SLNH has a pipeline of 1 GW or extra, similar to BITF, however has a market capitalization of only a fraction. With credit score amenities as much as $100 million for knowledge middle build-out, can Soluna be a child Airen created?

The following visitor put up comes from bitcoinminingstock.io, A public market intelligence platform that gives knowledge on firms uncovered to Bitcoin mining and cryptocurrency methods. Initially printed by Cindy Feng on September 24, 2025.

I cowl trades from some main HPC/AI pivots and public Bitcoin miners, however a substantial variety of followers are more and more identified by names of lesser identified names: Soluna Holdings (NASDAQ: SLNH). Dialogue? This can be a microcap participant that seems to be a $100 million credit score facility to fund a big vitality pipeline (>1GW), the development of an HPC knowledge middle, and extra lately, Challenge Kati.

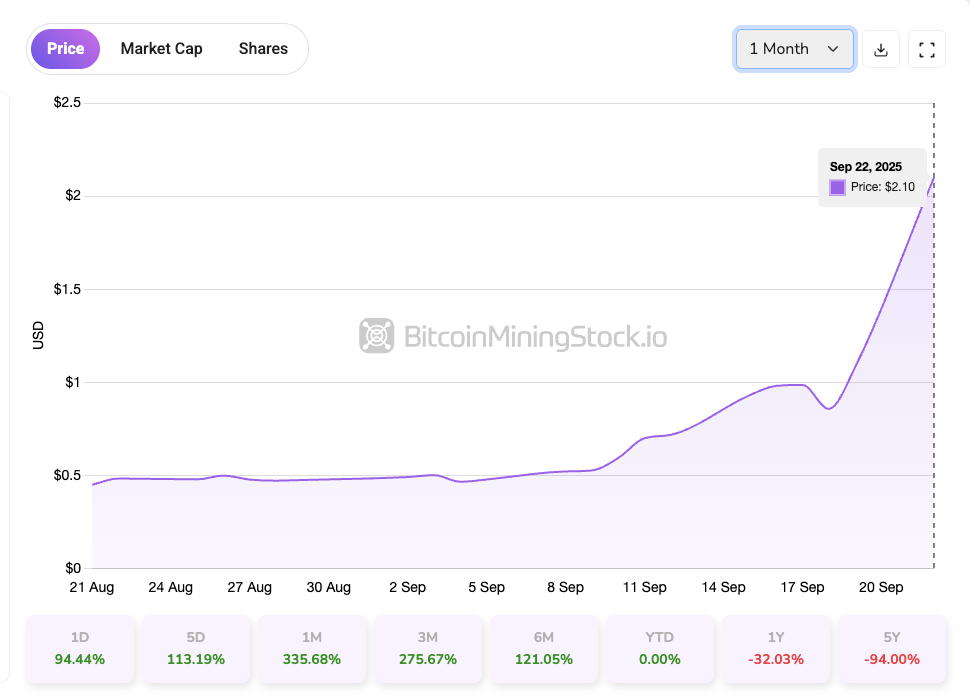

On September 22, 2025, $SLNH skyrocketed 94.44%.

Some imagine that Soluna can observe the same path to Iren or CIFR. Most might be shared at a low worth till the market acknowledges its huge HPC/AI potential. However transfer past hypothesis. query Does hype maintain up when stitching scattered details collectively?

Let's bounce in!

Soluna Infrastructure Footprint: Play past 1 Golden Week

Soluna Holdings is a US-based developer of modular inexperienced knowledge facilities designed particularly for intensive computing functions similar to Bitcoin mining and AI workloads. The corporate has established itself as a bridge between underutilized renewable vitality belongings and demand calculations.

