Ahead Industries, a digital asset-focused firm with a big place in Solana as a part of an ongoing shift, has authorized a $1 billion inventory repurchase program. This can be a transfer geared toward returning worth to shareholders as we transfer in direction of a digital asset monetary mannequin.

The inventory repurchase program authorized Monday will permit Ahead Industries to proceed repurchasing its personal inventory by way of open market purchases, block transactions or privately negotiated transactions, the corporate introduced.

Ahead mentioned the authorization gives flexibility amid market fluctuations, however share buybacks are sometimes geared toward returning worth to shareholders by decreasing the variety of shares excellent and minimizing dilution.

“This authorization gives us with the pliability to return capital to our shareholders if we decide that our inventory is beneath its intrinsic worth, whereas persevering with Solana's monetary and operational efforts,” the corporate mentioned.

Ahead Industries is at present the biggest company holder of Solana (SOL), with over 6.8 million SOL on its stability sheet, based on trade knowledge. At present market costs, the inventory is price roughly $1.1 billion.

As Cointelegraph lately reported, Ahead additionally launched validator nodes on the Solana community, additional deepening its involvement within the blockchain ecosystem.

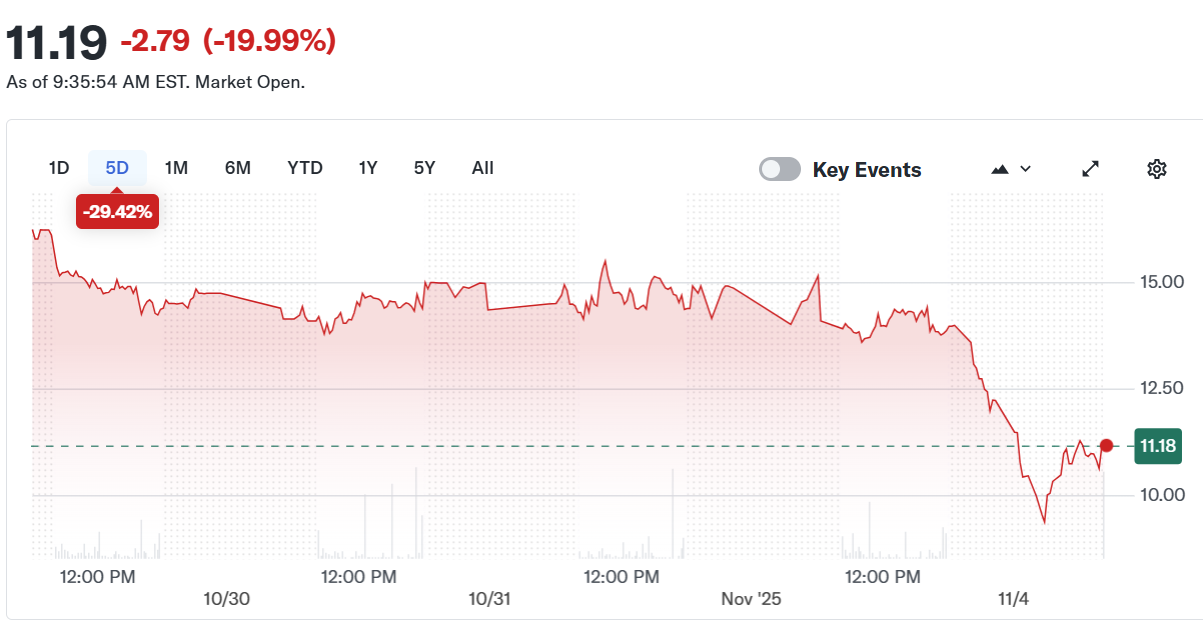

On Tuesday, Ahead's inventory worth fell by about 20% following a broader decline in shares associated to the crypto sector.

Ahead Industries (FORD) inventory. sauce: Yahoo Finance

Associated: Citadel takes large stake in Solana Monetary Firm public

Cryptocurrency treasury companies face growing valuation strain

A number of corporations pivoted to “crypto-asset” fashions in the course of the bull market, aiming to revive inventory costs and reposition their operations to higher-growth digital asset sectors. However these corporations have lately come underneath strain.

Analysts at Commonplace Chartered have warned that many crypto treasury corporations are going through a valuation disaster. It is because company worth is lowering in comparison with the market worth of the digital currencies they maintain, and their market web asset worth (mNAV) is definitely lowering.

The strain just isn’t restricted to altcoin-focused digital asset methods. Enterprise capital agency Breed warned in June that solely a handful of Bitcoin (BTC) treasury corporations are prone to keep away from the “dying spiral” brought on by the collapse of NAV.

Associated: Mega Matrix information for $2 billion shelf to construct Ethena stablecoin governance treasury