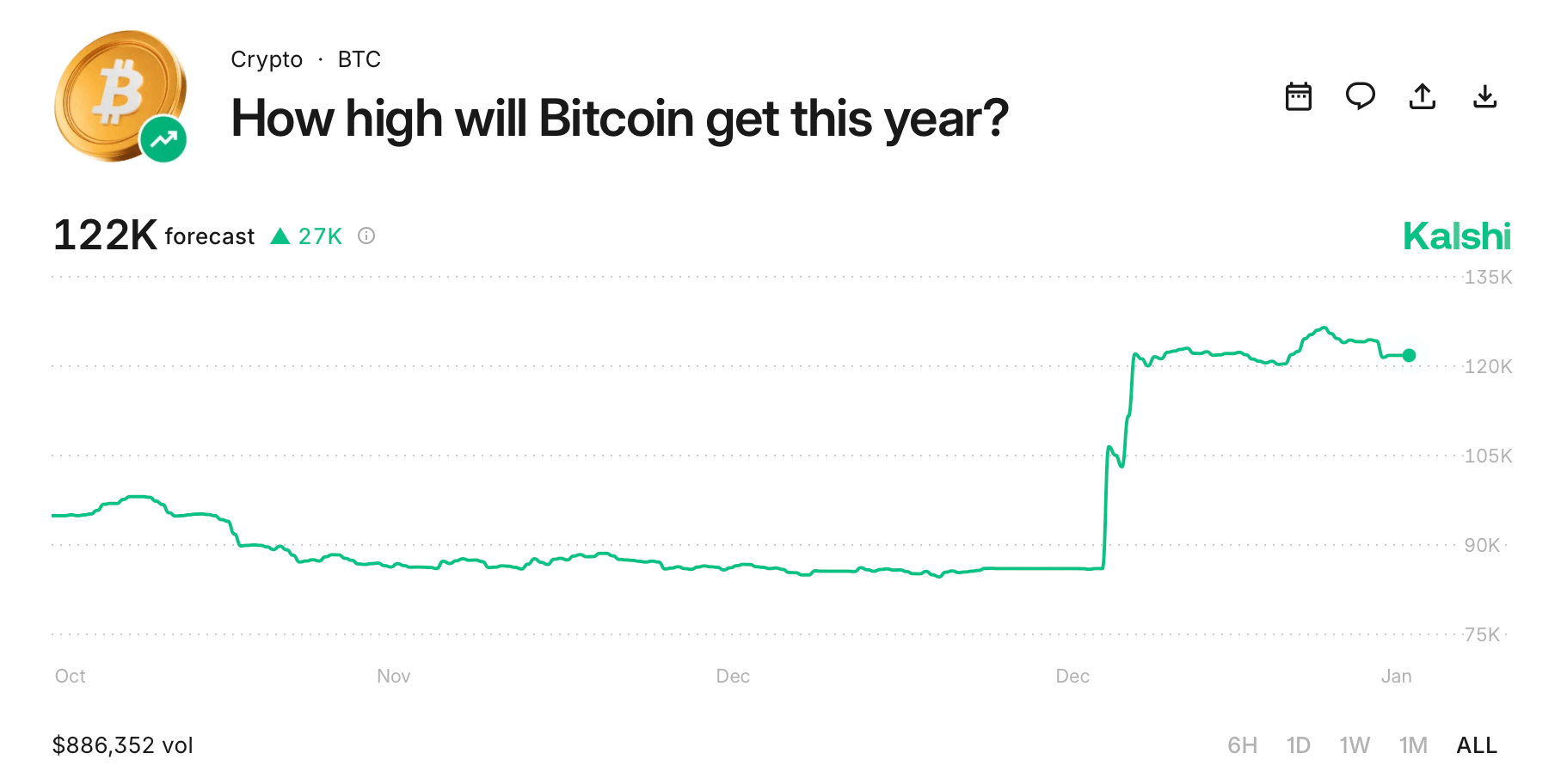

Karshi's associated market “How a lot will Bitcoin rise this 12 months?'' depicts the higher restrict. Merchants presently use knowledge from the CF Bitcoin Actual-Time Index for settlement, and place a roughly 52% probability of Bitcoin clearing $120,000 in 2026. Confidence improves at a decrease threshold (roughly 68% at $110,000), but it surely diminishes as expectations improve, with solely a 41% implied probability of exceeding $130,000. There’s some optimism, but it surely comes with a wholesome dose of self-control.

Supply: Kalsi, January 19, 2026.

Polymarket's long-term imaginative and prescient retains the moon at arm's size

Polymarket markets paint an analogous image: “What worth will Bitcoin be in 2026?” Excessive objectives stay a fringe concept, with solely a 5% chance of being assigned to $250,000 and a ten% chance of being assigned to $200,000 and $190,000. Sentiment firms near the bottom: 25% probability of $150,000, 31% probability of $140,000, 40% probability of $130,000. The very best conviction quantity is about $120,000, main the board at about 51%.

The primary cease issues: $100,000 beats $80,000 in a race.