Soluna's screenshot Investor presentation

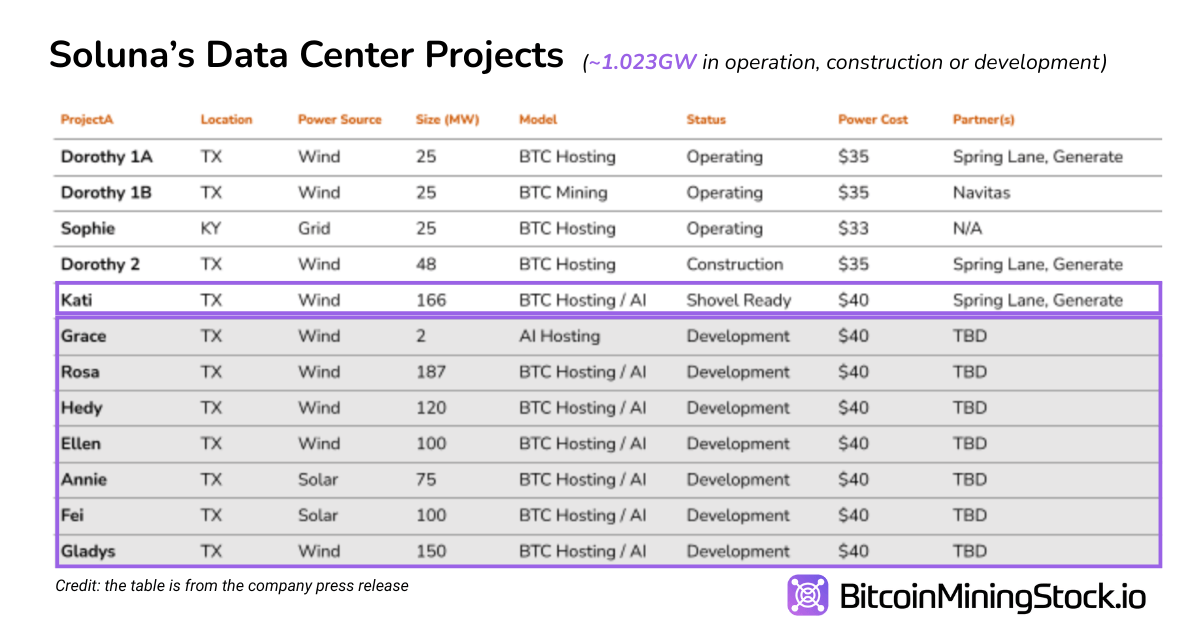

At present, many modular websites are run or constructed all through Texas and america, most of that are held in collaboration with renewable generations. As of the second quarter of 2025, Solna claimed a 2.8 GW Whole Clear Vitality Pipeline1.023 GW subset focuses on growth close to the mid-term. It locations them in the identical capability league as BitFarms (1.2 GW)*, however when it comes to market capitalization it was nearly 1.5/100 of the latter till lately.

* Regardless of reporting vitality capability in the same vary, Soluna had an EH/s set up of three.345 Hashrate As of August 2025 (0.526 EH/S for self-mining solely), in comparison with BitFarms' 19.5 EH/s.

Here’s a breakdown of Soluna's mission portfolio primarily based on public disclosures:

Challenge Kati is Solna's largest web site thus far It reveals a transparent transfer past Bitcoin mining and past AI and excessive efficiency computing (HPC) infrastructure. This web site is configured as a two-phase, 166 MW buildout.

development of For 1 (83 MW) is scheduled to start in September 2025 and be operated in early 2026. 48 MW is already leased to Galaxy Digital Beneath the internet hosting settlement, the remaining 35 MW is reserved for Soluna's personal Bitcoin internet hosting consumer.

Challenge Kati broke the bottom (Media Supply))

Part 2, Between 2further 83 MW is devoted to supporting AI and excessive efficiency computing (HPC) workloads. The enlargement, together with different knowledge middle build-out plans, positions Soluna because the rising infrastructure supplier for the AI financial system.

