Solana's Defi Ecosystem is seeing explosive development and is approaching the best stage ever, however Sol stays behind.

abstract

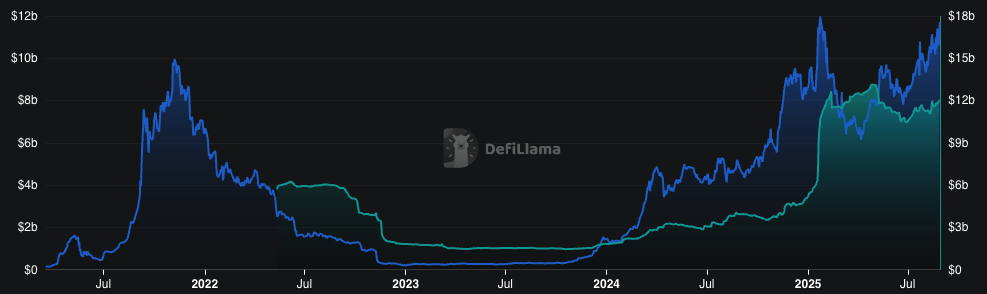

- Solana's Defi TVL is $11.725 billion, near its all-time excessive in January

- Nonetheless, Solprice is way from Ass in January

- Defi Metrics means that Sol could also be lagging behind its defi ecosystem

Solana (Sol) collects almost record-heavy capital, however its costs proceed to be lagging behind. On Thursday, August twenty eighth, whole debt worth locked in Solana reached $11.725 billion, near report numbers for January. On the identical time, Stablecoin's whole market capitalization was $12 billion, whereas Bridged TVL was $42 billion.

Solana's Defi TVL and Stablecoin Market Cap | Supply: Defilama

However regardless of the sturdy indicators, Sol's worth remains to be at $294.33, far under the January ATH, and remains to be hovering at round $200. On the time, Solana's Defi TVL was close to its present peak in August, suggesting that Defi TVL and costs started to diverge.

You would possibly prefer it too: The US launches GDP information to Bitcoin, Ethereum and Solana blockchain

Why Sol Worth is behind the Defi Ecosystem

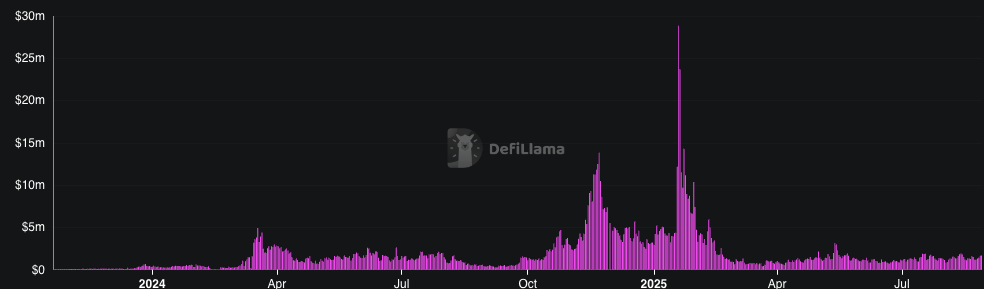

On the identical time, the charges incurred in Solana remained at a comparatively modest $1.68 million a day. That is removed from the January report of $2,889 million. Low chain income is why Sol is behind the expansion of decision ecosystems.

Solana On-Chain Costs | Supply: Defilama

You would possibly prefer it too: Will Solana be capable of regain $200 and get the place again past BNB?

Right now, a lot of Solana's ecosystem actions are going via platforms that prioritize low-costs. This contains Dex aggregators like Jupiter, who make up a big a part of the buying and selling exercise in Solana. With these protocols, excessive TVL equals increased liquidity and higher buying and selling situations.

Nonetheless, this doesn’t result in increased revenues for the Solana community, one of many key metrics of Solana worth efficiency. Greater revenues result in increased staking rewards, making Solana extra useful. Due to effectivity, Sol could also be behind its defi tvl no less than till the charges go up.

learn extra: Solana worth forecast: Is Sol dropping momentum after an explosive rally?