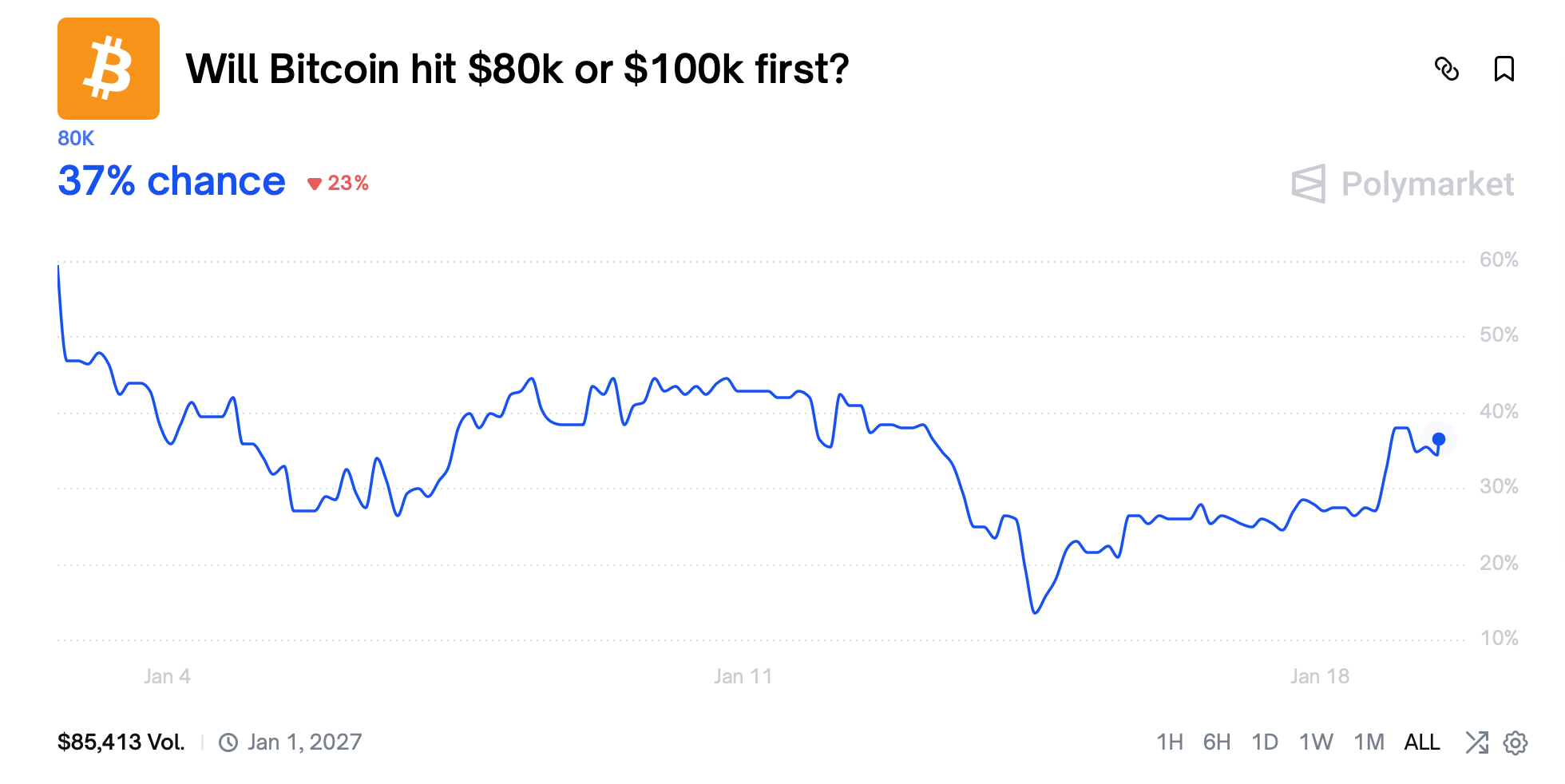

One other Polymarket contract asks whether or not Bitcoin will attain the $80,000 or $100,000 milestone first. Merchants want larger numbers, estimating a 63% probability that $100,000 will probably be printed earlier than falling to $80,000. The destructive outcome stays at almost 37%, reinforcing the broader theme that withdrawal is seen as an interruption slightly than an finish.

Supply: Polymarket, January 19, 2026.

Expectations for January stay the identical

Polymarket’s “What worth will Bitcoin attain in January?” dampens short-term optimism. market. Right here, merchants overwhelmingly reject stretch targets. Odds on $150,000 are lower than 1%, and $130,000 to $115,000 barely register. The chance curve thickens at $100,000, with about 25% yielding January outcomes, adopted by almost 9% at $105,000. On the tender aspect, the chance of a $85,000 ceiling is eighteen%, suggesting that merchants expect consolidation slightly than fireworks.

Additionally learn: Ethereum every day transaction rely hits document excessive, charges stay flat

6 markets, 1 constant sign

Taken collectively, these six markets inform a surprisingly constant story. There are debates in regards to the downsides of Bitcoin, however there’s nothing to worry. The upside is proscribed, however not ignored. And $100,000 has quietly change into the middle of gravity, much less a fantasy objective and extra a practical assumption shared throughout platforms, time durations, and contract buildings.

Regularly requested questions 🔮

- What worth degree is presently dominating the Bitcoin prediction market?Most markets are centered round $100,000 because the almost definitely milestone.

- Are merchants anticipating a giant crash in Bitcoin?Draw back dangers are priced in, however there’s a lack of robust conviction in a extreme collapse state of affairs.

- Does the market count on Bitcoin to achieve over $200,000?Excessive upside targets nonetheless yield outcomes with low chance throughout platforms.

- Is brief-term optimism as robust as long-term optimism?The market in January is clearly extra conservative than the full-year forecast.