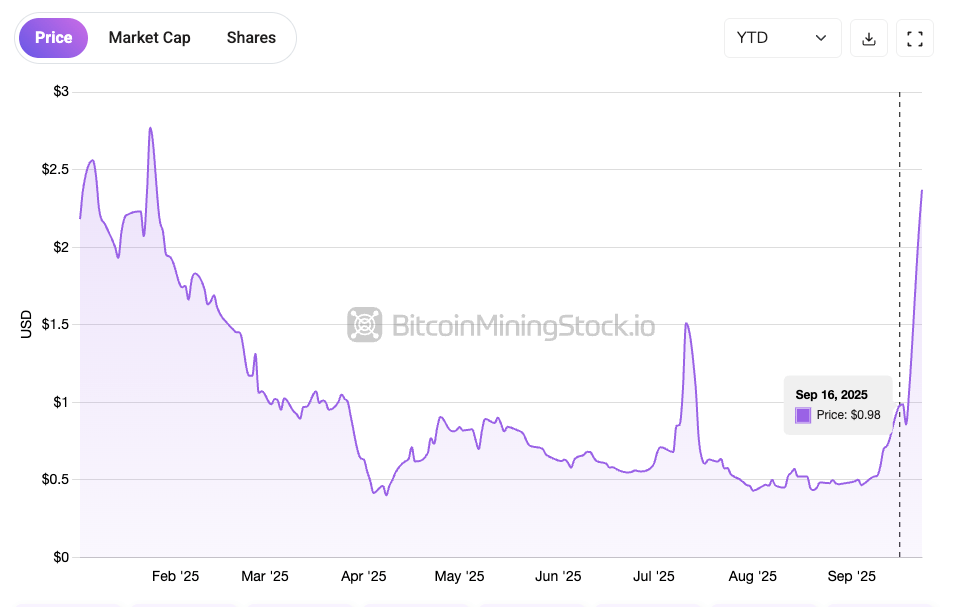

The market appears to be beginning to set pricing Following the announcement of Soluna's HPC/AI pivot, notably Soluna's $100 million credit score facility.

$SLHN has risen because the $100 million credit score facility introduced on September 16, 2025

$100 million credit score facility: capital prices

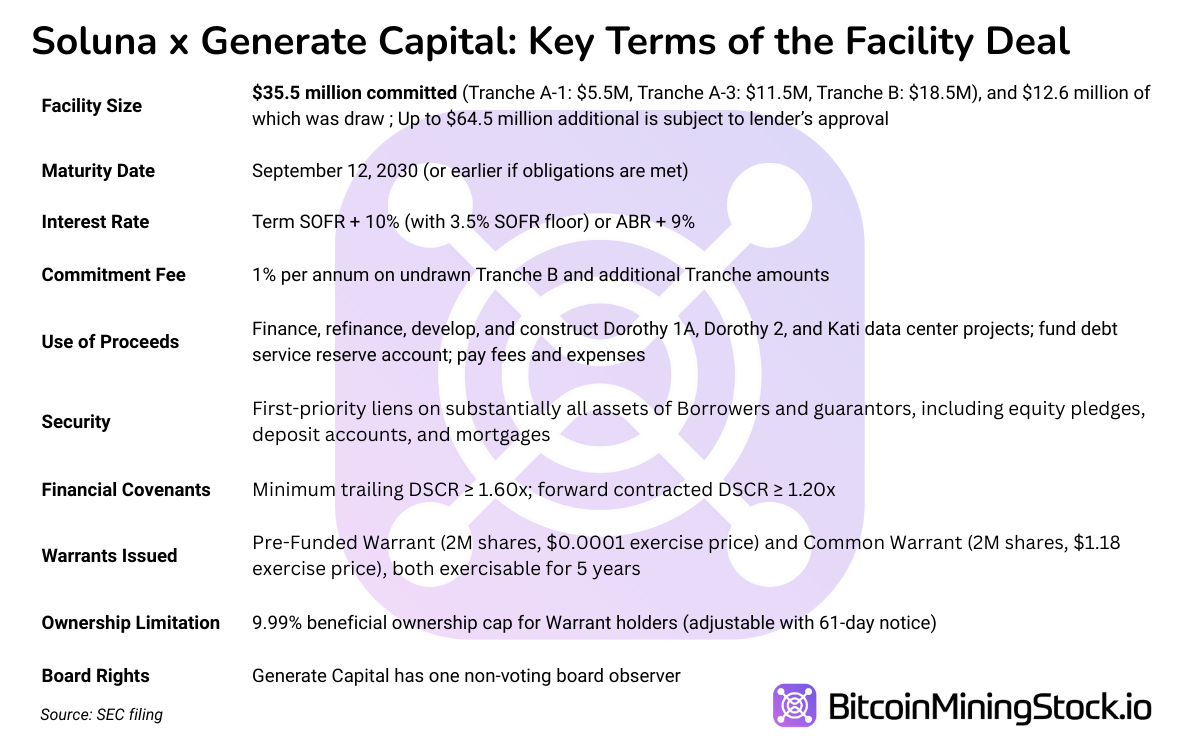

September 2025, on the left We’ve got introduced credit score options of as much as $100 million A lender identified for his help of sustainable infrastructure from Generate Capital. For an organization with quarterly income of $6.15 million and limitless money of $9.85 million, the transaction marks a serious step in securing long-term mission funding. However whereas the headline figures are substantial, the construction of contracts is layered with milestones and circumstances that form when and when capital might be accessible.

All amenities, $35.5 million is at the moment dedicated. This consists of the preliminary $12.6 million draw used to refinance Dorothy 1A and Dorothy 2, and an extra $22.9 million to help the continuing growth of Dorothy 2 and the primary part of Challenge Katy. The remaining $64.5 million has not been dedicated. This can be made accessible at Generate's discretion, relying on future milestones and efficiency. in brief, Heading numbers are ceilings and never assured.

Unlocking the capital isn’t low cost. For loans rate of interest SOFR + 10%, with a minimal SOFR flooring of three.50%, making a beginning rate of interest of no less than 13.5%. Alternatively, Soluna could select to hire at an ABR + 9% fee. That fee alone is taken into account aggressive. As well as, Solna pays a Annual charge of 1% of unused funds for a given trancheIn different phrases, the clock will start to file whether or not the cash is unfolding or not. It is going to be expensive to maintain it accessible even when Soluna doesn’t contact the remainder of the power.

Subsequent, there are restrictions. Funds are surrounded by ring fences It could solely be used on three particular belongings: Dorothy 1A, Dorothy 2 and Challenge Katy. Equally, collateral is on the mission stage. Generate Capital is the primary to request preliminary claims on the inventory, belongings, money accounts and actual property of the borrowing entity. Nonetheless, ensures are excluded, notably from Soluna's mother or father entities. This setup limits the corporate's legal responsibility past the mission and generates a transparent execution path associated to mission efficiency.

Additionally included in buying and selling Monetary Contracts It’s designed to watch steady viability. Soluna should keep protection charges for subsequent debt providers (dscr) no less than 1.60x, ahead I signed a DSCR no less than 1.20 instances. These protection checks are commonplace for mission financing and are meant to make sure that project-level money circulation is enough to cowl scheduled money owed.

Along with the mortgage, we additionally obtain generated productions Fairness-related incentives Within the type of two warrants, a warrant of as much as 2 million shares at a strike worth of close to zero, and a standard warrant of an extra 2 million shares of $1.18. Each might be exercised instantly over a five-year interval, with possession rising 9.99% to keep away from triggering disclosure thresholds. Such a construction provides the era Lengthy-term pursuits In the way forward for Soluna, dilution threat may also be launched.

This can be a basic case of stock-related infrastructure finance designed for Excessive-risk, high-upside state of affairs. This construction provides Soluna a key runway to refinance present belongings and fund the development of flagship buildouts. In the meantime, we introduce a brand new layer of price, monitoring and milestone-based circumstances. For firms with restricted conventional financing choices, transactions are Excessive Leverage Progress Enabler. Nevertheless it additionally locations the soluna on a decent rope. Execution can’t be negotiated. If Soluna stumbles, the lender will maintain each the capital and the management lever.

Ultimate Ideas

Soluna bull papers are easy. As soon as administration delivers on Kati 1 and efficiently strikes to Excessive-Margin AI internet hosting utilizing Kati 2, the corporate can unleash predictable repeat revenues on a scale not beforehand seen in historical past.

Assuming an annual income of $1.5 million per MW for AI/HPC workloads, a tough benchmark primarily based on peer disclosures reveals that Kati 2 can finally generate $124 million at full capability (83 MW x $1.5M). That's principally 20x Soluna's present quarterly execution fee. For an organization with a market capitalization of $100 million, benefit It's clearly transformed.

however The chance of drawbacks It's equally essential. There may be little room for error producing capital mortgage phrases. Whether or not you missed a DSCR contract, development delays, or poorly carried out, it may result in warrants, lack of belongings, or dilutions via warrant train or emergency funding.

In impact, Solna was discovered responsible of her means to carry out.

Greatest case: Scaling to authentic HPC infrastructure gamers with numerous income and strategic relevance, following the Iren or Corz path.

The worst case state of affairs: Powerful contracts and excessive debt prices suffocate the corporate earlier than the mission matures.

Speculations about potential JVs or M&As It could elevate investor curiosity. A current tweet from the CEO prompt curiosity from hyperscale miners, energy plant homeowners and infrastructure funds.

At @solunaholdings we’re ripe for choosing…

Like ripe apples at harvest.

We’re chosen as the highest minor in Hyperscale.

He has been chosen because the proprietor of the highest energy plant.

It has been chosen as a prime infrastructure fund.

A clear computing mission that exceeds 1GW…pic.twitter.com/ARN4GYYBPJ

-John Belizaire (@jbelizaitraceo) September 22, 2025

There are not any public confirmations of transactions from “High Hyperscale Miner,” however the basis is ready up for future partnerships with Galaxy Digital producing capital on board as anchor tenant and lender.

Both manner, Solna has entered the excessive stakes part. Credit score amenities purchase time, not certainty.

For now, 94% of the spikes mirror investor enthusiasm. What comes subsequent is determined by the execution.